- Cflow

- Supplier Payment Plan Automation

Supplier Payment Plan Automation

Clow Team

Supplier payment plans are essential in managing cash flow, maintaining vendor trust, and ensuring smooth procurement operations. However, manual processes create delays, miscommunication, inconsistent approvals, and financial exposure. According to recent studies, over 55% of organizations report delayed vendor payments due to manual plan approvals and documentation bottlenecks.

Without automation, procurement managers, finance controllers, legal teams, and CFOs struggle to coordinate payment terms, verify documentation, and ensure policy compliance. This guide walks you through exactly how Cflow automates the Supplier Payment Plan Process from request initiation to multi-level approvals and final disbursement.

What Is Supplier Payment Plan Process?

The Supplier Payment Plan Process governs how organizations formalize, approve, and execute structured payment terms with vendors, based on deliverables, invoice schedules, contract clauses, and budget controls.

Think of payment plans as financial handshake agreements, each requiring strategic review, policy alignment, and traceable endorsement before execution.

Recent industry research reveals that automating supplier payment plans reduces approval time by 45% and improves vendor satisfaction by 50%.

Why Supplier Payment Plan Automation Matters for Organizations

Cash Flow Optimization

Policy Enforcement

Vendor Relationships

Audit Readiness

Maintains digital records of every approval, contract, and disbursement plan.

Operational Efficiency

Key Benefits of Automating Supplier Payment Plans with Cflow

- Unified Payment Plan Request Portal: Cflow allows procurement or project managers to initiate supplier payment plan requests by uploading contracts, invoices, deliverable milestones, and vendor credentials. All data is collected in a structured format and stored securely.

- Routing Based on Amount, Vendor Type, and Terms: The platform applies conditional routing logic depending on vendor category, contract value, installment structure, and criticality of the supplier. High-risk or high-value vendors are escalated for executive approval automatically.

- Multi-Tiered Review Workflows: Requests route through finance, compliance, legal, and leadership. Each team receives tailored tasks with specific deadlines. This eliminates ambiguity, accelerates decisions, and maintains control over large disbursements.

- Real-Time Alerts & Escalations: Cflow issues alerts for pending reviews or missed deadlines, with escalation rules for time-sensitive payment schedules. Alerts can be customized by supplier type, value, or milestone urgency.

- Compliance & Legal Checks Embedded: Built-in logic checks payment terms against company policy, contract clauses, regulatory standards, and budget thresholds. Deviations automatically trigger legal or compliance reviews.

- Full Traceability & Documentation Trail: Every approval, note, amendment, and confirmation is stored and timestamped. This creates a complete history for audit and dispute resolution.

- Mobile-Enabled Approvals: Busy executives and approvers can review and sign off from anywhere. The mobile UI supports document viewing, notes, and digital signatures to ensure payment plans are never delayed.

Get the best value for money with Cflow

User Roles & Permissions

Procurement Manager (Initiator)

- Responsibilities: Submit payment plan proposal with documents, milestones, and supplier details.

- Cflow Permission Level: Submit Form.

- Mapping: “Procurement Team”

Finance Controller

- Responsibilities: Validate budget availability, financial viability, and payment timeline.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Group”

Compliance Officer

- Responsibilities: Ensure payment terms comply with policies and vendor compliance requirements.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Team”

Legal Reviewer

- Responsibilities: Review supplier contract clauses and enforceability of payment terms.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Group”

CFO / Executive Leadership

- Responsibilities: Provide final sign-off on high-value or policy-sensitive payment plans.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board”

Discover why teams choose Cflow

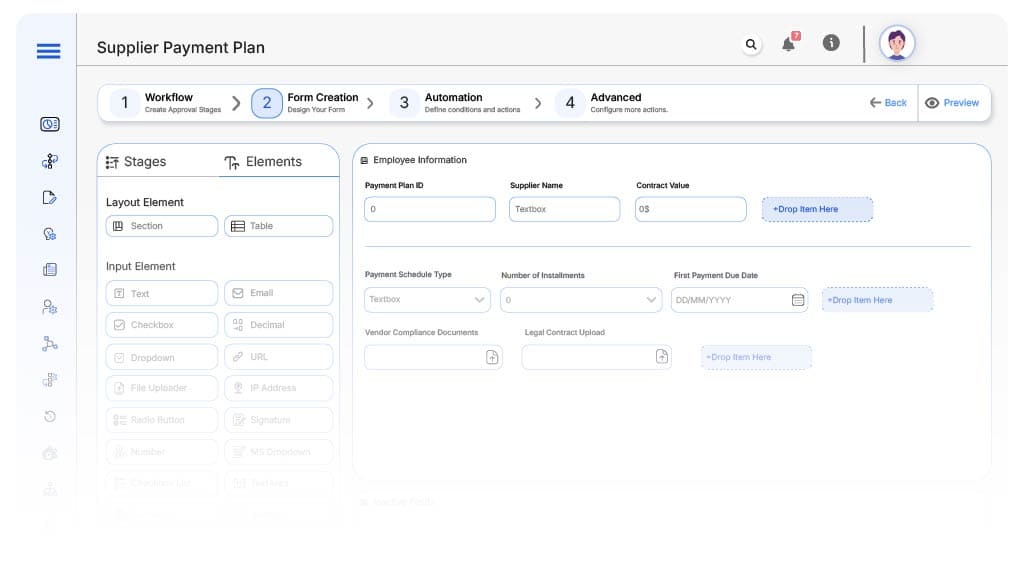

Form Design & Field Definitions

Field Label: Payment Plan ID

- Type: Autonumber

- Auto-Populate Rules: Generated upon form submission.

Field Label: Supplier Name

- Type: Text

- Logic/Rules: Mandatory

Field Label: Contract Value (USD)

- Type: Numeric Field

- Logic/Rules: Drives approval flow

Field Label: Payment Schedule Type

- Type: Dropdown (Milestone-based, Fixed Interval, On Delivery, Lump Sum)

- Logic/Rules: Drives routing

Field Label: Number of Installments

- Type: Numeric Field

- Logic/Rules: Required if not Lump Sum

Field Label: First Payment Due Date

- Type: Date Picker

- Logic/Rules: Mandatory

Field Label: Vendor Compliance Documents

- Type: File Upload

- Logic/Rules: Required

Field Label: Legal Contract Upload

- Type: File Upload

- Logic/Rules: Required

Field Label: Finance Review Comments

- Type: Text Area

- Logic/Rules: Required

Field Label: Compliance Observations

- Type: Text Area

- Logic/Rules: Required

Field Label: Legal Remarks

- Type: Text Area

- Logic/Rules: Required

Field Label: Executive Endorsement Comments

- Type: Text Area

- Logic/Rules: Required

Field Label: Final Plan Approval

- Type: Checkbox

- Logic/Rules: Marks full endorsement

Transform your Workflow with AI fusion

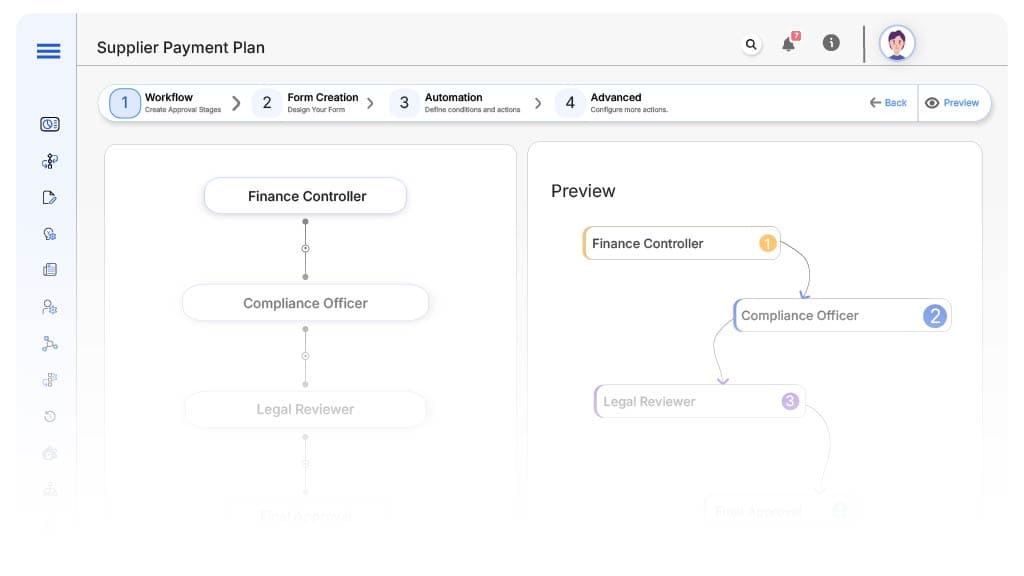

Approval Flow & Routing Logic

Submission → Finance Controller

- Status Name: Pending Finance Review

- Notification Template: “Hi Finance, new supplier payment plan submitted for review.”

- On Approve: Moves to Compliance Officer

- On Reject: Returns to Procurement Manager

- Escalation: Reminder after 1 day

Finance → Compliance Officer

- Status Name: Pending Compliance Check

- Notification Template: “Hi Compliance, verify plan terms and supplier documents.”

- On Approve: Moves to Legal Reviewer

- On Reject: Returns to Finance Controller

- Escalation: Reminder after 1 day

Compliance → Legal Reviewer

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, review payment contract and terms.”

- On Approve: Moves to CFO

- On Reject: Returns to Compliance Officer

- Escalation: Reminder after 1 day

Legal → CFO

- Status Name: Pending Final Endorsement

- Notification Template: “Hi CFO, supplier payment plan ready for executive approval.”

- On Approve: Moves to Approved

- On Reject: Returns to Legal Reviewer

- Escalation: Reminder after 1 day

Final → Approved

- Status Name: Payment Plan Approved

- Notification Template: “Supplier payment plan fully approved and scheduled for execution.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build process flow

Configure notifications

Apply conditional logic

Save and publish

Test

Adjust

Go live

Example Journey: IT Vendor Payment Plan

FAQ's

Yes. You can define multiple payment types and route approvals accordingly.

Unleash the full potential of your AI-powered Workflow