- Cflow

- Supplier Payment Dispute Automation

Supplier Payment Dispute Automation

Clow Team

Supplier payment disputes can result in strained relationships, legal conflicts, and financial misstatements. Manually managing these disputes through emails or spreadsheets often leads to delayed resolutions and lost documentation. Research indicates that unresolved payment disputes can increase supplier churn by 35%.

Without automation, finance and procurement teams lack the centralized visibility and audit readiness needed to resolve disputes efficiently. This guide walks you through exactly how Cflow automates Supplier Payment Dispute Process, from dispute initiation to final resolution.

What Is Supplier Payment Dispute Process?

The Supplier Payment Dispute Process manages discrepancies between suppliers and buyers regarding invoiced amounts, payment delays, or contract mismatches. It includes dispute logging, evidence collection, routing to relevant departments, and approval or escalation.

Automating this process helps reduce resolution times, improve documentation consistency, and ensure fair dispute handling. Research shows that automated dispute workflows reduce processing time by 45% and improve supplier satisfaction by over 30%.

Why Supplier Payment Dispute Automation Matters for Organizations?

Dispute Resolution Efficiency

Vendor Relationship Management

Compliance & Audit Trail

Financial Accuracy

Key Benefits of Automating Supplier Payment Disputes with Cflow

- Centralized Dispute Submission Portal: Cflow provides a dedicated form for vendors or internal teams to submit payment disputes with invoice details, PO references, and issue descriptions. This unified system eliminates scattered email trails and ensures every case is properly recorded, acknowledged, and prioritized based on urgency and financial impact.

- Automated Routing Based on Dispute Type: Disputes are dynamically routed to the appropriate teams – finance, procurement, or legal – based on the nature of the issue (pricing, delivery, penalties, etc.). Cflow applies threshold-based logic to involve senior stakeholders when large-value discrepancies or repeated vendor issues arise, ensuring swift and accountable resolution.

- Integrated Document Review & Validation: Cflow allows upload and comparison of invoices, delivery receipts, contracts, and correspondence within the dispute form. Reviewers can easily verify claims against system records, reducing time spent gathering documentation and preventing resolution delays due to incomplete or conflicting information.

- Real-Time Communication & Notifications: Cflow keeps vendors and internal stakeholders informed at every step through automated alerts. Whether it’s acknowledgment, clarification requests, or resolution status, everyone stays aligned. Timely notifications ensure no dispute is left unresolved due to oversight or miscommunication.

- Complete Audit Trail & Compliance Record: Each dispute case is logged with timestamps, reviewer comments, decisions, and supporting attachments. Cflow’s audit-ready format enables organizations to demonstrate compliance with payment policies, maintain transparency with vendors, and reduce risks during financial audits or supplier reviews.

Get the best value for money with Cflow

User Roles & Permissions

Supplier / Procurement Initiator

- Responsibilities: Logs the payment dispute with required documentation.

- Cflow Permission Level: Submit Form.

- Mapping: “Procurement Team.”

Accounts Payable Officer

- Responsibilities: Verifies financial mismatch and matches with payment logs.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Group.”

Legal Reviewer

- Responsibilities: Validates if contractual terms were breached or misinterpreted.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Team.”

Finance Director (Final Approver)

- Responsibilities: Resolves and authorizes dispute outcomes based on internal and supplier interests.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Group.”

Discover why teams choose Cflow

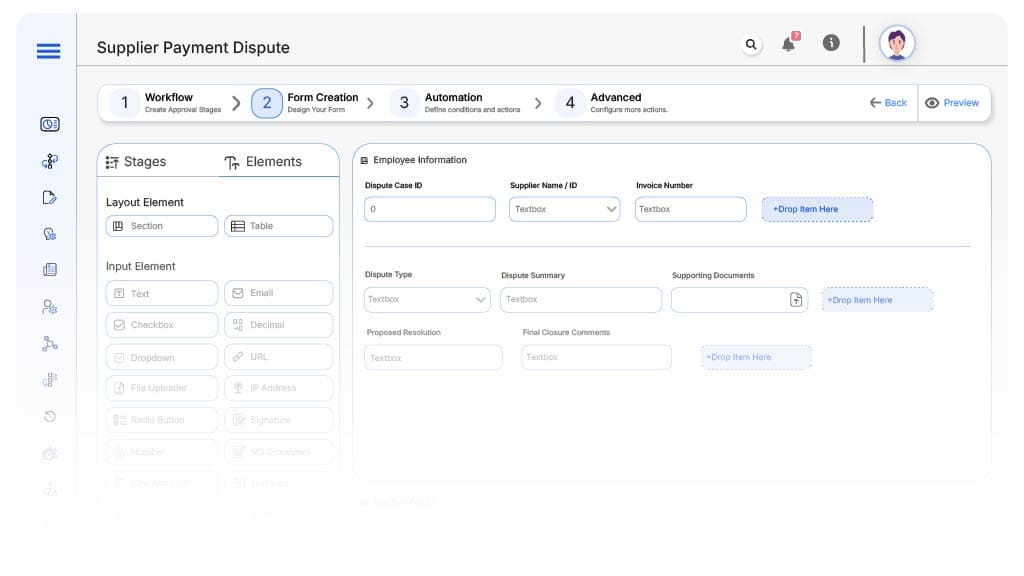

Form Design & Field Definitions

Field Label: Dispute Case ID

- Type: Autonumber

- Auto-Populate Rules: Generated upon submission.

Field Label: Supplier Name / ID

- Type: Dropdown

- Logic/Rules: Must match supplier registry.

Field Label: Invoice Number

- Type: Text Field

- Logic/Rules: Required.

Field Label: Dispute Type

- Type: Dropdown (Overpayment, Late Payment, Contract Terms, Duplicate Entry)

- Logic/Rules: Drives routing.

Field Label: Dispute Summary

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Supporting Documents

- Type: File Upload

- Logic/Rules: Required.

Field Label: Proposed Resolution

- Type: Text Area

- Logic/Rules: Optional.

Field Label: Final Closure Comments

- Type: Text Area

- Logic/Rules: Required before closure.

Transform your Workflow with AI fusion

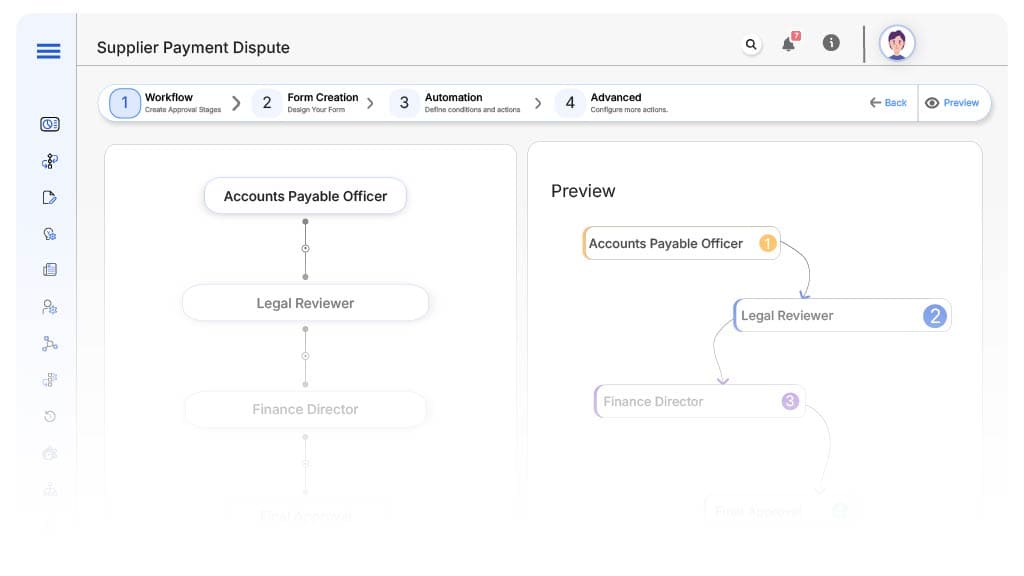

Approval Flow & Routing Logic

Submission → Accounts Payable Officer

- Status Name: Pending AP Review

- Notification Template: “New dispute submitted—please verify financial records.”

- On Approve: Route to Legal Reviewer.

- On Reject: Return to Initiator.

- Escalation: Notify AP Supervisor in 24 hours.

Accounts Payable Officer → Legal Reviewer

- Status Name: Pending Legal Review

- Notification Template: “Review dispute terms and contractual validity.”

- On Approve: Forward to Finance Director.

- On Reject: Return to Accounts Payable.

- Escalation: Legal Head notified.

Legal Reviewer → Finance Director

- Status Name: Pending Final Approval

- Notification Template: “Final resolution needed on payment dispute case.”

- On Approve: Mark as Closed.

- On Reject: Return to Legal.

- Escalation: Escalate to CFO Office.

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Assign User Roles/Groups

Design approval flow

Configure notifications

Apply logic

Save and publish

Test scenario

Tweak logic

Go live

Example Journey: Late Payment Dispute – INV-2025-702

FAQ's

Unleash the full potential of your AI-powered Workflow