- Cflow

- Tax Filing Authorization Automation

Tax Filing Authorization Automation

Clow Team

Tax filing is a complex, high-stakes process involving multiple departments, documentation, deadlines, and regulatory obligations. Without automation, manual tax filing authorizations lead to missed deadlines, incomplete documentation, penalties, and audit risks. Recent industry research shows that 58% of businesses experience tax filing delays due to poor coordination between tax and compliance teams.

Processes like compliance report submission face similar challenges, where accuracy, deadlines, and multi-level approvals are non-negotiable.

Without automation, tax teams, finance controllers, compliance officers, legal counsel, auditors, and CFOs struggle to track submission deadlines, validate tax data, review filings, and maintain audit trails. This guide walks you through exactly how Cflow automates Tax Filing Authorization Process, from data preparation to final CFO authorization.

What Is Tax Filing Authorization Process?

The Tax Filing Authorization Process governs how corporate tax filings (income tax, VAT/GST, payroll tax, excise tax, property tax, etc.) are prepared, reviewed, validated, and officially authorized before submission to tax authorities.

Think of tax filing authorizations as formal compliance checkpoints , every filing is verified for accuracy, compliance, and approval before submission.

The same level of scrutiny applies in financial audit sign-offs, where detailed reviews ensure data integrity and regulatory alignment.

Recent industry research shows that automating tax filing approvals reduces late filings by 50% and lowers audit risks by 40%.

Why Tax Filing Authorization Matters for Organizations

Regulatory Compliance

Ensures timely and accurate tax filings aligned with statutory requirements.

Penalty Avoidance

Audit Readiness

Internal Controls

Transparency

Facilitates real-time visibility into tax filing status and review progress.

Key Benefits of Automating Tax Filing Authorization with Cflow

- Centralized Filing Request Portal: Cflow allows tax teams to submit filings with supporting schedules, reconciliations, and documentation into one unified platform for complete transparency. All related documents are version-controlled and securely stored within the system. This centralized visibility minimizes miscommunication and ensures accountability across finance, tax, and compliance teams.

- Dynamic Routing Based on Tax Type: Cflow applies routing logic based on filing type (corporate income tax, VAT/GST, payroll tax, etc.), jurisdiction, and financial exposure. It dynamically assigns reviewers and approvers based on risk thresholds and entity structure. This ensures the right experts handle the right filings, reducing delays and errors.

- Multi-Level Review Workflows: Filings route through tax, finance, compliance, legal, external auditors, and CFO based on filing complexity and risk. Each stakeholder receives a task with built-in turnaround timelines and supporting context. The multi-stage process ensures no critical filing is submitted without the right level of oversight.

- Real-Time Notifications & Escalations: Automated alerts ensure deadlines are met while escalation rules prevent last-minute risks. Alerts can be configured by jurisdiction, tax type, or dollar threshold. Stakeholders are notified of overdue tasks and pending reviews, allowing faster resolution of bottlenecks.

- Regulatory Validation: Cflow enforces country-specific tax codes, documentation standards, filing deadlines, and e-filing requirements into the process flow. The system automatically flags deviations from statutory formats or compliance gaps. Teams can focus on accuracy rather than manually tracking every regulatory update.

- Full Audit Trail & Filing History: Every schedule review, correction, authorization, and submission is archived for audits and government inspections. Timestamped logs make it easy to verify who took what action and when. The audit trail can be exported instantly during inquiries or regulatory audits.

- Mobile Accessibility: CFOs and tax managers can review, approve, or sign-off tax filings remotely. The mobile interface supports secure access with role-based permissions and multi-factor authentication. Whether traveling or working offsite, decision-makers remain connected to critical tax operations.

Get the best value for money with Cflow

User Roles & Permissions

Tax Specialist (Initiator)

- Responsibilities: Prepare tax filings, upload schedules, and submit for approval.

- Cflow Permission Level: Submit Form.

- Mapping: “Tax Team.”

Finance Controller

- Responsibilities: Verify financial reconciliations and confirm tax calculations.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Team.”

Compliance Officer

- Responsibilities: Ensure tax compliance with internal policies and external regulations.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Legal Counsel

- Responsibilities: Review tax exposure, legal interpretations, and regulatory positions.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Group.”

CFO (Final Approver)

- Responsibilities: Provide final authorization for filing submission.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board.”

Discover why teams choose Cflow

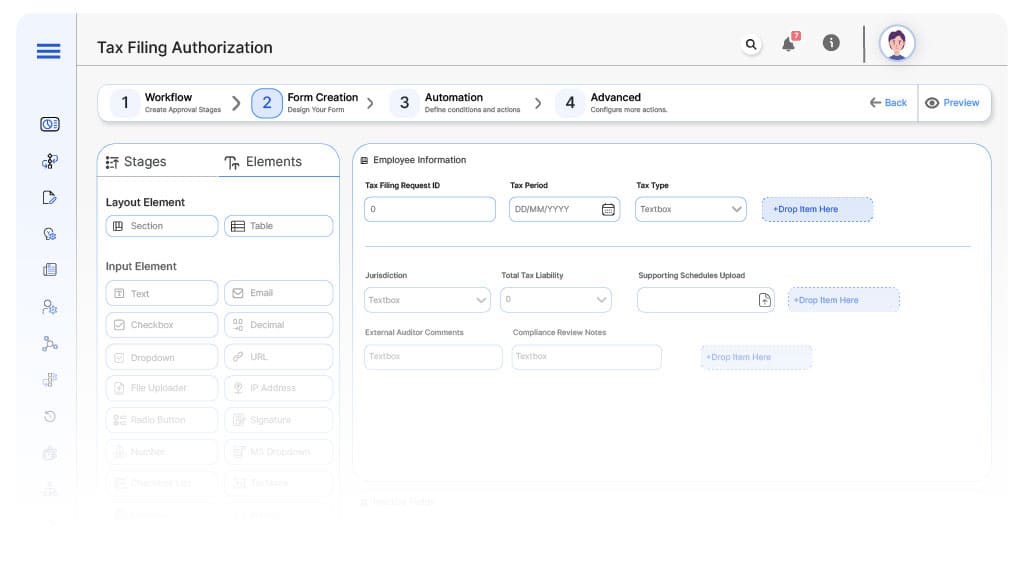

Form Design & Field Definitions

Field Label: Tax Filing Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Tax Period

- Type: Date Range Picker

- Logic/Rules: Mandatory.

Field Label: Tax Type

- Type: Dropdown (Income Tax, VAT/GST, Payroll Tax, Property Tax, Excise Tax, Customs Duties)

- Logic/Rules: Drives routing.

Field Label: Jurisdiction

- Type: Dropdown (Country/Region)

- Logic/Rules: Mandatory.

Field Label: Total Tax Liability (USD)

- Type: Numeric Field

- Logic/Rules: Drives financial exposure.

Field Label: Supporting Schedules Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: External Auditor Comments (Optional)

- Type: Text Area

- Logic/Rules: Optional field for audit review.

Field Label: Compliance Review Notes

- Type: Text Area

- Logic/Rules: Required for compliance officer.

Field Label: Legal Counsel Notes

- Type: Text Area

- Logic/Rules: Required for legal review.

Field Label: Finance Review Notes

- Type: Text Area

- Logic/Rules: Required for finance controller.

Field Label: CFO Certification Notes

- Type: Text Area

- Logic/Rules: Required for CFO.

Field Label: Filing Approved Confirmation

- Type: Checkbox

- Logic/Rules: Marks filing as authorized for submission.

Transform your Workflow with AI fusion

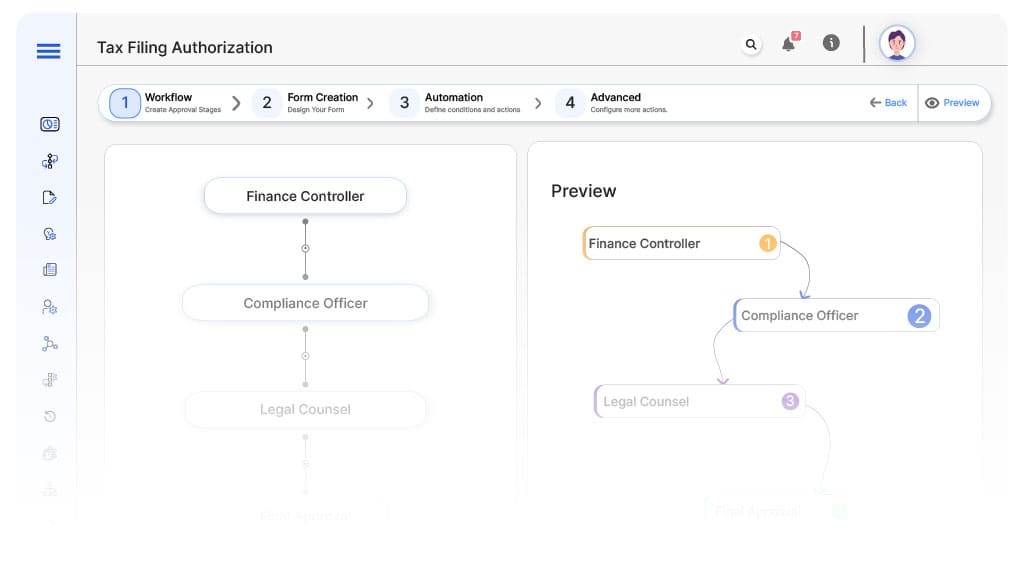

Approval Flow & Routing Logic

Submission → Finance Controller

- Status Name: Pending Financial Review

- Notification Template: “Hi Finance, tax filing submitted for reconciliation and financial accuracy.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Tax Specialist.

- Escalation: Reminder after 1 day.

Finance → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Hi Compliance, filing requires regulatory and policy validation.”

- On Approve: Moves to Legal Counsel.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Compliance → Legal Counsel

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, tax filing requires legal review of exposure positions.”

- On Approve: Moves to CFO.

- On Reject: Returns to Compliance Officer.

- Escalation: Reminder after 1 day.

Legal → CFO

- Status Name: Pending CFO Approval

- Notification Template: “Hi CFO, filing is ready for final authorization.”

- On Approve: Moves to Filing Authorized.

- On Reject: Returns to Legal Counsel.

- Escalation: Reminder after 1 day.

Final → Filing Authorized

- Status Name: Tax Filing Authorized

- Notification Template: “Tax filing fully authorized. Submission ready for e-filing.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: VAT Filing Authorization

FAQ's

Setup typically completes within 5–7 business days.

Absolutely. Cflow integrates with ERP, tax reporting, audit, and compliance platforms.

Unleash the full potential of your AI-powered Workflow