- Cflow

- Refund Request Approval Automation

Refund Request Approval Automation

Clow Team

Processing refund requests manually can result in delayed resolutions, scattered documentation, and poor customer experience. In high-volume environments, missed validations or improper approvals can also lead to revenue leakage and audit risks. Reports show that companies with automated refund workflows resolve requests 40% faster.

Cflow enables organizations to automate refund request approvals with customizable forms, role-based approvals, and audit trails. This guide explains how the refund process is streamlined using Cflow from initiation to final refund issuance.

What Is Refund Request Approval Automation?

Refund Request Approval Automation is the process of managing customer or vendor refund claims through a structured digital workflow. It ensures refund claims are validated, routed to appropriate reviewers, and tracked through resolution.

With Cflow, refund requests are submitted through a standard form, automatically routed for finance and compliance review, and finalized with approval from leadership. The system ensures documentation is intact, eligibility rules are enforced, and payments are traceable.

Why Refund Request Approval Automation Matters for Organizations

Faster Processing

Reduced Errors

Improved Audit Readiness

Customer Experience

Key Benefits of Automating Refund Requests with Cflow

- Centralized Refund Submission Form: Cflow provides a structured form to capture refund reason, invoice details, customer ID, and payment reference. It ensures no request is submitted without mandatory documentation or eligibility criteria.

- Conditional Routing Based on Refund Type or Value: Refund requests are routed differently based on type (product, service, overcharge) and value. High-value refunds can be routed through compliance or CFO, while small refunds move faster through finance only.

- Built-in Document Validation: The form supports mandatory file uploads such as invoices or bank statements. Finance reviewers can validate attached data before approval, ensuring proper evidence exists for every transaction.

- Audit Trail & Status Transparency: Every request in Cflow is time-stamped with user actions, reviewer comments, and approval flow. Requestors can track the status, reducing internal follow-ups and bottlenecks.

- Integration with Finance Systems: Approved refunds can sync with ERP or payment platforms via integration. This prevents double-entry, ensures visibility across systems, and accelerates fund disbursement.

Get the best value for money with Cflow

User Roles & Permissions

Customer Support Agent

- Responsibilities: Initiates refund request with required attachments.

- Cflow Permission Level: Submit Form

- Mapping: “Support Team”

Finance Reviewer

- Responsibilities: Validates documentation, refund eligibility, and payment source.

- Cflow Permission Level: Approve/Reject

- Mapping: “Finance Department”

Compliance Officer

- Responsibilities: Ensures policy compliance for high-value or disputed refunds.

- Cflow Permission Level: Approve/Reject

- Mapping: “Compliance Group”

CFO / Director

- Responsibilities: Final approval for high-value or escalated refunds.

- Cflow Permission Level: Approve/Reject

- Mapping: “Executive Team”

Discover why teams choose Cflow

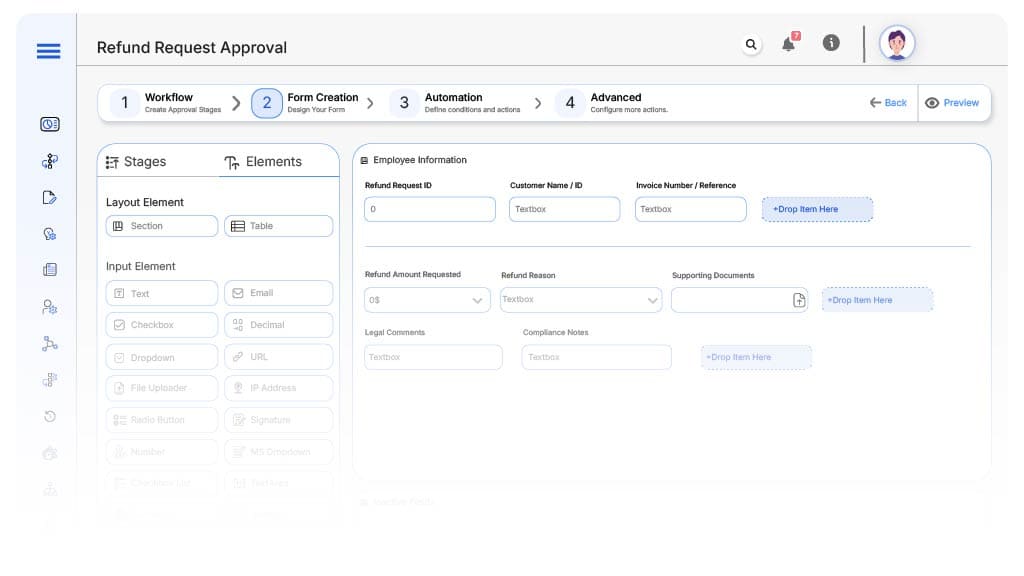

Form Design & Field Definitions

Field Label: Refund Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Customer Name / ID

- Type: Text Field

- Logic/Rules: Mandatory

Field Label: Invoice Number / Reference

- Type: Text Field

- Logic/Rules: Required and validated

Field Label: Refund Amount Requested

- Type: Currency Field

- Logic/Rules: Triggers approval levels

Field Label: Refund Reason

- Type: Dropdown (Product Return, Overcharge, Service Issue, Other)

- Logic/Rules: Drives routing logic

Field Label: Supporting Documents

- Type: File Upload

- Logic/Rules: Required

Field Label: Compliance Notes

- Type: Text Area

- Logic/Rules: Visible only at compliance stage

Transform your Workflow with AI fusion

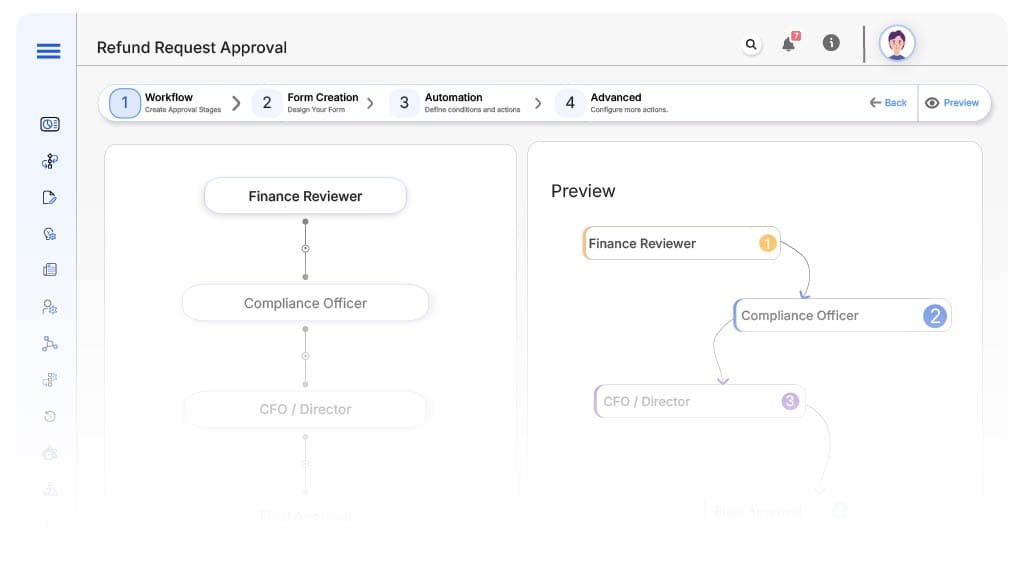

Approval Flow & Routing Logic

Submission → Finance Reviewer

- Status Name: Pending Finance Review

- Notification Template: “New refund request submitted. Please verify details and documentation.”

- On Approve: Route to Compliance or Mark Approved (based on amount)

- On Reject: Return to Requester

- Escalation: Notify Finance Lead in 1 day

Finance → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Refund request requires compliance validation.”

- On Approve: Route to CFO

- On Reject: Return to Finance

- Escalation: Alert Compliance Head

Compliance → CFO / Director

- Status Name: Pending Final Approval

- Notification Template: “Final review required for high-value refund request.”

- On Approve: Mark as Approved

- On Reject: Return to Compliance

- Escalation: Notify CEO Office

Final → Refund Processed

- Status Name: Refund Request Fully Approved

- Notification Template: “Refund request approved. Finance team may initiate the disbursement.”

- On Approve: Archive and notify requester

- On Reject: N/A

- Escalation: None

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Add all fields from the “Form Design” section. Ensure mandatory validations and field logic are applied.

Set up User Roles/Groups

Map workflow logic

Configure alerts

Set routing rules

Test workflow

Tweak settings

Go live

Example Journey: Overcharge Refund of $2,800

FAQ's

Unleash the full potential of your AI-powered Workflow