- Cflow

- Investment Proposal Approval Automation

Investment Proposal Approval Automation

Clow Team

Loan application endorsement is a critical phase in financial institutions to ensure proper evaluation, risk assessment, and regulatory compliance before final loan disbursement. Without automation, manual endorsement processes result in delayed decisions, inconsistent risk evaluation, customer dissatisfaction, and regulatory exposure. Recent industry research shows that 60% of financial institutions face processing delays due to manual endorsement and review bottlenecks.

Without automation, relationship managers, credit officers, risk analysts, compliance officers, legal counsel, and senior approvers struggle to coordinate documentation review, financial analysis, and regulatory assessments. This guide walks you through exactly how Cflow automates Loan Application Endorsement Process, from application submission to final endorsement.

What Is Investment Proposal Approval Process?

The Investment Proposal Approval Process governs how new investment opportunities are submitted, evaluated, and authorized based on financial feasibility, strategic fit, risk exposure, and compliance standards before funds are committed.

Think of investment approvals as strategic capital gatekeeping , every investment proposal must be fully validated before deployment.

Recent industry research shows that automating investment approvals reduces approval cycle time by 55% and improves capital allocation discipline by 40%.

Why Investment Proposal Approval Matters for Organizations

Strategic Governance

Financial Oversight

Risk Management

Regulatory Compliance

Audit Trail

Key Benefits of Automating Investment Proposal Approval with Cflow

- Centralized Proposal Submission Portal: Cflow allows business units to submit detailed investment proposals, financial models, market studies, and supporting documents into a unified transparent workflow. All proposal components are version-controlled and linked to a single submission ID. This ensures better tracking, reduces duplication, and enhances collaboration between strategic planning, finance, and executive stakeholders.

- Dynamic Routing Based on Investment Type: Cflow applies routing logic based on investment category (M&A, capital projects, technology upgrades, partnerships, venture capital, internal projects), financial exposure, and risk profile. Custom rules assign reviewers based on domain expertise and risk thresholds. This ensures relevant stakeholders are automatically looped in to maintain policy and fiscal discipline.

- Multi-Level Review Workflows: Proposals route through finance, strategy, risk, legal, compliance, and executive leadership depending on project size and complexity. Each review stage has defined SLAs, validation criteria, and mandatory documentation. The workflow guarantees rigorous due diligence while minimizing delays in capital deployment.

- Real-Time Notifications & Escalations: Automated alerts ensure timely evaluations while escalation rules prevent stalled decisions. Reminders are triggered for pending reviews, missed deadlines, or conditional approvals. Stakeholders are kept informed throughout the proposal lifecycle, enhancing visibility and ensuring no critical investment is left unattended.

- Policy Compliance Enforcement: Cflow integrates capital allocation policies, investment thresholds, ROI benchmarks, and board approval requirements directly into routing and approval logic. Proposals outside set parameters are flagged for additional validation or redirected for revision. This ensures consistent, compliant decision-making aligned with governance frameworks.

- Full Audit Trail & Decision Logs: Every proposal, evaluation, review comment, risk assessment, and board resolution is archived for governance and external audits. Time-stamped logs and user actions create an immutable decision trail. Audit reports can be generated instantly for internal reviews or regulatory disclosures.

- Mobile Accessibility: Senior executives and board members can review and endorse proposals remotely for faster approvals on strategic investments. The mobile interface supports annotations, approvals, and comment threads on the go. It ensures leadership remains responsive to time-sensitive proposals – even outside the office.

Get the best value for money with Cflow

User Roles & Permissions

Business Unit Sponsor (Initiator)

- Responsibilities: Submit detailed investment proposal with financial projections and strategic justification.

- Cflow Permission Level: Submit Form.

- Mapping: “Business Unit.”

Finance Controller

- Responsibilities: Validate financial feasibility, funding availability, ROI calculations, and budget allocations.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Team.”

Strategy Officer

- Responsibilities: Review strategic alignment with corporate goals and business roadmap.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Strategy Team.”

Risk Manager

- Responsibilities: Evaluate financial, operational, and regulatory risks of proposed investment.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Risk Team.”

Compliance Officer

- Responsibilities: Verify adherence to regulatory standards and internal investment guidelines.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Legal Counsel

- Responsibilities: Review contractual, regulatory, and legal implications of the investment.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Group.”

Board / Investment Committee (Final Approver)

- Responsibilities: Final authorization for significant investments.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board.”

Discover why teams choose Cflow

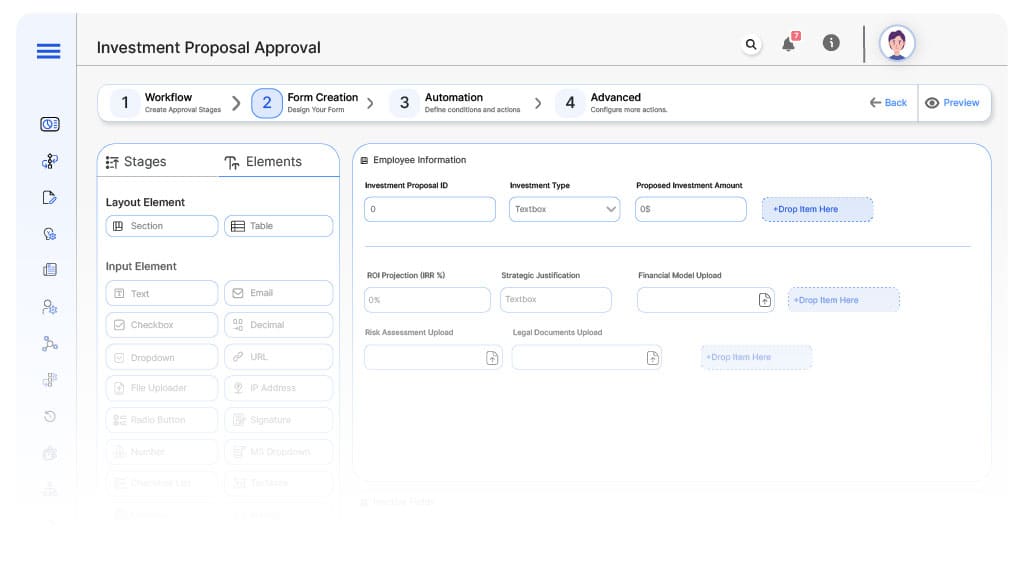

Form Design & Field Definitions

Field Label: Investment Proposal ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Investment Type

- Type: Dropdown (M&A, Capital Project, Venture Investment, Technology Upgrade, Partnership, Internal Project)

- Logic/Rules: Drives routing.

Field Label: Proposed Investment Amount (USD)

- Type: Numeric Field

- Logic/Rules: Drives financial and board-level routing.

Field Label: ROI Projection (IRR %)

- Type: Numeric Field

- Logic/Rules: Mandatory for finance evaluation.

Field Label: Strategic Justification

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Financial Model Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Risk Assessment Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Legal Documents Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Finance Review Notes

- Type: Text Area

- Logic/Rules: Required.

Field Label: Strategy Review Notes

- Type: Text Area

- Logic/Rules: Required.

Field Label: Risk Review Notes

- Type: Text Area

- Logic/Rules: Required

Field Label: Compliance Review Notes

- Type: Text Area

- Logic/Rules: Required.

Field Label: Legal Review Notes

- Type: Text Area

- Logic/Rules: Required.

Field Label: Board Approval Comments

- Type: Text Area

- Logic/Rules: Required.

Field Label: Board Approval Comments

- Type: Checkbox

- Logic/Rules: Marks investment as fully approved.

Transform your Workflow with AI fusion

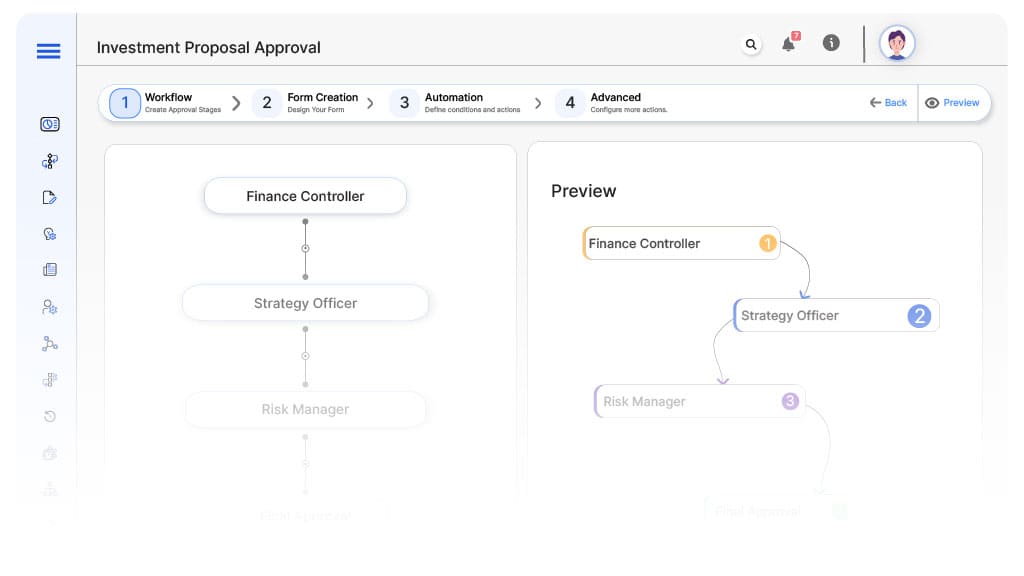

Approval Flow & Routing Logic

Submission → Finance Controller

- Status Name: Pending Financial Review

- Notification Template: “Hi Finance, new investment proposal submitted for financial evaluation.”

- On Approve: Moves to Strategy Officer.

- On Reject: Returns to Business Unit Sponsor.

- Escalation: Reminder after 1 day.

Finance → Strategy Officer

- Status Name: Pending Strategic Review

- Notification Template: “Hi Strategy, proposal requires alignment evaluation.”

- On Approve: Moves to Risk Manager.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Strategy → Risk Manager

- Status Name: Pending Risk Evaluation

- Notification Template: “Hi Risk Team, investment requires risk profile assessment.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Strategy Officer.

- Escalation: Reminder after 1 day.

Risk → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Hi Compliance, review regulatory adherence and guidelines.”

- On Approve: Moves to Legal Counsel.

- On Reject: Returns to Risk Manager.

- Escalation: Reminder after 1 day.

Compliance → Legal Counsel

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, legal contract and due diligence documents require review.”

- On Approve: Moves to Board.

- On Reject: Returns to Compliance Officer.

- Escalation: Reminder after 1 day.

Legal → Board

- Status Name: Pending Board Approval

- Notification Template: “Hi Board, significant investment proposal ready for final decision.”

- On Approve: Moves to Investment Approved.

- On Reject: Returns to Legal Counsel.

- Escalation: Reminder after 1 day.

Final → Investment Approved

- Status Name: Investment Fully Approved

- Notification Template: “Investment proposal fully authorized. Proceed with execution.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Venture Capital Investment Proposal

FAQ's

Unleash the full potential of your AI-powered Workflow