- Cflow

- Foreign Exchange Transaction Automation

Foreign Exchange Transaction Automation

Clow Team

Foreign exchange (forex) transactions are high-risk, high-value operations that require strict oversight, regulatory compliance, and multi-level approvals. In many organizations, these transactions are still processed manually via emails, spreadsheets, or informal chats between treasury and finance teams, leading to delays, errors, and compliance gaps.

Lack of visibility, missed rate locks, and approval lags often result in financial losses or regulatory penalties. This guide outlines how Cflow automates the foreign exchange transaction process, ensuring every request is validated, approved, and executed with precision and traceability.

What Is Foreign Exchange Transaction Process?

The foreign exchange transaction process governs how companies initiate, review, approve, and settle currency conversions and international payments. It involves multiple stakeholders – finance, treasury, compliance, and top management – to validate the transaction’s purpose, FX rate, and documentation.

Think of it like authorizing a high-stakes money transfer: every detail matters, timing, currency pair, counterparty, and policy compliance. Without automation, organizations risk miscommunication, exposure to rate fluctuations, or regulatory breaches.

A structured FX workflow not only standardizes execution but also creates a digital trail for every transaction, essential for audits and reporting.

Why FX Transaction Automation Is Important for Finance Teams

Risk Mitigation

Policy Adherence

Audit Compliance

Faster Execution

Key Benefits of Automating FX Transactions with Cflow

- Centralized FX Request Dashboard: Cflow offers a single interface for submitting and tracking forex transactions. Treasury and finance teams get real-time visibility into status, pending approvals, and settlement history. It eliminates the need to manage requests across spreadsheets, emails, or multiple tools.

- Rate Lock Deadline Monitoring: Cflow can track FX quote validity (e.g., 15-minute rate locks) and trigger reminders or escalations to approvers, reducing the risk of missed windows and rate changes. This ensures approvals happen within time-sensitive windows, avoiding unexpected rate fluctuations.

- Automated Multi-Level Approvals: Based on transaction value, Cflow routes approvals to CFO, treasury head, or compliance officer. Rules are customizable by currency, amount, or counterparty. The system reduces back-and-forth and ensures all high-value transactions receive appropriate oversight.

- Regulatory Document Handling: Teams can attach KYC, RBI forms, invoices, or tax declarations directly in the form. Cflow blocks progression until mandatory documents are uploaded and verified. This helps organizations stay compliant with regulatory standards and avoid documentation gaps.

- Audit-Ready Recordkeeping: Every FX request, comment, attachment, and decision is logged with timestamps. During audits, finance teams can instantly export transaction histories with full traceability. The audit trail enhances transparency and reduces time spent preparing compliance reports.

Get the best value for money with Cflow

User Roles & Permissions

Initiator (Finance Executive)

- Responsibilities: Submit FX request with amount, currency, counterparty, and purpose.

- Cflow Permission: Submit Form

- Mapping: “Finance” group

Treasury Manager

- Responsibilities: Verify FX rate, select bank/counterparty, and initiate booking.

- Cflow Permission: Task Owner

- Mapping: “Treasury” group

Compliance Officer

- Responsibilities: Review documentation, ensure regulatory adherence (FEMA, RBI).

- Cflow Permission: Approve/Reject

- Mapping: “Compliance” group

CFO / Leadership

- Responsibilities: Final approval for high-value or sensitive transactions.

- Cflow Permission: Approve/Reject

- Mapping: “Leadership” group

Accounts Payable

- Responsibilities: Process payment post-approval.

- Cflow Permission: Task Owner

- Mapping: “Accounts Team” group

Discover why teams choose Cflow

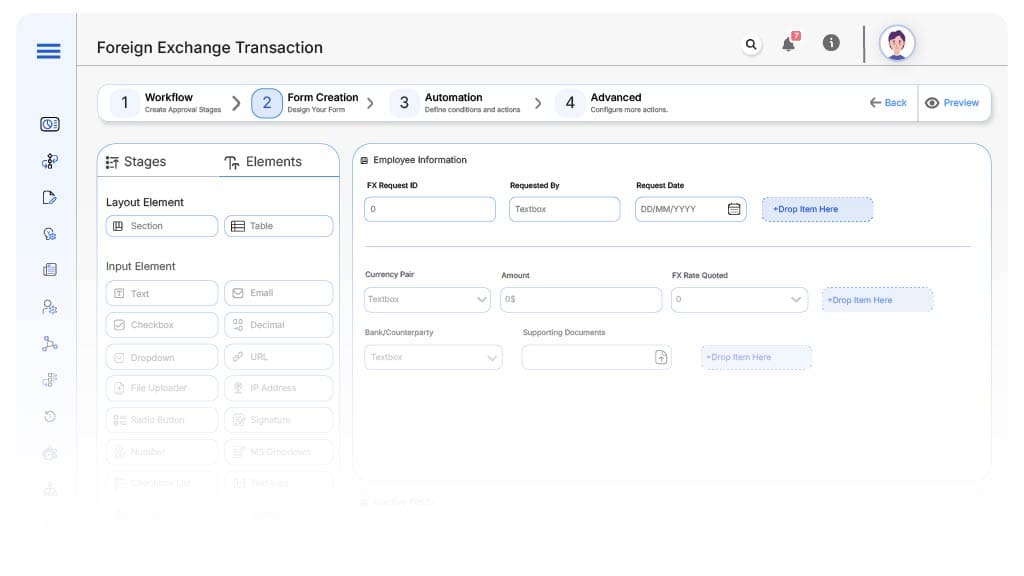

Form Design & Field Definitions

Field Label: FX Request ID

- Type: Autonumber

- Auto-Populate: Generated automatically on submission.

Field Label: Requested By

- Type: Text

- Auto-Populate: From user profile

Field Label: Request Date

- Type: Date Picker

- Logic: Required

Field Label: Currency Pair

- Type: Dropdown (e.g., USD/INR, EUR/INR)

- Logic: Required

Field Label: Amount

- Type: Currency

- Logic: Drives approval thresholds

Field Label: FX Rate Quoted

- Type: Decimal

- Logic: Verified by Treasury

Field Label: Bank/Counterparty

- Type: Dropdown

- Logic: Approved banks only

Field Label: Supporting Documents

- Type: File Upload

- Logic: Required for compliance stage

Field Label: Payment Mode

- Type: Dropdown (NEFT, RTGS, SWIFT)

- Logic: Triggers AP instructions

Field Label: CFO Approval Required

- Type: Checkbox

- Logic: If amount > defined limit

Field Label: Final Booking Confirmation

- Type: Checkbox

- Logic: Checked by Treasury

Transform your Workflow with AI fusion

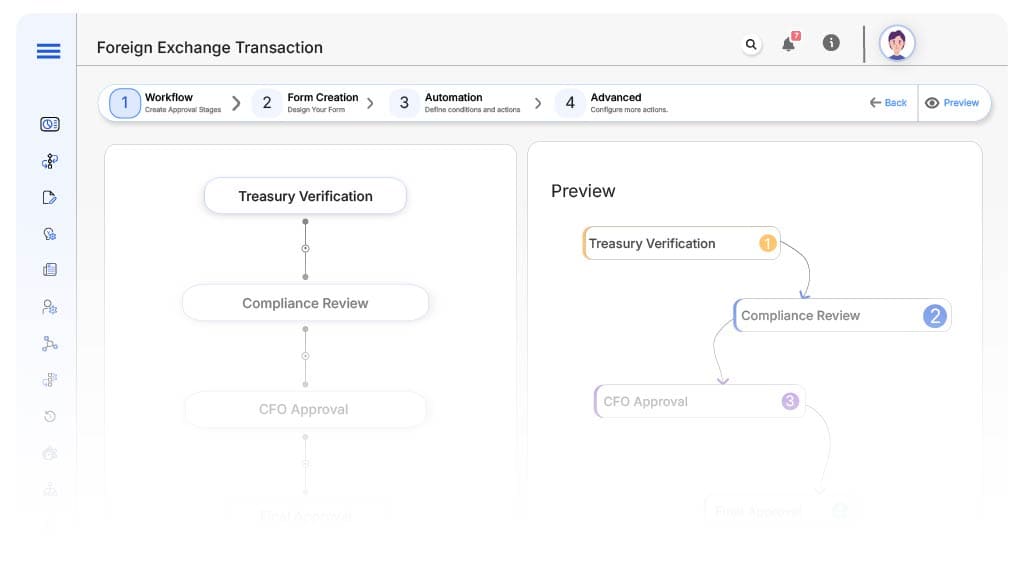

Approval Flow & Routing Logic

Submission → Treasury Verification

- Status: Pending Treasury Review

- Notification: “New FX request from {User}. Please verify rate and bank details.”

- On Approve: Routes to Compliance

Treasury → Compliance Review

- Status: Pending Compliance Clearance

- Notification: “Please verify documents for FX request {FX ID}.”

- Escalation: Alert after 24 hours

Compliance → CFO Approval (Conditional)

- Status: Pending Leadership Approval

- Notification: “High-value FX request requires CFO sign-off.”

- On Approve: Routes to AP

Compliance → Accounts Payable (if no CFO needed)

- Status: Pending Payment Execution

- Notification: “FX request cleared. Proceed with fund settlement.”

Final → Completed

- Status: FX Transaction Complete

- Notification: “Transaction {FX ID} successfully executed and archived.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Define User Groups

Map Approval Flow

Configure Alerts

Apply Conditions

Test Workflow

Go live

Example Journey: INR to EUR Payout

FAQ's

Unleash the full potential of your AI-powered Workflow