- Cflow

- Employee Expense Reimbursement Automation

Employee Expense Reimbursement Automation

Clow Team

Employee expense reimbursements are frequent, often high-volume financial processes that require clear policies, fast approvals, and compliance with tax regulations. Without automation, manual processing leads to delays, incomplete documentation, policy violations, and employee dissatisfaction. Recent industry research shows that 49% of finance teams report errors or delays in reimbursement due to manual processes.

Without automation, employees, managers, HR, finance controllers, and CFOs struggle to validate receipts, enforce policies, calculate entitlements, and maintain audit trails. This guide walks you through exactly how Cflow automates Employee Expense Reimbursement Process, from claim submission to final payout.

Similar approval flows exist in relocation expense claim automation, where staff submit travel- or move-related costs and finance speeds up policy-compliant reimbursements.

What Is Employee Expense Reimbursement Process?

The Employee Expense Reimbursement Process governs how employees submit claims for work-related expenses, how those claims are validated against company policies, approved by multiple stakeholders, and reimbursed while ensuring tax and audit compliance.

You’ll see the same validate-then-pay logic in refund request approval automation, which verifies claims and authorizes timely payouts.

Think of expense reimbursement like mini vendor payments , every claim requires policy matching, receipt validation, management review, finance oversight, and audit-ready documentation.

Recent industry research shows that automating expense reimbursements reduces processing time by 65% and minimizes errors by 75%.

Why Employee Expense Reimbursements Matter for Organizations

Employee Satisfaction

Policy Compliance

Tax Compliance

Audit Trail

Maintains complete documentation for financial and tax audits.

Key Benefits of Automating Employee Expense Reimbursement with Cflow

- Centralized Reimbursement Portal: Cflow centralizes expense claim submissions into one standardized portal where employees can upload receipts, select expense categories, and assign cost centers. This unified system eliminates scattered processes and manual tracking. It brings consistency, accuracy, and efficiency to every reimbursement workflow.

- Dynamic Routing Based on Amount and Category: Cflow applies intelligent routing logic to move claims based on the amount, type of expense, and department. Higher-value or exceptional claims automatically escalate through multiple approval layers. This ensures timely, accurate reviews while minimizing unnecessary delays.

- Multi-Level Approval Workflows: Claims pass through structured approval tiers such as reporting managers, HR, finance controllers, or CFOs, depending on predefined rules. Each stakeholder is notified automatically without manual follow-ups. This layered process ensures compliance and audit readiness.

- Real-Time Notifications & Escalations: Approvers receive real-time alerts when claims require their action, ensuring nothing gets overlooked. If responses are delayed, the system escalates the task to higher authorities. This prevents reimbursement slowdowns and maintains steady process flow.

- Policy Validation Rules: Cflow verifies each claim for missing receipts, incorrect coding, or violations before it’s routed for approval. Any non-compliance is flagged upfront, reducing rework. Built-in validation ensures cleaner, more accurate claim processing. When a claim falls outside policy, teams rely on expense policy exception automation to route exceptions, capture justification, and approve or reject payouts.

- Full Audit Trail & Expense Logs: Every interaction – submission, approval, flag, or edit—is recorded in a secure audit trail within Cflow. This ensures full transparency and accountability for all claims. The logs are accessible for internal reviews and external audits.

- Mobile Accessibility: Cflow’s mobile interface enables employees, managers, and finance teams to handle claims anytime, anywhere. Remote approvals and submissions keep workflows moving regardless of location. This flexibility supports today’s hybrid work environment.

Get the best value for money with Cflow

User Roles & Permissions

Employee (Initiator)

- Responsibilities: Submit reimbursement request with receipts and expense breakdown.

- Cflow Permission Level: Submit Form.

- Mapping: “Employee Group.”

Manager

- Responsibilities: Review policy compliance, documentation completeness, and exception handling.

- Cflow Permission Level: Approve/Reject.

- Mapping: “HR Group.”

Finance Controller

- Responsibilities: Validate consolidated department budgets and funding requests.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Controllers” group.

Finance Controller

- Responsibilities: Validate accounting codes, taxable classification, and budget impact.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Team.”

CFO (Conditional)

- Responsibilities: Final sign-off for high-value or exception reimbursements.

- Cflow Permission Level: Approve/Reject.

- Mapping: “CFO Group.”

Discover why teams choose Cflow

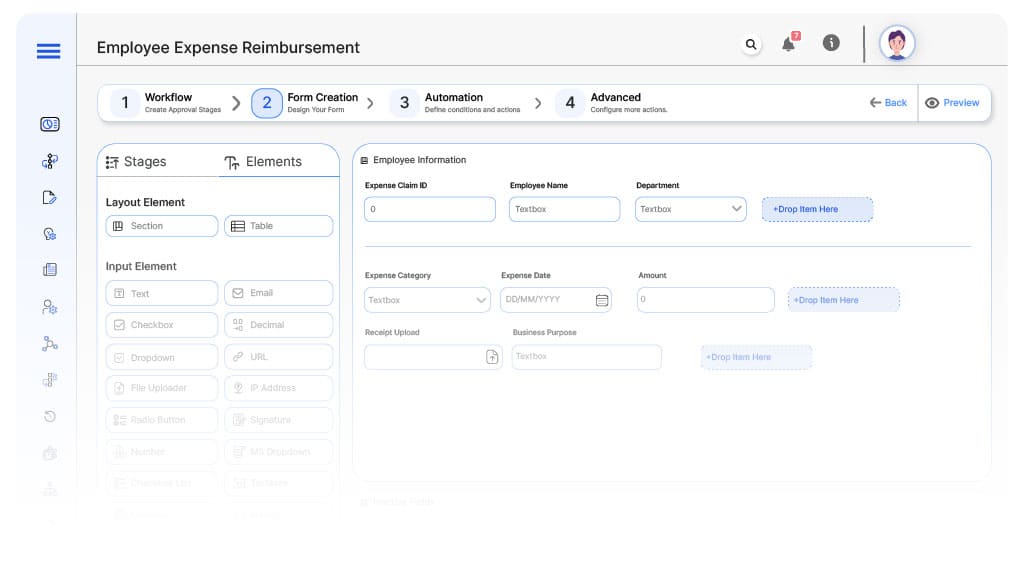

Form Design & Field Definitions

Field Label: Expense Claim ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Employee Name

- Type: Text (Autofill)

- Auto-Populate: From user profile.

Field Label: Department

- Type: Dropdown

- Logic/Rules: Mandatory.

Field Label: Expense Category

- Type: Dropdown (Travel, Meals, Accommodation, Training, Supplies, Others)

- Logic/Rules: Drives routing.

Field Label: Expense Date

- Type: Date Picker

- Logic/Rules: Mandatory.

Field Label: Amount

- Type: Numeric Field

- Logic/Rules: Drives routing and policy validation.

Field Label: Receipt Upload

- Type: File Upload

- Logic/Rules: Mandatory unless categorized as per diem.

Field Label: Business Purpose

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Policy Violation Flag

- Type: System Flag

- Logic/Rules: Triggered by amount limits or unapproved categories.

Field Label: Manager Review Notes

- Type: Text Area

- Logic/Rules: Required for manager approval.

Field Label: HR Review Notes

- Type: Text Area

- Logic/Rules: Required for HR.

Field Label: Finance Review Notes

- Type: Text Area

- Logic/Rules: Required for finance controller.

Field Label: CFO Comments

- Type: Text Area

- Logic/Rules: Required for CFO approvals.

Field Label: Payment Confirmation

- Type: Checkbox

- Logic/Rules: Finance marks reimbursement processed.

Transform your Workflow with AI fusion

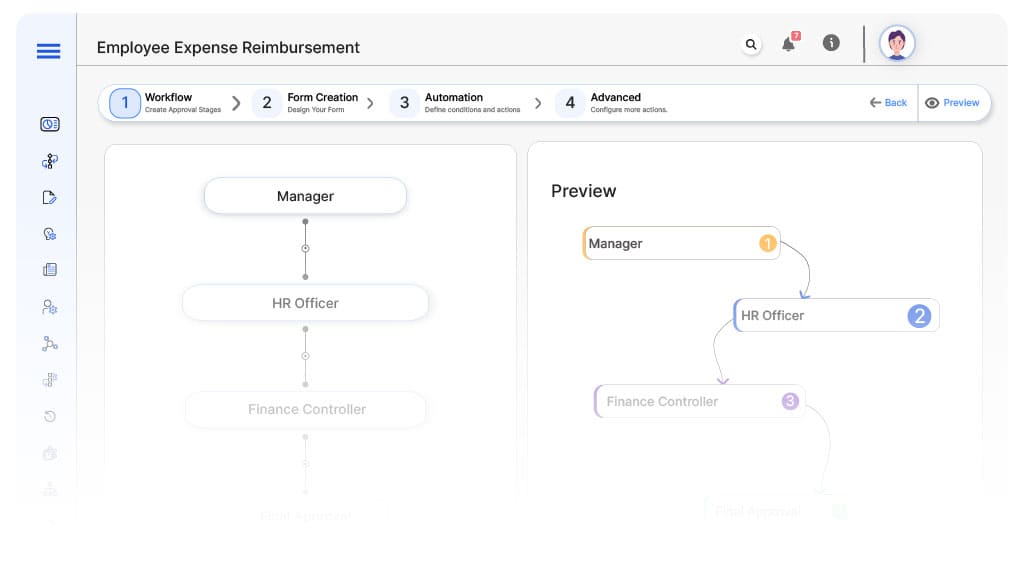

Approval Flow & Routing Logic

Submission → Manager

- Status Name: Pending Manager Review

- Notification Template: “Hi Manager, new reimbursement request submitted for your review.”

- On Approve: Moves to HR Officer.

- On Reject: Returns to Employee.

- Escalation: Reminder after 1 day.

Manager → HR Officer

- Status Name: Pending HR Review

- Notification Template: “Hi HR, reimbursement request ready for policy validation.”

- On Approve: Moves to Finance Controller.

- On Reject: Returns to Manager.

- Escalation: Reminder after 1 day.

HR → Finance Controller

- Status Name: Pending Finance Review

- Notification Template: “Hi Finance, reimbursement request ready for accounting review.”

- On Approve: Moves to CFO (if applicable).

- On Reject: Returns to HR.

- Escalation: Reminder after 1 day.

Finance → CFO (Conditional)

- Status Name: Pending CFO Approval

- Notification Template: “Hi CFO, high-value or exception reimbursement requires final sign-off.”

- On Approve: Moves to Reimbursement Authorized.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Final → Reimbursement Authorized

- Status Name: Reimbursement Approved

- Notification Template: “Expense reimbursement fully approved and payment scheduled.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: International Travel Claim

FAQ's

Setup typically completes within 5–7 business days.

Unleash the full potential of your AI-powered Workflow