- Cflow

- Credit Note Authorization Automation

Credit Note Authorization Automation

Clow Team

Credit notes are essential for correcting billing errors, applying post-sale discounts, or managing customer refunds. However, manually authorizing credit notes often leads to processing delays, approval ambiguities, and compliance risks. According to recent surveys, 48% of finance teams face inconsistencies in credit note handling.

Without automation, finance, sales, and audit teams struggle with version control, justification tracking, and ensuring that approvals comply with company policy. This guide walks you through how Cflow automates Credit Note Authorization Process, from initiation to final approval.

Similar challenges occur in invoice validation workflows, where finance teams struggle to match records, approvals, and supporting documents without automation.

What Is Credit Note Authorization Process?

The Credit Note Authorization Process governs how a credit adjustment request is submitted, reviewed, approved, and applied against a customer invoice. This includes validation of the reason, amount, documentation, and stakeholder sign-offs.

Proper authorization ensures that customer credits are aligned with sales terms, avoid revenue leakage, and support audit transparency. Automation streamlines the approval journey, reduces turnaround time, and improves compliance. Research shows automated credit processes improve audit accuracy by 42%.

Linked processes like employee expense reimbursements also require policy checks, supporting documents, and multi-level approvals before final payout.

Why Credit Note Authorization Matters for Organizations?

Revenue Accuracy

Audit Readiness

Customer Satisfaction

Policy Compliance

Enforces internal rules for approval limits, mandatory documentation, and automatic escalation to ensure full policy adherence.

Key Benefits of Automating Credit Note Authorization with Cflow

- Centralized Credit Note Request Portal: Cflow provides a single submission form that captures invoice details, credit reason, amount, and supporting attachments. This reduces errors, accelerates approval timelines, and ensures that each credit request is backed by consistent documentation.

- Role-Based Review Routing: Cflow automatically routes credit notes based on amount, region, and department. A small credit for a pricing error might go to the finance manager, while a large client refund routes to the CFO. This tailored routing ensures policy compliance.

- Real-Time Notifications & Escalations: Every stakeholder receives alerts when a request enters their queue. If no action is taken within defined SLAs, the system escalates to senior leadership. This prevents stalled approvals and enhances responsiveness.

- Integrated Documentation & Comments: Each request allows upload of invoice snapshots, emails, contracts, and finance notes. Stakeholders can review and add contextual comments before approval, ensuring clarity and preventing disputes.

- Full Audit Trail & Reporting: Cflow logs every action – submission, review, decision, and change in a permanent audit trail. Finance and compliance teams can generate reports for audits, reconciliations, or fraud detection. Strong audit practices are also supported by financial audit sign-off workflows, which validate accuracy before closing reporting cycles.

- ERP Integration: Approved credit notes can be synced with accounting systems like QuickBooks, NetSuite, or SAP. This eliminates manual journal entries and ensures financial systems stay accurate.

Get the best value for money with Cflow

User Roles & Permissions

Sales Representative (Initiator):

- Responsibilities: Submits the credit request with justification and invoice reference.

- Cflow Permission Level: Submit Form.

- Mapping: “Sales Team.”

Finance Reviewer:

- Responsibilities: Validates invoice, reason, and policy adherence.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Team.”

Compliance Officer:

- Responsibilities: Verifies that documentation and credit logic comply with regulations.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

CFO (Final Approver):

- Responsibilities: Grants final approval based on credit impact and business justification.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board.”

Discover why teams choose Cflow

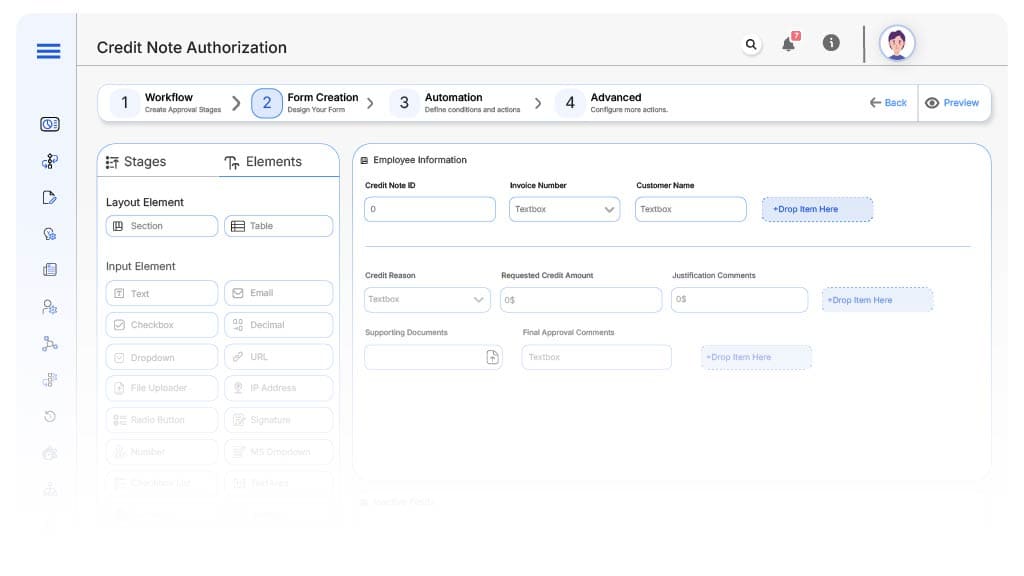

Form Design & Field Definitions

Field Label: Credit Note ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Invoice Number

- Type: Text

- Logic/Rules: Mandatory field.

Field Label: Customer Name

- Type: Dropdown

- Logic/Rules: Linked to CRM.

Field Label: Credit Reason

- Type: Dropdown (Overbilling, Discount Adjustment, Return, Cancellation)

- Logic/Rules: Drives routing.

Field Label: Requested Credit Amount

- Type: Currency Field

- Logic/Rules: Determines approval level.

Field Label: Justification Comments

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Supporting Documents

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Final Approval Comments

- Type: Text Area

- Logic/Rules: Required at CFO stage.

Transform your Workflow with AI fusion

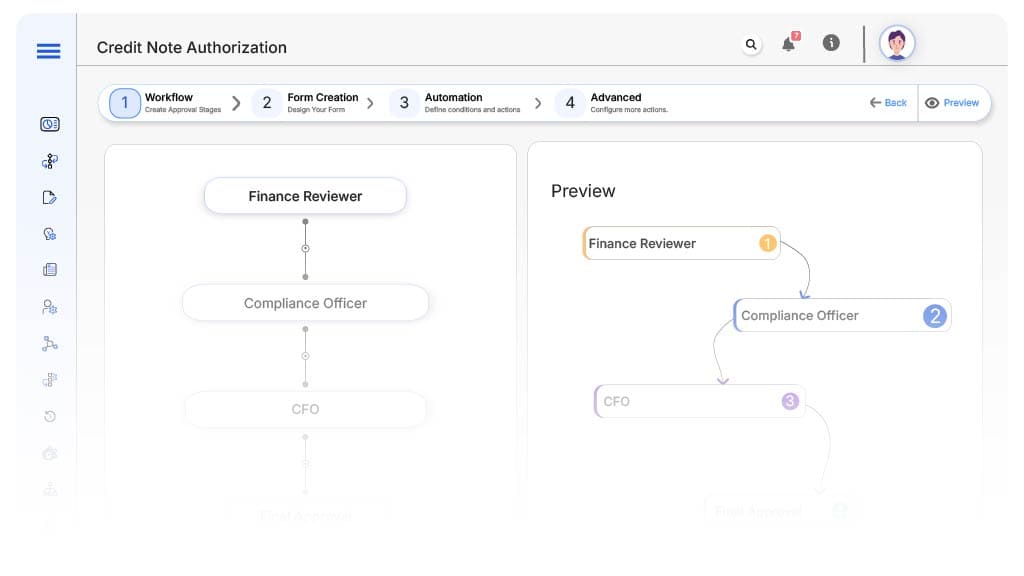

Approval Flow & Routing Logic

Submission → Finance Reviewer

- Status Name: Pending Finance Review

- Notification Template: “A new credit request has been submitted. Please review invoice and policy match.”

- On Approve: Route to Compliance.

- On Reject: Return to Sales.

- Escalation: Notify Finance Head after 1 day.

Finance → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Validate documentation and credit policy compliance.”

- On Approve: Route to CFO.

- On Reject: Return to Finance.

- Escalation: Escalate to Compliance Manager.

Compliance Officer → CFO

- Status Name: Pending Final Approval

- Notification Template: “Final sign-off required for customer credit note.”

- On Approve: Mark as Approved.

- On Reject: Return to Compliance.

- Escalation: Notify CEO Office.

Final → Credit Note Approved

- Status Name: Credit Note Approved

- Notification Template: “Customer credit note fully authorized. Proceed with ledger update and customer communication.

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set conditional logic

Save and publish workflow

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Overbilling Adjustment

FAQ's

Unleash the full potential of your AI-powered Workflow