- Cflow

- Compliance Report Submission Automation

Compliance Report Submission Automation

Clow Team

Submitting compliance reports accurately and on time is essential for organizations in regulated industries. Manual tracking, multi-level reviews, and disorganized documentation often result in missed deadlines, reporting errors, and audit risks. Recent industry research shows that 65% of compliance failures are due to human error and miscommunication.

Without automation, finance, legal, and compliance teams struggle to collect inputs, format data, and secure approvals from multiple stakeholders. This guide walks you through exactly how Cflow automates Compliance Report Submission, from data collection to final regulatory filing.

What Is Compliance Report Submission Process?

The Compliance Report Submission Process is a structured workflow that governs how organizations prepare, validate, and submit mandatory reports to regulatory bodies. These may include financial disclosures, operational summaries, audit responses, or environmental compliance forms.

In heavily regulated sectors like banking, healthcare, or energy, this process requires coordination between multiple departments, verification of data sources, and formal approvals before submission.

Recent industry research shows that automated compliance workflows can reduce reporting time by 50% and improve accuracy by 70%.

Why Compliance Report Submission Automation Matters for Organizations?

Regulatory Adherence

Data Accuracy

Cross-Department Visibility

Audit Readiness

Submission Timeliness

Key Benefits of Automating Compliance Report Submission with Cflow

- Centralized Report Template: Cflow provides predefined templates for regulatory and operational reporting, ensuring teams follow consistent formats across submissions. This reduces formatting errors and presents a unified reporting structure for stakeholders and auditors.

- Conditional Logic for Section Visibility: Based on the report type selected (e.g., financial or operational), Cflow dynamically shows or hides specific sections of the form. This keeps the interface clean and minimizes the risk of entering irrelevant data.

- Multi-Tier Review Chain: Each report submission passes through a structured review process involving finance, legal, and compliance teams. Cflow enforces this flow strictly, allowing only designated users to validate content at each stage and maintain process integrity.

- Real-Time Notifications & Escalations: Cflow sends automated notifications to stakeholders when actions are required and escalates overdue items according to configured rules. This ensures no review is missed and all reporting tasks stay on track without manual follow-ups.

- Audit Trail & Version Control: Every change, comment, and sign-off is logged, allowing teams to trace back all reporting activities. This builds accountability and makes audits smoother with a complete version history available at any time.

- Secure Document Uploads: Users can upload regulatory forms, datasets, and supporting files securely into the workflow. Documents are encrypted, access-controlled, and archived for reference and audit compliance.

- Mobile Review Capabilities: Executives and team members can review, comment, and approve reports directly from their mobile devices. This ensures reporting does not get delayed even when decision-makers are traveling or away from their desks.

Get the best value for money with Cflow

User Roles & Permissions

Finance Analyst (Initiator)

- Responsibilities: Prepares initial draft of report with financial inputs and uploads required datasets.

- Cflow Permission Level: Submit Form.

- Mapping: “Finance Team.”

Legal Reviewer

- Responsibilities: Verifies report language for legal accuracy, aligns with regulatory requirements.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Group.”

Compliance Officer:

- Responsibilities: Conducts final check against regulatory checklist and confirms report compliance.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Audit Head:

- Responsibilities: Final oversight and approval for archival and readiness for audit.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Audit Team.”

Discover why teams choose Cflow

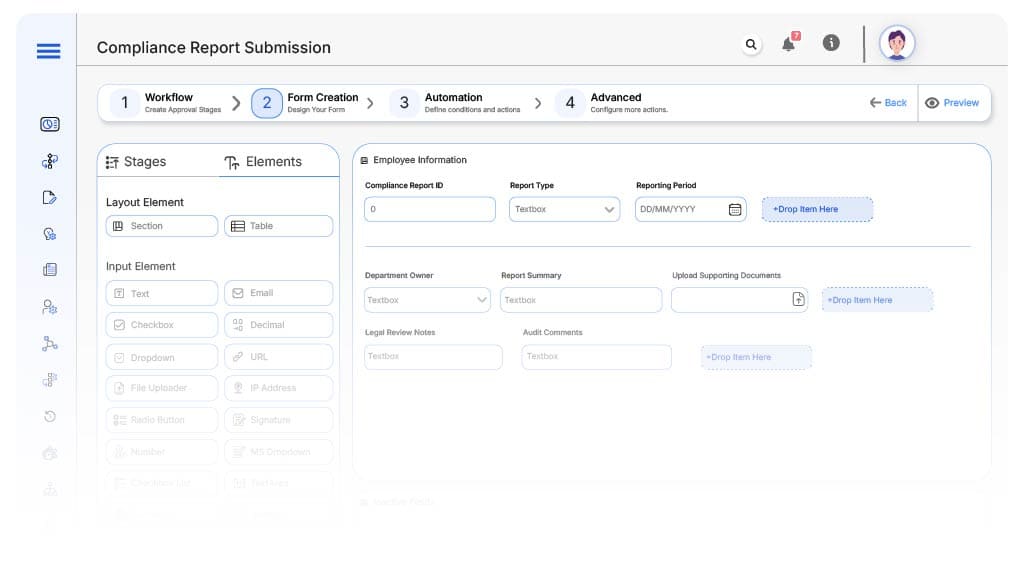

Form Design & Field Definitions

Field Label: Compliance Report ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Report Type

- Type: Dropdown (Financial, Environmental, Operational, Legal)

- Logic/Rules: Determines which sections become visible.

Field Label: Reporting Period

- Type: Date Range Picker

- Logic/Rules: Required.

Field Label: Department Owner

- Type: Dropdown (Finance, Legal, Operations)

- Logic/Rules: Drives review routing.

Field Label: Report Summary

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Upload Supporting Documents

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Legal Review Notes

- Type: Text Area

- Logic/Rules: Visible only to Legal Reviewer.

Field Label: Compliance Checklist Acknowledgement

- Type: Checkbox

- Logic/Rules: Must be checked before final approval.

Field Label: Audit Comments

- Type: Text Area

- Logic/Rules: Editable by Audit Head only.

Transform your Workflow with AI fusion

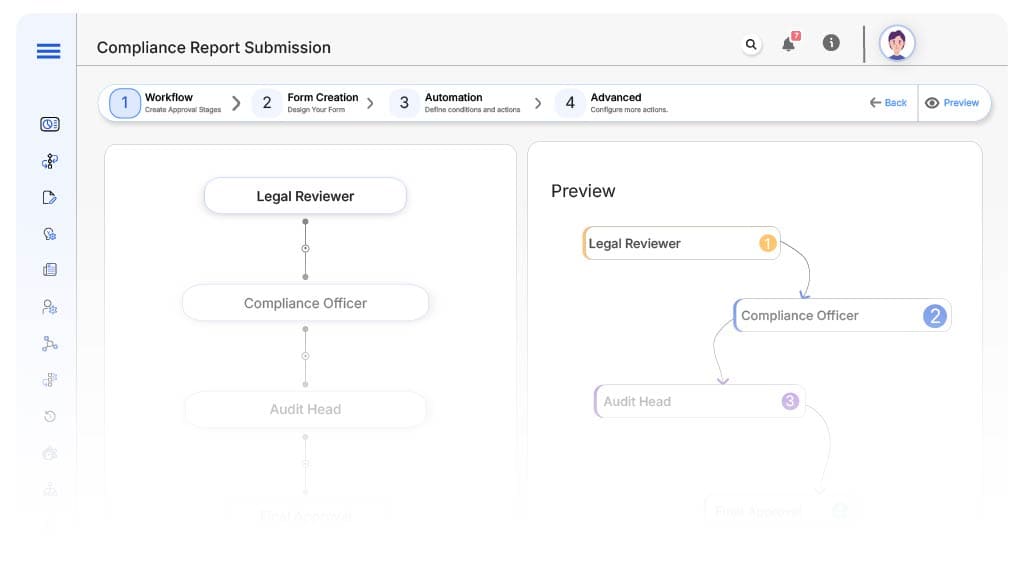

Approval Flow & Routing Logic

Submission → Legal Reviewer

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, compliance report draft submitted for legal review.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Finance Analyst.

- Escalation: Notify Legal Lead after 24 hours.

Legal Reviewer → Compliance Officer

- Status Name: Pending Compliance Validation

- Notification Template: “Hi Compliance, please validate compliance alignment for the report draft.”

- On Approve: Moves to Audit Head.

- On Reject: Returns to Legal Reviewer.

- Escalation: Alert Compliance Head after 24 hours.

Compliance Officer → Audit Head

- Status Name: Final Audit Review

- Notification Template: “Hi Audit, report ready for final audit sign-off.”

- On Approve: Moves to Report Finalized.

- On Reject: Returns to Compliance Officer.

- Escalation: Notify Audit Team Lead after 24 hours.

Final → Report Finalized

- Status Name: Report Finalized

- Notification Template: “Compliance report fully approved. Archive the record and proceed with regulatory submission.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Financial Report Q1

Finance Analyst submits a Q1 Financial Compliance Report. Cflow assigns ID CR-2025-177. Legal approves language and regulatory alignment. Compliance confirms checklist adherence. Audit Head signs off. Report is archived with supporting Excel sheets, legal summary, and audit timestamp.

FAQ's

Yes. Upload existing Word, Excel, or PDF templates and apply fields.

Unleash the full potential of your AI-powered Workflow