- Cflow

- Bank Reconciliation Approval Automation

Bank Reconciliation Approval Automation

Clow Team

Loan application endorsement is a critical phase in financial institutions to ensure proper evaluation, risk assessment, and regulatory compliance before final loan disbursement. Without automation, manual endorsement processes result in delayed decisions, inconsistent risk evaluation, customer dissatisfaction, and regulatory exposure. Recent industry research shows that 60% of financial institutions face processing delays due to manual endorsement and review bottlenecks.

Without automation, relationship managers, credit officers, risk analysts, compliance officers, legal counsel, and senior approvers struggle to coordinate documentation review, financial analysis, and regulatory assessments. This guide walks you through exactly how Cflow automates Loan Application Endorsement Process, from application submission to final endorsement.

What Is Bank Reconciliation Approval Process?

The Bank Reconciliation Approval Process involves verifying company ledger balances against external bank statements to identify and resolve discrepancies. It requires collecting bank feeds, validating transactions, preparing reconciliation reports and routing them for approvals.

Accurate reconciliations are vital for financial transparency, fraud detection and compliance. Automating this process speeds up month-end close, improves accountability and reduces the risk of missed variances. Research confirms automated reconciliations reduce processing time by up to 50% and improve audit readiness by 45%.

Why Bank Reconciliation Approval Process Matters for Organizations?

Error Reduction

Faster Month-End Close

Regulatory Compliance

Fraud Detection

Transparency

Creates a clear audit trail from bank statement to books, improving accountability, stakeholder trust, and decision-making clarity.

You can get started with Cflow for free

Key Benefits of Automating Bank Reconciliation Approval with Cflow

- Central Reconciliation Tracker: Cflow enables finance teams to submit reconciliation reports along with attached bank feeds and justifications. Each entry captures key financial details within a centralized portal. This ensures all reconciliation records are organized and easy to access for audit purposes.

- Exception-Driven Routing: Reconciliations with variances or manual adjustments are automatically flagged and routed for review. Standard entries bypass escalation to reduce unnecessary approvals. This streamlines the process while ensuring high-risk items receive proper attention.

- Multi-Level Approvals: Cflow supports multi-tier approvals based on reconciliation value and account type. Submissions pass through accounting, audit, and treasury departments. This layered validation helps maintain financial accuracy and internal control.

- Real-Time Status Visibility: Users can track the status of each reconciliation in real time by reporting period. Visual indicators show whether entries are pending, approved, or rejected. This transparency improves follow-up and accountability across teams.

- Integrated Uploads: Users can securely attach XLS, CSV, and PDF documents such as bank statements or ledgers. All files are stored directly within the request form. This eliminates dependency on external tools or scattered storage systems.

- Automated Variance Thresholds: Cflow allows teams to define variance thresholds for acceptable differences. If a reconciliation exceeds the set limit, it is automatically flagged for review. This proactive approach ensures exceptions are managed quickly.

- Audit Trail & Version Logs: Every change made to a reconciliation is captured with timestamps and user information. Cflow maintains a complete log of edits, comments, and approvals. This provides full traceability for internal audits and compliance checks.

Get the best value for money with Cflow

User Roles & Permissions

Reconciliation Preparer (Initiator):

- Responsibilities: Uploads bank statement, prepares reconciliation, documents variance.

- Cflow Permission Level: Submit Form.

- Mapping: “Finance Team.”

Accounting Reviewer:

- Responsibilities: Reviews calculations, validates GL alignment.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Accounting Group.”

Compliance Officer:

- Responsibilities: Verifies adherence to financial policies.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Treasury Manager:

- Responsibilities: Final approval, ensures cash positions align with reports.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Treasury Group.”

Discover why teams choose Cflow

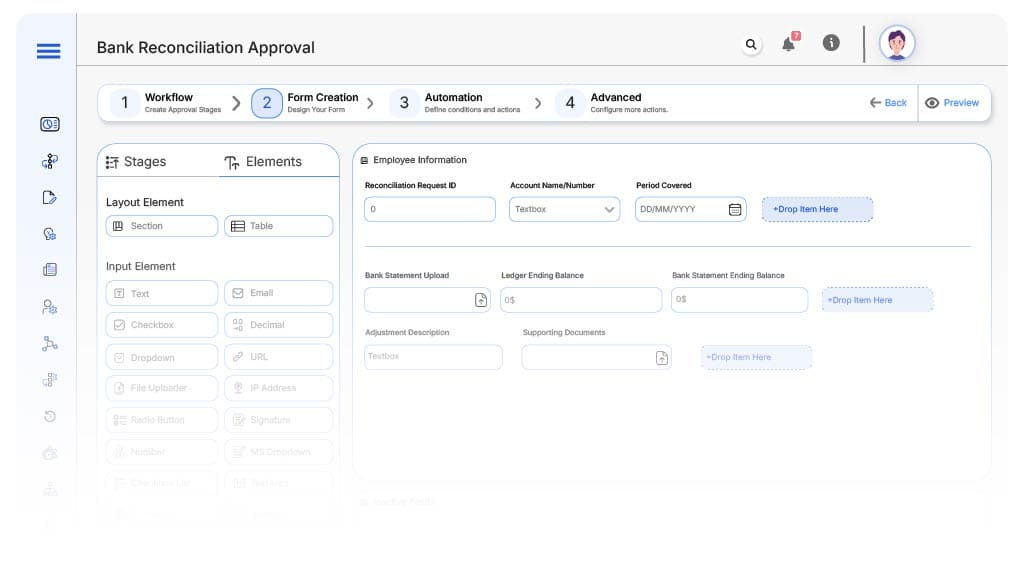

Form Design & Field Definitions

Field Label: Reconciliation Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Account Name/Number

- Type: Dropdown

- Logic/Rules: Mandatory field mapped to chart of accounts.

Field Label: Period Covered

- Type: Numeric Field

- Logic/Rules: Drives financial and board-level routing.

Field Label: ROI Projection (IRR %)

- Type: Date Range Picker

- Logic/Rules: Required.

Field Label: Bank Statement Upload

- Type: File Upload

- Logic/Rules: Required.

Field Label: Ledger Ending Balance

- Type: Currency Field

- Logic/Rules: Mandatory.

Field Label: Bank Statement Ending Balance

- Type: Currency Field

- Logic/Rules: Mandatory.

Field Label: Adjustment Description

- Type: Text Area

- Logic/Rules: Required if there is a mismatch.

Field Label: Supporting Documents

- Type: File Upload

- Logic/Rules: Required for mismatches over threshold.

Field Label: Final Reconciliation Status

- Type: Dropdown (Matched, Adjusted, Pending Review)

- Logic/Rules: Required.

Transform your Workflow with AI fusion

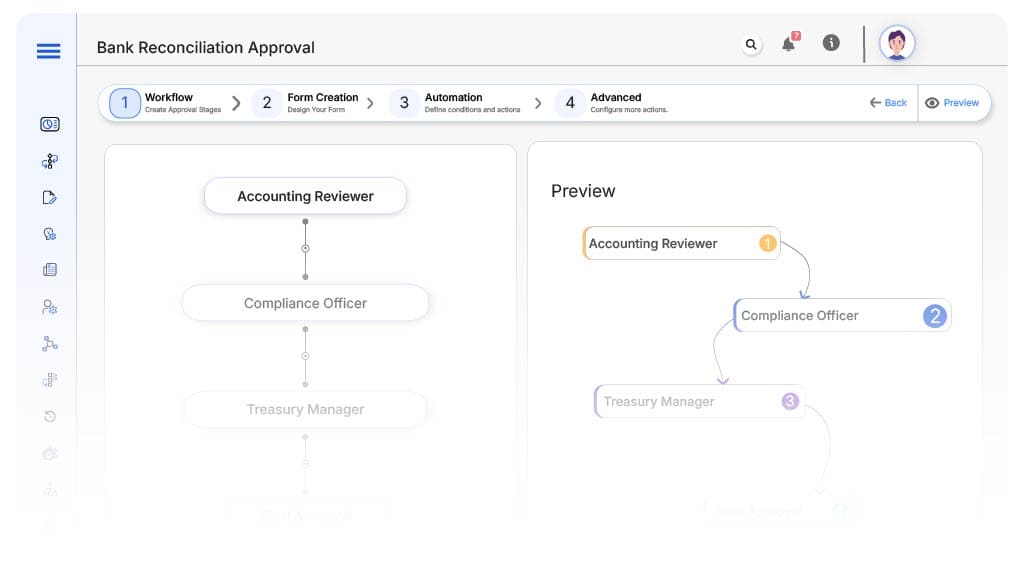

Approval Flow & Routing Logic

Submission → Accounting Reviewer

- Status Name: Pending Accounting Review

- Notification Template: “Reconciliation submitted—please review GL balances.”

- On Approve: Move to Compliance Officer.

- On Reject: Return to Preparer.

- Escalation: Notify Finance Controller in 1 day.

Accounting Reviewer → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Please verify compliance and policy adherence.”

- On Approve: Move to Treasury.

- On Reject: Return to Accounting Reviewer.

- Escalation: Alert Risk Officer.

Compliance Officer → Treasury Manager

- Status Name: Pending Final Approval

- Notification Template: “Final sign-off required for reconciliation.”

- On Approve: Mark as Completed.

- On Reject: Return to Compliance Officer.

- Escalation: Escalate to CFO after 24 hours.

Final → Reconciliation Completed

- Status Name: Reconciliation Completed

- Notification Template: “Reconciliation fully approved. Process marked complete and logged for audit.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set conditional logic

Save and publish workflow

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Monthly Reconciliation - March 2025

FAQ's

Unleash the full potential of your AI-powered Workflow