Paperless Invoice: The Smarter Way to Manage Business Payments

Cflow Team

Key takeaways

- Paperless invoice systems eliminate the need for manual paperwork and speed up accounts payable processing

- Businesses using digital invoicing save time, reduce human error, and increase visibility across finance operations

- E-invoicing platforms support compliance, secure document storage, and faster approvals

- Cflow enables companies to automate and digitize the invoice lifecycle without writing a single line of code

Table of Contents

What is a Paperless Invoice?

A paperless invoice is an electronically generated invoice that replaces traditional paper-based billing. It is created, sent, received, and stored digitally, enabling businesses to manage their invoicing process entirely online. Paperless invoicing eliminates the need for physical paperwork, manual data entry, and in-person approvals—streamlining the entire billing cycle from start to finish.

Instead of mailing paper invoices or passing documents between desks, finance teams use automated platforms to route invoices through a digital workflow. These invoices can be submitted via email, uploaded through portals, or automatically generated by integrated accounting systems. Once in the system, they are reviewed, approved, and stored securely in the cloud.

As businesses continue to digitize their operations, paperless invoicing plays a critical role in making finance workflows more efficient, transparent, and scalable. In this blog, we’ll explore the benefits of switching to paperless invoices, how to implement them, key software features to look for, integration options, compliance considerations, and the top tools for managing paperless invoice workflows.

Why Should You Go Paperless?

The shift from paper to digital invoicing is no longer just a matter of convenience—it’s a business necessity. As companies grow, paper-based processes become harder to manage. Stacks of invoices, lost documents, approval delays, and data entry errors can quickly slow down operations and inflate costs.

Going paperless reduces administrative workload by automating routine tasks such as invoice matching, approval routing, and payment scheduling. Finance teams no longer waste time hunting down documents or chasing approvals across departments. This improves turnaround time, increases cash flow visibility, and reduces processing costs per invoice.

There’s also a compliance and audit advantage. With digital records, businesses can easily retrieve invoices, track activity logs, and demonstrate policy adherence—all without sifting through filing cabinets. This makes regulatory audits and financial reviews significantly easier to manage.

Additionally, environmental sustainability is a growing concern for businesses and consumers alike. Reducing paper usage by digitizing invoices contributes to a company’s green initiatives and corporate social responsibility goals.

In short, going paperless isn’t just about eliminating paperwork—it’s about creating a smarter, faster, and more resilient invoicing process that adapts to modern business needs.

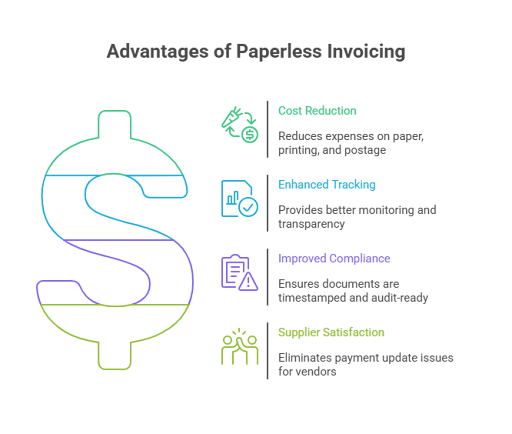

Transitioning to a paperless invoice system offers measurable and strategic advantages for businesses of all sizes. Beyond eliminating physical paperwork, it creates a more agile, cost-efficient, and accurate accounts payable process. Here’s a deeper look at the key benefits:

Faster Processing and Approval Cycles

Manual invoicing involves multiple steps—receiving paper invoices, entering data into spreadsheets or accounting systems, printing copies, and circulating them for signatures. This process is time-consuming and often delayed by missing documents or unavailable approvers.

With a paperless system, invoices are routed automatically to the right person based on predefined rules. Digital approvals can happen in minutes instead of days. Automated notifications remind approvers of pending tasks, while escalations prevent bottlenecks. The result is significantly faster invoice turnaround and on-time payments.

Reduced operational costs

Processing a single paper invoice can cost anywhere from $10 to $25 when factoring in printing, postage, labor, filing, and storage. These costs add up quickly, especially for businesses handling hundreds or thousands of invoices each month.

By going paperless, organizations eliminate printing and mailing costs, reduce labor-intensive data entry, and minimize error correction. Digital storage replaces physical filing cabinets, cutting down on office space and supply expenses. Over time, the shift to paperless translates to major savings in operational overhead.

Improved accuracy and fewer errors

Manual data entry is prone to human error—miskeyed invoice numbers, incorrect totals, or mismatched vendor details. These errors lead to rework, delayed payments, and in some cases, overpayments or duplicate payments.

Paperless systems often include data validation features, automated matching against purchase orders, and OCR (optical character recognition) capabilities that extract information from digital files with precision. These tools improve accuracy and reduce the chances of financial discrepancies.

Enhanced visibility and tracking

One of the biggest challenges with paper-based invoicing is the lack of visibility. Once an invoice enters the approval cycle, it’s hard to know its exact status or location. This leads to frequent follow-ups, missed deadlines, and frustrated vendors.

Digital invoicing systems provide real-time dashboards where users can see every invoice’s status—submitted, in review, approved, rejected, or paid. Finance leaders gain full transparency into pending liabilities, invoice aging, and bottlenecks, enabling better decision-making and forecasting.

Stronger vendor relationships

Vendors rely on timely payments to maintain cash flow and operational stability. Delays caused by manual processes or lost invoices can strain these relationships and increase support queries.

A paperless system ensures that invoices are acknowledged, processed, and paid on time. Vendors receive automated updates on the status of their invoices, eliminating the need for repeated follow-ups. This proactive communication builds trust and leads to more favorable vendor terms.

Easier audit and compliance readiness

Maintaining regulatory compliance and audit readiness is much simpler with digital invoices. Every action—submission, approval, modification—is logged and timestamped, creating a full audit trail.

Documents are stored securely in a centralized system with access controls, version tracking, and retention settings. Whether you’re preparing for a financial audit, responding to tax inquiries, or reviewing internal policies, digital systems make retrieval and reporting effortless.

Environmentally responsible operations

Eliminating paper from the invoicing process aligns with sustainability goals and environmental responsibility. Businesses reduce their paper consumption, lower their carbon footprint, and contribute to a greener future.

In today’s market, this commitment to sustainability is more than a nice-to-have—it’s an expectation from clients, partners, and investors. Going paperless not only improves efficiency but also strengthens your corporate social responsibility profile.

In summary, switching to a paperless invoice system streamlines your workflow, saves money, improves accuracy, and creates a more responsive finance operation. The longer businesses wait to digitize, the more they risk falling behind competitors who are already reaping these benefits.

How to Implement Paperless Invoicing in Your Business

Adopting a paperless invoice system doesn’t have to be disruptive. Start by mapping out your current accounts payable workflow—from invoice receipt to approval and payment. Identify where bottlenecks occur, such as delayed approvals, missing documents, or duplicate entries.

Next, choose a digital invoicing platform that matches your business size and complexity. Look for features like automated workflows, multi-user access, document storage, and ERP integration.

Once the system is selected, train your team on how to use it. Ensure that both internal users and external vendors understand how invoices should be submitted and approved going forward. For smooth onboarding, consider running the paperless and paper-based systems in parallel for a short transition period.

Finally, standardize your digital invoice formats and document policies to support consistency and legal compliance. Define naming conventions, required data fields, retention periods, and approval roles to ensure clean and auditable records.

Paperless Invoice Processing Software for Small Businesses

For small businesses, adopting paperless invoicing can be a game-changer. With fewer resources and limited finance teams, manual processing often takes up valuable time that could be spent on growth-focused tasks.

Paperless invoice processing software helps small businesses digitize invoice receipt, automate approvals, and trigger payments—without requiring expensive infrastructure. These tools are usually cloud-based and subscription-based, making them affordable and easy to scale.

Many platforms offer prebuilt templates, drag-and-drop form builders, and mobile-friendly access so that approvals can be made on the go. For businesses just starting out with automation, these tools offer a low-risk entry point into digital finance.

The software also helps with cash flow management. By tracking invoice aging, due dates, and payment history, small business owners can make more informed decisions about spending and supplier relationships.

Difference Between Paper and Electronic Invoicing

The key difference between paper and electronic invoicing lies in how information is exchanged, processed, and stored. Paper invoices require printing, physical handling, and manual data entry into financial systems. They’re prone to human error, misplacement, and delays.

In contrast, electronic invoices are generated and transmitted digitally. They can be uploaded, validated, and approved through automated systems with little to no manual intervention. This improves accuracy, reduces processing time, and enhances visibility.

Another major distinction is in recordkeeping. Paper invoices must be physically filed and stored—often in multiple locations—which can be inefficient and expensive. Electronic invoices are archived in cloud storage, easily searchable, and securely backed up for audits or regulatory compliance.

By making the switch to e-invoicing, companies reduce their environmental footprint, streamline operations, and create a more agile finance function.

Secure Paperless Billing Solutions for Finance Teams

Security is a top concern when digitizing finance processes. A well-designed paperless billing solution includes features that protect sensitive financial data while ensuring accessibility for authorized users.

These systems often come with role-based access control, two-factor authentication, and audit logs that track every action taken on an invoice. Documents are encrypted during storage and transmission, protecting them from unauthorized access or tampering.

For finance teams managing high volumes of vendor payments, these security features provide peace of mind. They also support compliance with privacy regulations like GDPR, SOX, or HIPAA, depending on the industry.

Many platforms also allow users to automate document retention and archiving policies. This ensures that invoices are stored securely for the required period and automatically deleted when no longer needed—minimizing the risk of data breaches or storage bloat.

Automating Invoice Approvals with Paperless Workflows

One of the biggest bottlenecks in invoice processing is the approval cycle. In a manual system, invoices sit in inboxes or on desks, waiting for sign-off. If someone is on leave or forgets to approve, payments get delayed and late fees pile up.

Paperless workflows eliminate this problem by routing invoices to the right approvers based on predefined rules. If an invoice is under a certain amount, it might be auto-approved. For larger amounts, it could be routed through multiple levels of management before payment is released.

Automation also ensures that reminders are sent out for pending approvals and that escalations occur when deadlines are missed. This keeps everything moving and ensures that payments are processed on time.

With digital audit trails and approval timestamps, finance teams also gain better control and accountability—making compliance audits much easier.

Reducing Accounts Payable Costs with Paperless Invoicing

Manual invoice processing can be costly—not just in terms of labor, but also due to late payments, duplicate payments, and errors. By switching to paperless invoicing, businesses can cut these costs significantly.

Automation reduces manual entry and processing time, freeing up finance staff to focus on analysis, vendor management, and strategic planning. It also reduces the need for physical supplies like paper, envelopes, filing cabinets, and shredding services.

Late fees and penalties from delayed approvals can be minimized, and opportunities for early payment discounts can be capitalized on. Some companies report a 40–70% reduction in per-invoice processing costs after adopting paperless solutions.

These savings can be reinvested into other areas of the business, improving overall operational efficiency and profitability.

Compliance Considerations for Paperless Invoicing Systems

Going digital doesn’t mean ignoring compliance—in fact, it makes compliance easier. A good paperless invoicing system helps businesses stay aligned with tax laws, data privacy regulations, and internal policies.

To ensure compliance, look for systems that offer time-stamped entries, secure document storage, user activity logs, and flexible audit reporting. These features make it easier to prove financial accuracy and follow regulatory requirements during an audit.

International companies must also ensure their invoicing software complies with regional laws, such as e-invoicing mandates in Latin America or VAT reporting in Europe.

Having automated retention and deletion policies built into the system further reduces the risk of non-compliance by ensuring documents are kept for the correct period and disposed of responsibly afterward.

How paperless Invoice Software Integrates with ERP Systems

A paperless invoice solution delivers maximum value when it integrates seamlessly with your ERP or accounting system. This integration ensures that data flows automatically from the invoice to financial records—eliminating the need for duplicate entry.

When integrated properly, approved invoices can trigger journal entries, update payables, and initiate payment batches within the ERP system. This not only speeds up month-end closing but also reduces the chance of errors.

Real-time integration also supports better decision-making. CFOs and controllers can get instant insights into cash flow, pending liabilities, and invoice performance metrics without toggling between systems.

Some advanced solutions offer API-based integration, allowing businesses to sync data across platforms like QuickBooks, NetSuite, SAP, and Microsoft Dynamics. These connections make finance operations more agile and data-driven.

Top Tools for Managing Paperless Invoice Workflows in 2025

The market for digital invoice solutions is growing rapidly, and several tools are leading the charge. Platforms like Cflow, Tipalti, Stampli, and Yooz are known for helping businesses of all sizes automate and manage invoice workflows with ease.

Cflow stands out for its no-code approach to invoice approval automation. It lets users build custom workflows, route documents for approval, and integrate with other finance systems—all without needing IT support. Other tools offer OCR data extraction, vendor portals, and AI-powered fraud detection features.

When selecting the right tool, consider ease of use, scalability, integration options, reporting capabilities, and vendor support. Choose a solution that not only digitizes your current workflow but also evolves with your business.

Why Cflow is the Best Invoice Approval Software?

Cflow is more than just an invoice management tool—it’s a powerful, no-code automation platform that transforms the way businesses handle invoice approvals. Whether you’re looking to eliminate paperwork, accelerate approvals, or gain better visibility into your accounts payable process, Cflow provides a complete, paperless solution tailored to modern finance needs.

Seamless paperless invoice approvals

Cflow enables finance teams to create fully digital invoice approval workflows without writing a single line of code. Invoices can be uploaded directly into the platform or integrated from external systems. Once received, Cflow routes them automatically based on predefined rules—by department, amount, vendor, or project.

Approvers are notified instantly and can approve or reject invoices through a secure web interface or mobile device. No more chasing paper files or email threads. Every step is logged, timestamped, and accessible, ensuring full transparency and accountability.

Customizable workflows for every scenario

One of Cflow’s standout features is its intuitive workflow builder. Users can visually design approval flows that match their internal processes—from multi-level approvals to conditional routing. Whether you need single approvals for low-value invoices or multi-tier approvals for strategic expenses, Cflow adapts to your structure.

With built-in logic, escalations, and notification triggers, invoices move smoothly through the workflow without bottlenecks. Teams can eliminate manual handoffs and standardize approval processes across departments.

Centralized document management

Cflow eliminates the need for physical filing by offering a secure, cloud-based repository for all invoice documents. Users can upload, tag, and retrieve invoices with ease. Attachments such as purchase orders, delivery receipts, and vendor contracts can be linked directly to each invoice for a complete transaction record.

This centralization supports audit readiness, improves document control, and makes financial reporting far more efficient.

Real-time visibility and audit trails

Finance leaders need clarity over payables at any point in time. Cflow provides real-time dashboards and status updates for every invoice. You can monitor pending approvals, track turnaround times, and review historical data—all from a single interface.

Detailed audit logs capture every action taken on an invoice, including who approved it, when it was processed, and any notes or comments. This level of transparency simplifies audits and supports compliance with financial controls and regulatory standards.

Powerful integrations and flexibility

Cflow integrates effortlessly with popular ERP and accounting systems like QuickBooks, NetSuite, and SAP. This ensures that once an invoice is approved, it flows directly into your finance system for payment, eliminating duplicate data entry and reducing errors.

Its flexibility also makes it suitable for industries with specific needs—such as legal, healthcare, insurance, education, and professional services. Whether you’re managing vendor invoices, internal expense reports, or project-based billing, Cflow offers the structure and flexibility to handle it all.

Designed for scalability and ease of use

Unlike traditional finance tools that require IT support or lengthy implementation cycles, Cflow is built for business users. Its no-code interface allows teams to make changes, add steps, or launch new workflows in minutes.

As your business grows, Cflow scales with you—supporting more users, workflows, and integrations without losing performance or usability.

In short, Cflow brings the power of automation, visibility, and paperless invoice processing into one platform. It’s the ideal solution for businesses that want to move faster, improve accuracy, and stay ahead of growing financial complexity—without the burden of manual processes.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Final Thoughts

A paperless invoice system is more than just a convenience—it’s a strategic advantage. It enables faster processing, reduces costs, improves accuracy, and ensures your finance team operates with transparency and control.

Whether you’re a small business looking to cut back on paperwork or a large enterprise managing thousands of transactions a month, the shift to digital invoicing is worth the investment.

Platforms like Cflow make the transition easy by offering flexible, no-code workflows that help you automate and scale your invoice management process. Want to eliminate bottlenecks and modernize your AP process? Sign up for a free trial of Cflow and experience the benefits of going paperless.

FAQs

What is a paperless invoice system?

It’s a digital platform that allows you to receive, process, approve, and store invoices electronically—eliminating the need for paper-based workflows.

How secure are paperless invoicing systems?

They use features like encryption, access control, and audit logs to ensure sensitive financial data is stored and transmitted securely.

Can paperless invoicing help reduce processing costs?

Yes. By automating manual tasks and minimizing delays, businesses can cut invoice processing costs by up to 70%, while improving cash flow visibility and accuracy.

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.