- Cflow

- Risk Assessment Approval Automation

Risk Assessment Approval Automation

Clow Team

The Risk Assessment Approval Process is an essential compliance and operations workflow that ensures every identified risk – whether operational, financial, or cyber—is evaluated, reviewed, and approved with the right level of scrutiny. Without automation, risk assessments are often delayed, inconsistently reviewed, or buried in emails and spreadsheets.

Industry data reveals that 62% of organizations struggle with fragmented risk workflows, leading to unresolved risks, audit gaps, and slow mitigation.

Managing submissions, reviews, risk scoring, impact evaluation, legal oversight, and final approval manually can cause bottlenecks and missed escalations. This guide walks you through how Cflow automates the Risk Assessment Approval Process, from initiation to sign-off, ensuring end-to-end visibility and compliance.

What Is Risk Assessment Approval Process?

The Risk Assessment Approval Process governs how risks are documented, reviewed, and validated within an organization. It standardizes the identification of threats, categorizes them by severity and impact, and ensures relevant stakeholders approve mitigation plans.

Think of it like quality control for your organization’s vulnerabilities—every risk, whether cybersecurity, legal, or financial, must go through the right checks before being accepted or addressed.

According to PwC, organizations with automated risk approval workflows resolve risk issues 35% faster and are 50% more likely to meet audit deadlines.

Why Risk Assessment Approval Process Is Important for Organizations

Operational Readiness

Compliance & Governance

Multi-Level Oversight

Audit Readiness

Key Benefits of Automating Risk Assessment Approval Process with Cflow

- Centralized Risk Register: Cflow provides a unified dashboard where all risk submissions are tracked by category, severity, and department. Compliance teams can review status, ownership, and history in one place. This improves response time and oversight.

- Role-Based Routing Logic: Each risk is routed to specific approvers based on department and severity level. For example, a high-impact financial risk goes to the CFO, while an IT vulnerability is routed to the CISO. Cflow ensures no risk goes unreviewed.

- Dynamic Risk Scoring: Submitters assign severity, probability, and impact levels. Cflow auto-calculates a risk score and color codes each record (Low, Medium, High, Critical). Reviewers can prioritize high-risk items instantly and assign mitigation owners accordingly.

- Automated Alerts & Escalations: If a risk remains unapproved beyond SLA, Cflow triggers alerts to the next-level approver. Reminders ensure nothing slips through. Teams stay aligned and accountable, especially during audits or risk audits.

- Mandatory Mitigation Plans: Submitters must include mitigation strategy, owner, and timeline before submission. Cflow blocks incomplete entries, ensuring every risk includes an action plan before review. This enforces accountability across departments.

- Full Audit Trail & History Logs: All reviews, changes, and approvals are timestamped and stored securely. During audits or reviews, teams can pull full reports showing how a risk was evaluated, mitigated, and approved—complete with comments and status changes.

- Mobile-Friendly Workflow: Executives, risk officers, and team leads can review, approve, or comment on risk assessments from their mobile devices. Cflow’s mobile interface ensures timely responses even while traveling or working remotely.

Get the best value for money with Cflow

User Roles & Permissions

Risk Reporter (Department User)

- Responsibilities: Submit risk details, attach evidence, and propose mitigation.

- Cflow Permission Level: Submit Form.

- Mapping: “Business Units” group.

Department Reviewer

- Responsibilities: Validate risk impact and accuracy.

- Cflow Permission Level: Task Owner.

- Mapping: “Department Leads” group.

Compliance Officer

- Responsibilities: Review risk scoring and verify regulatory obligations.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance” group.

Legal Counsel

- Responsibilities: Review legal exposure and approve mitigation if required.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Team” group.

Executive Risk Committee

- Responsibilities: Review critical risks and provide final sign-off.

- Cflow Permission Level: Admin.

- Mapping: “Executives” group.

Audit Reviewer

- Responsibilities: View approved risk records and logs for compliance reviews.

- Cflow Permission Level: View Only.

- Mapping: “Audit” group.

Discover why teams choose Cflow

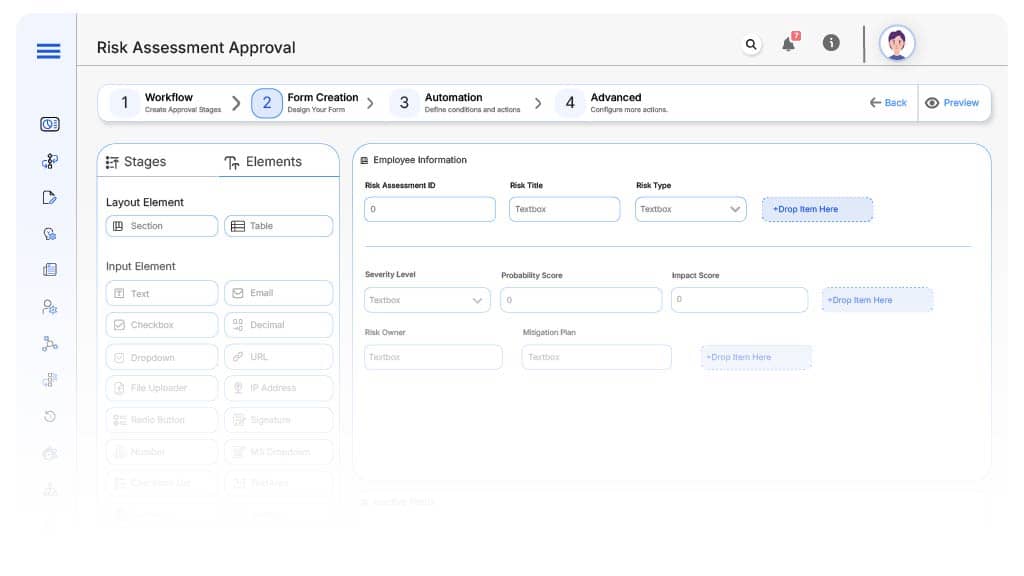

Form Design & Field Definitions

Field Label: Risk Assessment ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Risk Title

- Type: Text

- Logic/Rules: Required.

Field Label: Risk Type

- Type: Dropdown (Operational, IT, Legal, Financial, Reputational)

- Logic/Rules: Drives routing.

Field Label: Severity Level

- Type: Dropdown (Low, Medium, High, Critical)

- Logic/Rules: Impacts approval flow.

Field Label: Probability Score

- Type: Numeric (1–5)

- Logic/Rules: Required.

Field Label: Impact Score

- Type: Numeric (1–5)

- Logic/Rules: Auto-calculates total score.Type: Numeric (1–5)

Field Label: Risk Owner

- Type: Text

- Logic/Rules: Required.

Field Label: Mitigation Plan

- Type: Text Area

- Logic/Rules: Mandatory for submission.

Field Label: Supporting Documents

- Type: File Upload

- Logic/Rules: Optional.

Field Label: Compliance Notes

- Type: Text Area

- Logic/Rules: Required if rejected.

Field Label: Legal Sign-Off

- Type: Checkbox

- Logic/Rules: Required for high-risk categories.

Field Label: Final Approval Checkbox

- Type: Checkbox

- Logic/Rules: Triggers closure.

Transform your Workflow with AI fusion

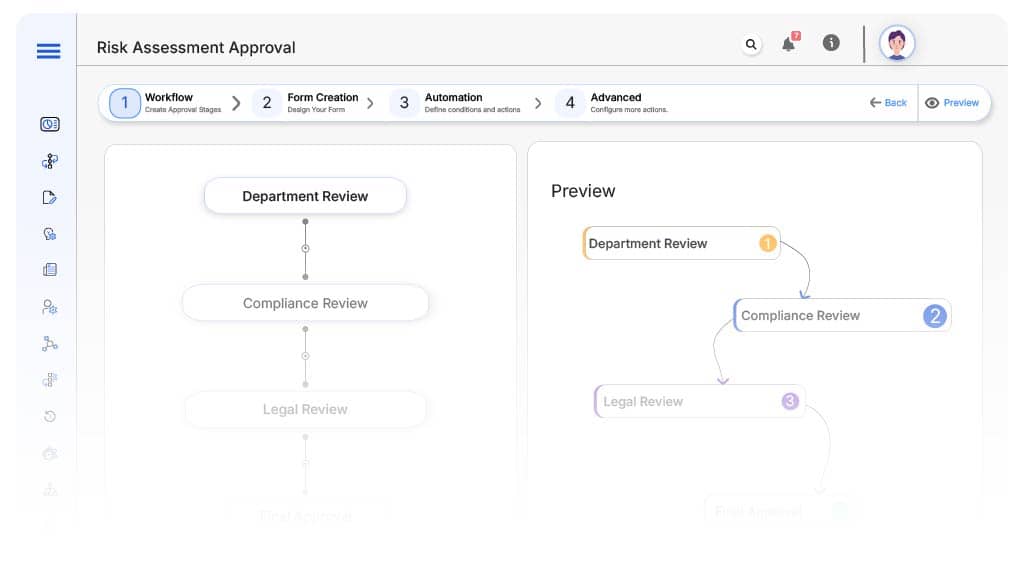

Approval Flow & Routing Logic

Submission → Department Review

- Status Name: Pending Departmental Review

- Notification Template: “New risk assessment submitted. Please review details and confirm impact.”

- On Approve: Routes to Compliance.

Department → Compliance Review

- Status Name: Pending Compliance Check

- Notification Template: “Please verify risk categorization and ensure policy alignment.”

- On Approve: Routes to Legal.

- Escalation: Reminder after 2 days.

Compliance → Legal Review

- Status Name: Pending Finance Review

- Notification Template: “Finance, review budget alignment for {Contract}.”

- On Complete: Moves to Executive.

- Escalation: Reminder after 2 days.

Legal → Executive Review

- Status Name: Pending Final Approval

- Notification Template: “All reviews complete. Please review and approve final risk assessment.”

- On Approve: Moves to Risk Closed.

- Escalation: Reminder after 2 days.

Final → Risk Approved

- Status Name: Risk Assessment Approved

- Notification Template: “Risk {Risk Title} has been reviewed and approved. Logged for future audits.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set conditional logic

Save and publish workflow

Test with a sample request

Adjust logic

Go live

Example Journey: Data Breach Risk Evaluation

FAQ's

Unleash the full potential of your AI-powered Workflow