- Cflow

- Vendor Payment Schedule Automation

Vendor Payment Schedule Automation

Clow Team

Vendor payment schedules ensure suppliers are paid on time, maintain strong supplier relationships, and support financial forecasting. Manual coordination often results in missed deadlines, duplicate payments, or strained vendor relationships. Recent industry research shows that organizations automating vendor payment scheduling reduce late payments by 35% and improve vendor satisfaction scores.

Without automation, procurement and finance teams struggle to track payment terms, monitor due dates, and secure multi-level approvals for scheduled payments. This guide walks you through exactly how Cflow automates Vendor Payment Schedule Approval, from invoice submission to scheduled payment authorization.

What Is Vendor Payment Schedule Process?

The Vendor Payment Schedule Process governs how vendor payments are requested, reviewed, validated, and approved for disbursement according to contract terms and internal cash flow policies.

Each request includes payment date proposals, invoice verification, budget checks, and approval from finance controllers, compliance officers, procurement leads, and treasury executives.

Recent industry research shows that organizations with automated payment schedules achieve better cash flow predictability and reduce financial reconciliation errors by 40%.

Why Vendor Payment Schedule Automation Matters for Organizations

Cash Flow Control

Vendor Relationship Management

Compliance Assurance

Audit Readiness

Efficiency

Key Benefits of Automating Vendor Payment Schedule with Cflow

- Centralized Payment Schedule Repository: Cflow provides a unified platform where procurement and finance teams enter, track, and monitor vendor payment schedules. This eliminates errors from disconnected spreadsheets, ensures that due dates align with contract terms, and provides a single source of truth for all vendor-related payments.

- Milestone-Based Routing & Alerts: Approvals are triggered based on delivery milestones, invoice submission, or predefined thresholds. Cflow sends automated notifications and reminders to reviewers, preventing delays and unauthorized payments. Escalation logic ensures critical schedules are reviewed without bottlenecks.

- Integration with Finance Systems: Cflow integrates with ERP or accounting software to keep payment schedules in sync. Approved dates and amounts are pushed to finance systems automatically, minimizing data entry, improving accuracy, and supporting better cash flow visibility and forecasting.

- Audit Trail & Escalation Logic: Every edit, comment, and approval on vendor payment timelines is time-stamped and logged for transparency. If an approver delays action, Cflow escalates the task to higher authority, ensuring continuity in payment processing and audit-readiness.

- Mobile Accessibility: Approvers can review payment schedules, check pending items, and authorize disbursements directly from their mobile devices. Cflow’s responsive interface helps leadership teams stay updated and act quickly, even while traveling or working remotely.

Get the best value for money with Cflow

User Roles & Permissions

Procurement Manager (Initiator)

- Responsibilities: Submits vendor payment request with invoice details, contract references, and payment due dates.

- Cflow Permission Level: Submit Form.

- Mapping: “Procurement Team.”

Finance Controller

- Responsibilities: Validates budget availability and financial impact of the payment schedule.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Group.”

Compliance Officer

- Responsibilities: Verifies invoice accuracy, contract compliance, tax obligations, and vendor status.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Treasury Officer

- Responsibilities: Oversees cash availability, liquidity, and scheduling of large or multi-vendor payments.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Treasury Group.”

Executive Approver (for high-value payments)

- Responsibilities: Provides final sign-off for significant or strategic vendor payments.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board.”

Discover why teams choose Cflow

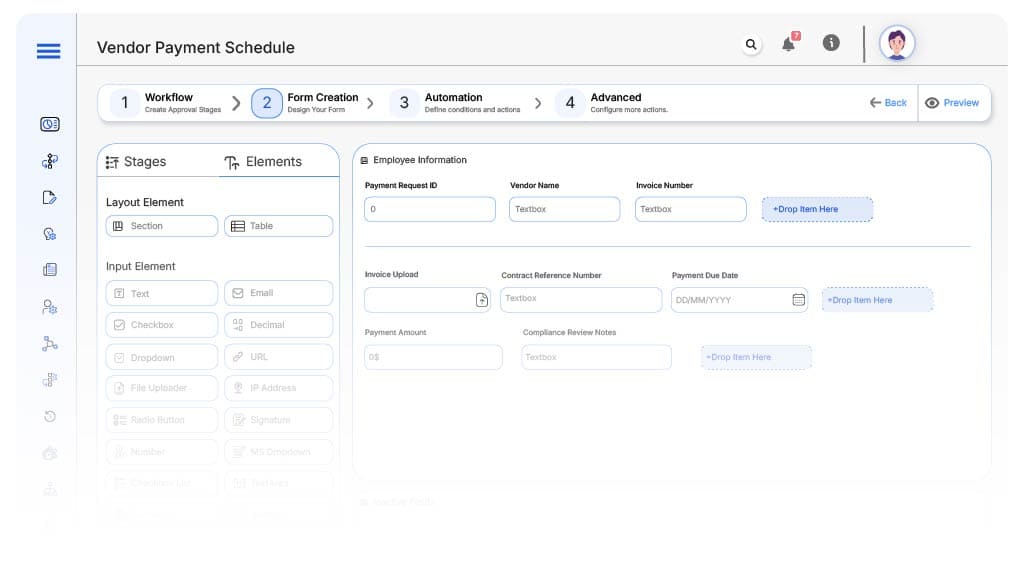

Form Design & Field Definitions

Field Label: Payment Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Vendor Name

- Type: Text

- Logic/Rules: Mandatory.

Field Label: Invoice Number

- Type: Text

- Logic/Rules: Mandatory.

Field Label: Invoice Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Contract Reference Number

- Type: Text

- Logic/Rules: Mandatory.

Field Label: Payment Due Date

- Type: Date Picker

- Logic/Rules: Mandatory.

Field Label: Payment Amount

- Type: Currency Field

- Logic/Rules: Mandatory.

Field Label: Compliance Review Notes

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Treasury Liquidity Confirmation

- Type: Checkbox

- Logic/Rules: Required for large payments.

Field Label: Executive Approval Checkbox

- Type: Checkbox

- Logic/Rules: Mandatory for final sign-off if applicable.

Transform your Workflow with AI fusion

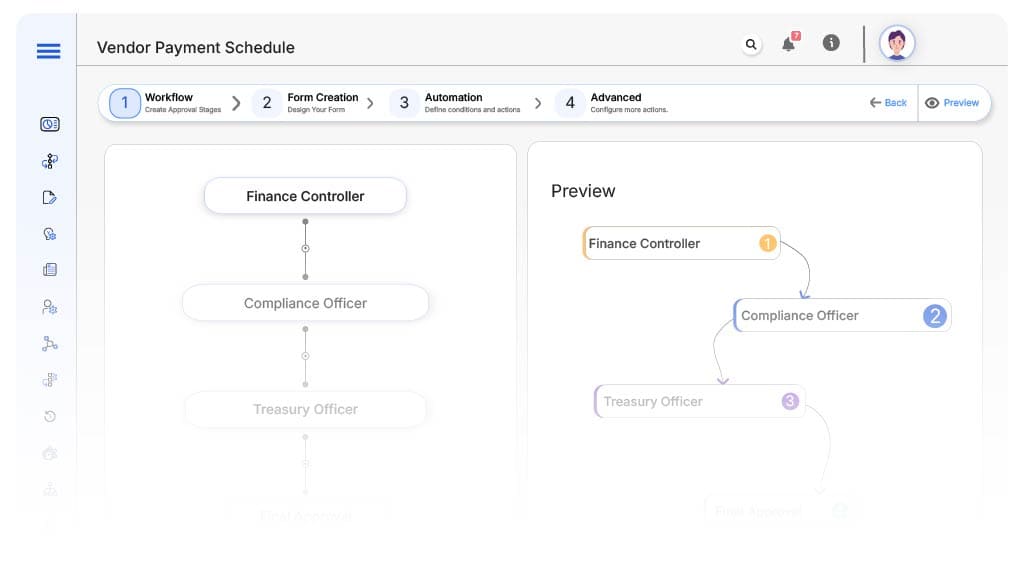

Approval Flow & Routing Logic

Submission → Finance Controller

- Status Name: Pending Budget Validation

- Notification Template: “Hi Finance, vendor payment request submitted for budget validation.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Procurement Lead.

- Escalation: Reminder after 1 day.

Finance Controller → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Hi Compliance, vendor payment request requires contract and tax verification.”

- On Approve: Moves to Treasury Officer.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Compliance Officer → Treasury Officer

- Status Name: Pending Treasury Review

- Notification Template: “Hi Treasury, vendor payment request requires liquidity confirmation.”

- On Approve: Moves to Executive Approver (if applicable).

- On Reject: Returns to Compliance Officer.

- Escalation: Reminder after 1 day.

Treasury Officer → Executive Approver (if high-value)

- Status Name: Pending Executive Approval

- Notification Template: “Hi Executive, high-value vendor payment requires final sign-off.”

- On Approve: Moves to Payment Scheduled.

- On Reject: Returns to Treasury Officer.

- Escalation: Reminder after 1 day.

Final → Payment Scheduled

- Status Name: Payment Scheduled

- Notification Template: “Vendor payment request fully approved and scheduled for processing.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Vendor Quarterly Payment Schedule

FAQ's

Unleash the full potential of your AI-powered Workflow