- Cflow

- Capital Expenditure Approval Automation

Capital Expenditure Approval Automation

Clow Team

Capital expenditures (CapEx) are essential for funding business growth, infrastructure upgrades, and long-term asset acquisitions. However, manual CapEx approval workflows often result in inconsistent evaluations, missed budget targets, delayed project investments, and increased audit risks. Recent industry research shows that 68% of finance leaders cite fragmented capital expenditure approval processes as a key driver of project delays.

Without CapEx approval software, department heads, finance controllers, CFOs, and executives struggle to validate business cases, align requests with available budgets, apply multi-level approval workflows, and maintain a complete audit trail.

This guide walks you through exactly how Cflow automates the capital expenditure request process, from initial submission to final authorization, ensuring faster approvals, better budget control, and complete compliance visibility.

What Is Capital Expenditure Approval Process?

The capital expenditure approval process governs how organizations review, evaluate, and authorize CapEx requests for major asset purchases, facility upgrades, equipment acquisitions, and strategic projects. This ensures that every investment aligns with business priorities and financial goals.

Think of CapEx approval automation as a digital investment gate — every request must pass business justification, budget validation, and multi-stakeholder approval workflows before the release of funds.

According to industry benchmarks, automating the CapEx request approval process can reduce approval cycles by 45% and improve budget adherence by 60%.

Why Capital Expenditure Approvals Matter for Organizations

Financial Control

Risk Management

Cross-Department Collaboration

Audit & Compliance

Key Benefits of Automating Capital Expenditure Approval with Cflow

- Centralized CapEx Request Portal: Cflow allows department heads and project owners to submit CapEx requests with required business cases, vendor quotes, and budget impact summaries, all in one centralized platform for finance and leadership visibility. This ensures a single source of truth for all capital investment proposals.

- Dynamic Routing Based on Spend Size: Cflow applies conditional routing rules based on CapEx category, project scope, investment size, and strategic priority to ensure appropriate reviewer involvement. This guarantees that high-value or high-risk projects receive the right level of scrutiny before approval.

- Multi-Level Approval Workflows: Requests route through department heads, finance controllers, CFO, legal (if required), and executive board depending on investment scale and contractual obligations. This layered approach strengthens governance and prevents unauthorized spending.

- Real-Time Notifications & Escalations: Automated reminders prevent delays in project approvals while escalation rules ensure urgent investments are not stalled. This keeps all stakeholders aligned and responsive throughout the approval cycle.

- Vendor Quote Validation & Documentation: Cflow allows multiple vendor quotes, RFP responses, and supplier certifications to be attached for review alongside financial justification. This promotes competitive sourcing and transparent vendor selection.

- Full Audit Trail & Budget Integration: Every CapEx request, revision, approval comment, and funding allocation is archived and fully auditable for financial reporting. This creates an indisputable record for both internal and external audits.

- Mobile Accessibility: Finance leaders, project sponsors, and executives can review, comment, and approve CapEx requests remotely, ensuring investment momentum is maintained. This flexibility helps avoid delays when decision-makers are on the move.

Get the best value for money with Cflow

User Roles & Permissions

Project Owner (Initiator)

- Responsibilities: Submit capital expenditure request with business case, cost breakdown, and vendor proposals.

- Cflow Permission Level: Submit Form.

- Mapping: “Project Owners” group.

Department Head

- Responsibilities: Validate operational need, alignment with department goals, and resource availability.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Department Heads” group.

Finance Controller

- Responsibilities: Review budget availability, ROI analysis, and forecast impact.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Team” group.

Legal Counsel (Conditional)

- Responsibilities: Review contracts, vendor liabilities, and compliance risks (for large vendor agreements).

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Team” group.

CFO

- Responsibilities: Approve consolidated CapEx requests for financial governance.

- Cflow Permission Level: Approve/Reject.

- Mapping: “CFO” group.

Executive Leadership (Conditional)

- Responsibilities: Final sign-off for strategic or high-value capital projects.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board” group.

Discover why teams choose Cflow

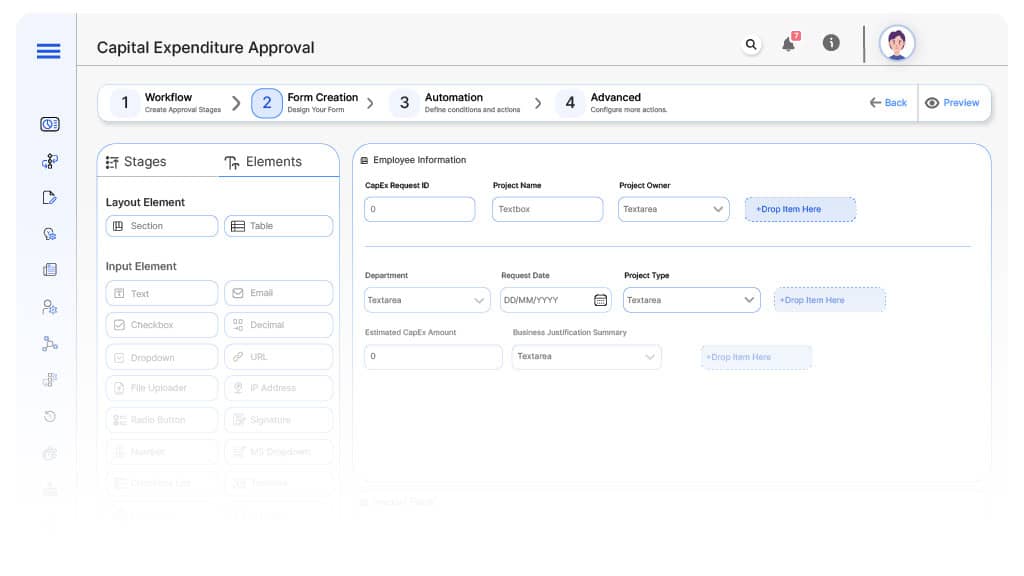

Form Design & Field Definitions

Field Label: CapEx Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Project Name

- Type: Text

- Logic/Rules: Mandatory.

Field Label: Project Owner

- Type: Dropdown (User Directory)

- Auto-Populate: From user profile.

Field Label: Department

- Type: Dropdown

- Auto-Populate: From user profile.

Field Label: Request Date

- Type: Date Picker

- Logic/Rules: Mandatory.

Field Label: Project Type

- Type: Dropdown (Facility Upgrade, Equipment Purchase, IT Hardware, Vehicles, Real Estate, etc.)

- Logic/Rules: Drives routing.

Field Label: Estimated CapEx Amount

- Type: Numeric Field

- Logic/Rules: Drives finance and leadership approvals.

Field Label: Business Justification Summary

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Vendor Quotes

- Type: File Upload

- Logic/Rules: Mandatory for finance and legal review.

Field Label: ROI Analysis Attachment

- Type: File Upload

- Logic/Rules: Required for finance controller.

Field Label: Finance Review Notes

- Type: Text Area

- Logic/Rules: Required for finance controller.

Field Label: Legal Review Notes

- Type: Text Area

- Logic/Rules: Required if legal involved.

Field Label: CFO Review Notes

- Type: Text Area

- Logic/Rules: Required for CFO approval.

Field Label: Executive Comments

- Type: Text Area

- Logic/Rules: Required for executive board.

Field Label: CapEx Approval Confirmation

- Type: Checkbox

- Logic/Rules: Finance marks allocation finalized.

Transform your Workflow with AI fusion

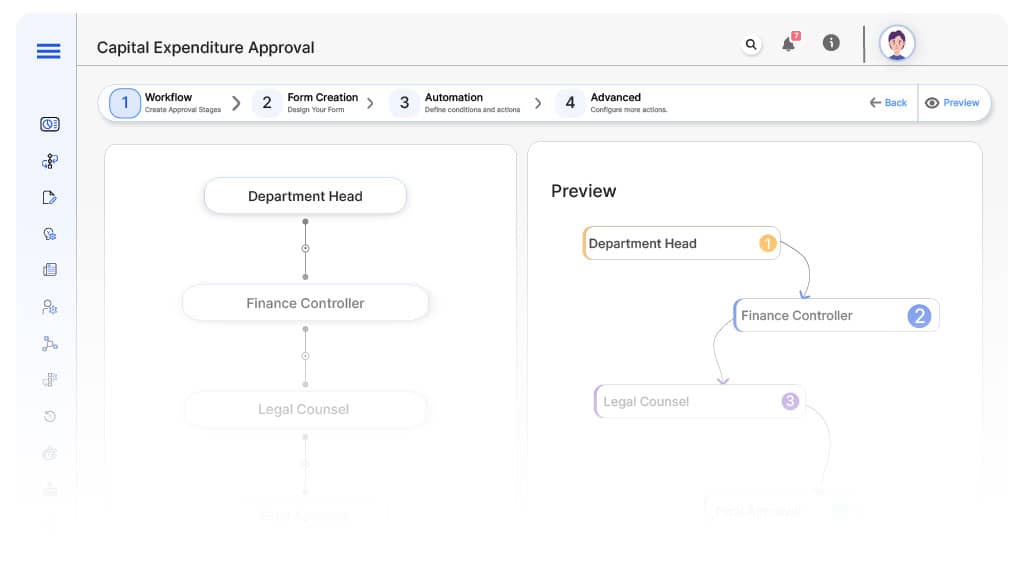

Approval Flow & Routing Logic

Submission → Department Head

- Status Name: Pending Department Review

- Notification Template: “Hi Department Head, new CapEx request submitted for operational validation.”

- On Approve: Moves to Finance Controller.

- On Reject: Returns to Project Owner.

- Escalation: Reminder after 1 day.

Department → Finance Controller

- Status Name: Pending Finance Review

- Notification Template: “Hi Finance, CapEx request requires budget and ROI validation.”

- On Approve: Moves to Legal Counsel (if applicable).

- On Reject: Returns to Department Head.

- Escalation: Reminder after 1 day.

Finance → Legal Counsel (Conditional)

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, vendor agreements require legal review.”

- On Approve: Moves to CFO.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Legal → CFO

- Status Name: Pending CFO Review

- Notification Template: “Hi CFO, consolidated CapEx request ready for financial governance review.”

- On Approve: Moves to Executive Leadership (if applicable).

- On Reject: Returns to Legal Counsel.

- Escalation: Reminder after 1 day.

Final → CapEx Approved

- Status Name: Capital Expenditure Authorized

- Notification Template: “CapEx request approved and funds allocated.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set conditional logic

Save and publish workflow

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Manufacturing Equipment Acquisition

FAQ's

Yes. All requests, approvals, quotes, and financial notes are archived for audits.

Unleash the full potential of your AI-powered Workflow