- Cflow

- Supplier Credit Limit Approval Automation

Supplier Credit Limit Approval Automation

Clow Team

Supplier credit limits are crucial to managing financial exposure, procurement stability, and vendor relationships. Without automation, manual credit limit approvals lead to uncontrolled liabilities, supplier disputes, blocked orders, and audit risks. Recent industry research shows that 59% of companies experience procurement delays due to mismanaged supplier credit limits.

Without automation, procurement teams, finance controllers, credit risk officers, compliance managers, and CFOs struggle to evaluate supplier financial health, creditworthiness, payment history, and contractual obligations. This guide walks you through exactly how Cflow automates Supplier Credit Limit Approval Process, from request submission to final sign-off.

What Is Supplier Credit Limit Approval Process?

The Supplier Credit Limit Approval Process governs how vendor credit limit requests are reviewed, evaluated against supplier financial standing, payment trends, and organizational risk policies before assigning or modifying credit limits.

Think of supplier credit approvals as financial risk gates , each limit decision balances business needs with financial exposure control.

Recent industry research shows that automating credit limit approvals reduces blocked procurement orders by 45% and minimizes supplier payment defaults by 35%.

Why Supplier Credit Limit Approval Matters for Organizations

Risk Control

Procurement Continuity

Compliance Assurance

Vendor Management

Audit Trail

Key Benefits of Automating Supplier Credit Limit Approval with Cflow

- Centralized Credit Request Portal : Cflow allows procurement teams to submit supplier credit requests with financial statements, payment history, and supporting documentation into one streamlined workflow.

- Dynamic Routing Based on Credit Value : Cflow applies routing logic based on requested credit limit, supplier risk rating, and contract exposure.

- Multi-Level Review Workflows : Requests route through procurement, finance, credit risk, compliance, and executive leadership depending on exposure level.

- Real-Time Notifications & Escalations : Automated alerts ensure timely evaluations while escalation rules prevent procurement interruptions.

- Risk Policy Enforcement : Cflow integrates company credit policies, payment terms, aging thresholds, and vendor evaluation criteria directly into the approval logic.

- Full Audit Trail & Limit History : Every request, evaluation, risk assessment, and approval is archived for governance, compliance, and future reviews.

- Mobile Accessibility : Leadership can review and approve urgent credit limit requests remotely, preventing operational delays.

Get the best value for money with Cflow

User Roles & Permissions

Procurement Officer (Initiator)

- Responsibilities: Submit supplier credit limit request with justification and supplier documentation.

- Cflow Permission Level: Submit Form.

- Mapping: “Procurement Team.”

Finance Controller

- Responsibilities: Evaluate supplier financial data, payment history, and outstanding exposure.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Group.”

Credit Risk Officer

- Responsibilities: Perform credit scoring, evaluate default risk, and verify policy compliance.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Credit Risk Group.”

Compliance Officer

- Responsibilities: Validate regulatory requirements and enforce internal credit policies.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

CFO (Final Approver)

- Responsibilities: Final sign-off for high-value or high-risk credit limits.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board.”

Discover why teams choose Cflow

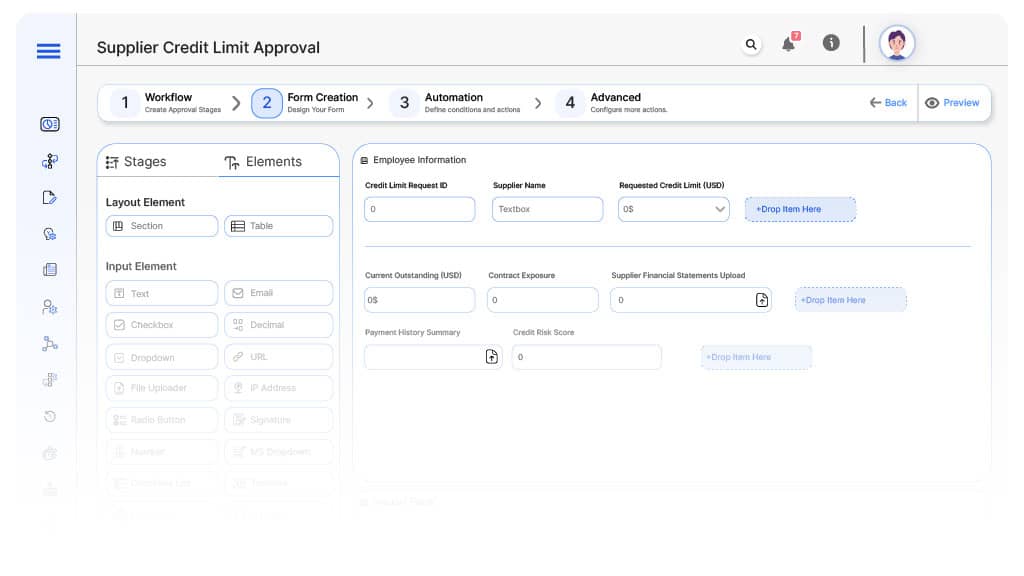

Form Design & Field Definitions

Field Label: Credit Limit Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Supplier Name

- Type: Text

- Logic/Rules: Mandatory.

Field Label: Requested Credit Limit (USD)

- Type: Numeric Field

- Logic/Rules: Mandatory.

Field Label: Current Outstanding (USD)

- Type: Numeric Field

- Logic/Rules: Mandatory.

Field Label: Contract Exposure

- Type: Numeric Field

- Logic/Rules: Drives routing.

Field Label: Supplier Financial Statements Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Payment History Summary

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Credit Risk Score

- Type: Numeric Field (0-100)

- Logic/Rules: Entered by Credit Risk Officer.

Field Label: Procurement Notes

- Type: Text Area

- Logic/Rules: Required for initiator.

Field Label: Finance Review Notes

- Type: Text Area

- Logic/Rules: Required for Finance Controller.

Field Label: Credit Risk Evaluation Notes

- Type: Text Area

- Logic/Rules: Required for Credit Risk Officer.

Field Label: Compliance Review Notes

- Type: Text Area

- Logic/Rules: Required for Compliance Officer.

Field Label: CFO Approval Comments

- Type: Text Area

- Logic/Rules: Required for final approver.

Field Label: Credit Limit Approved Confirmation

- Type: Checkbox

- Logic/Rules: Marks credit limit authorized

Transform your Workflow with AI fusion

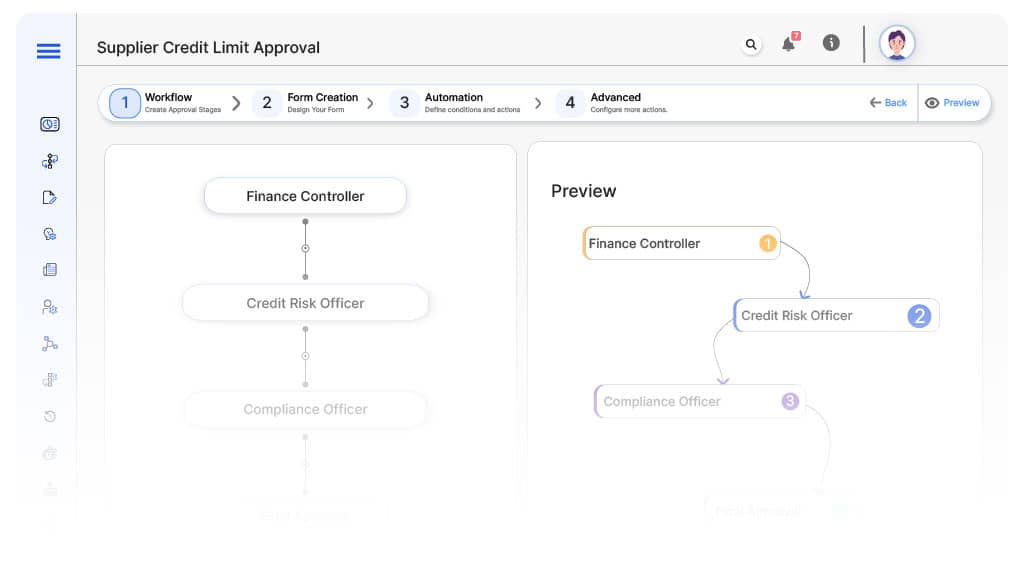

Approval Flow & Routing Logic

Submission → Finance Controller

- Status Name: Pending Financial Review

- Notification Template: “Hi Finance, new supplier credit limit request submitted for review.”

- On Approve: Moves to Credit Risk Officer.

- On Reject: Returns to Procurement Officer.

- Escalation: Reminder after 1 day.

Finance → Credit Risk Officer

- Status Name: Pending Credit Risk Assessment

- Notification Template: “Hi Credit Risk, supplier risk evaluation required.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Credit Risk → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Hi Compliance, credit limit request requires policy and regulatory validation.”

- On Approve: Moves to CFO.

- On Reject: Returns to Credit Risk Officer.

- Escalation: Reminder after 1 day.

Compliance → CFO

- Status Name: Pending Executive Approval

- Notification Template: “Hi CFO, supplier credit limit request ready for final sign-off.”

- On Approve: Moves to Credit Limit Authorized.

- On Reject: Returns to Compliance Officer.

- Escalation: Reminder after 1 day.

Final → Credit Limit Authorized

- Status Name: Supplier Credit Limit Approved

- Notification Template: “Supplier credit limit fully approved and recorded in procurement system.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: High-Value Supplier Credit Limit Request

FAQ's

Setup typically completes within 5–7 business days.

Unleash the full potential of your AI-powered Workflow