Deferred Revenue Adjustment Validation

Why automate?

Cflow Automation Benefits:

Contract Review Integration:

Adjustments must reference the original contract terms or amended agreements.

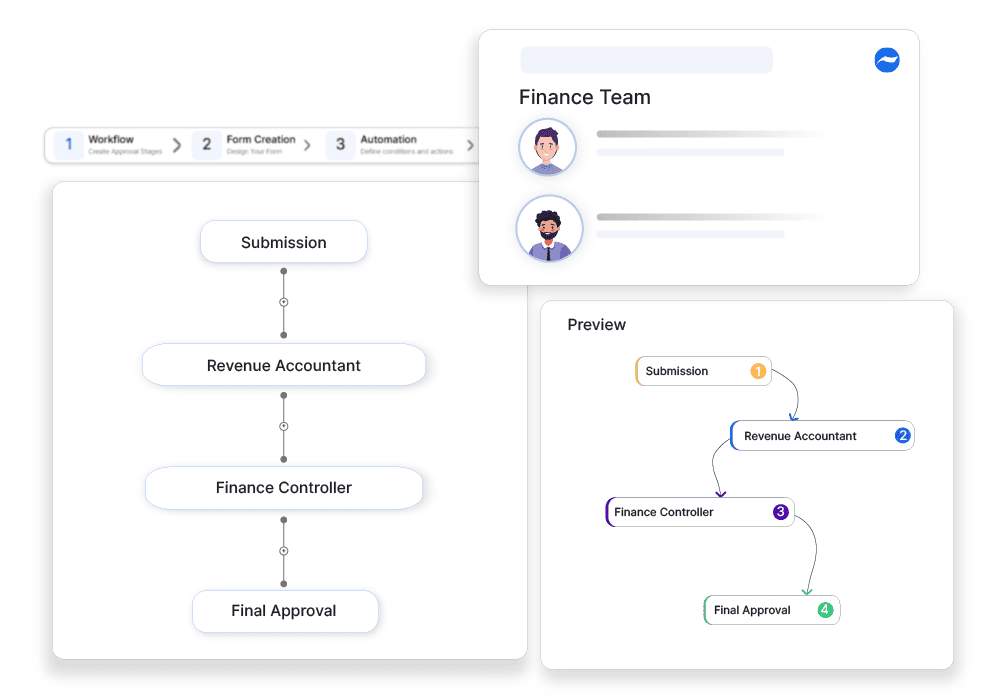

Multi-Level Approval Paths:

Material adjustments automatically escalate to senior finance or auditors.

Pre-Posting Validation:

Ensure all math and timing align with accounting standards like ASC 606.

Full Adjustment History:

Maintain logs of every change for internal and external audit use.

Frequently Asked Questions

What is deferred revenue adjustment validation?

A process to ensure that revenue adjustments comply with accounting standards and reflect accurate financial reporting.

What are the main challenges in deferred revenue adjustments?

Ensuring compliance with accounting standards, preventing revenue misstatements, and maintaining accurate financial records.

How can institutions streamline deferred revenue adjustments?

By automating revenue recognition, conducting regular reconciliations, and integrating accounting software.