- Cflow

- Financial Statement Sign-Off Process Automation

Financial Statement Sign-Off Process Automation

Clow Team

The Financial Statement Sign-Off Process is one of the most important workflows for finance and executive teams. It directly impacts financial accuracy, regulatory compliance, and timely reporting to stakeholders. Without automation, financial statement approvals often face delays, version control issues, and compliance risks due to poor coordination between finance, department heads, auditors, and leadership.

Manually handling statement preparation, verifying figures, validating compliance, and securing multi-level approvals leads to long turnaround times and higher chances of reporting errors. This can cause missed filing deadlines, loss of stakeholder trust, and even regulatory penalties.

This guide walks you through exactly how Cflow automates the Financial Statement Sign-Off Process – from initial statement preparation to final executive approval, ensuring statements are approved quickly, transparently, and in compliance with corporate and regulatory standards.

What Is Financial Statement Sign-Off Process?

The Financial Statement Sign-Off Process governs how company financial reports are reviewed, validated, and approved before being published or filed. It ensures that every figure is accurate, every compliance check is complete, and all necessary stakeholders – such as department heads, finance executives, auditors, and the board have approved the statement.

Think of it as the final quality checkpoint for corporate financial integrity – every financial statement must pass structured reviews to ensure it meets internal policies and regulatory requirements. Without a clear process, reporting errors can slip through, deadlines can be missed, and the company may face reputational or legal consequences.

Industry studies show that organizations using automated financial sign-off workflows reduce review cycle times by up to 50% and significantly improve compliance adherence.

Why Financial Statement Sign-Off Process Is Important for Finance Teams

Financial Accuracy

Regulatory Compliance

Audit Readiness

Cross-Department Coordination

Key Benefits of Automating Financial Statement Sign-Off Process with Cflow

- Centralized Review Dashboard: Cflow offers a single portal where finance, audit, and leadership teams can track statement status, assigned reviewers, and pending actions in real time, eliminating email chains and miscommunication. It also provides quick filters to locate specific statements by period, department, or approval stage.

- Dynamic Approval Templates: Cflow allows finance teams to create approval workflows tailored for monthly, quarterly, or annual statements. Conditional logic ensures high-risk reports undergo stricter review paths. Templates can be updated instantly to reflect regulatory changes without disrupting active processes.

- Multi-Level Approval Coordination: Statements are automatically routed from preparers to department heads, auditors, CFO, and finally to CEO or board approval, ensuring every stage is completed in sequence. This sequential routing improves accountability and prevents skipped approval steps.

- Real-Time Notifications & Escalations: Automated reminders keep approvals moving forward. Escalation alerts notify senior leadership when deadlines are approaching to avoid last-minute rushes. Notifications are customizable to match urgency levels and team preferences.

- Policy Enforcement & Compliance: Cflow enforces that all compliance documentation and checklists are complete before the statement advances to the next review stage. The system blocks incomplete submissions, ensuring full adherence to internal and external standards.

- Audit Trail & Recordkeeping: Every action in the sign-off process is timestamped and archived for easy retrieval during audits or compliance checks. Searchable logs make it easy to trace reviewer comments and decision history.

- Mobile Accessibility: Approvers can review, annotate, and approve statements securely from any device, keeping the process active regardless of location. Offline access ensures approvals can still be completed during network outages.

Get the best value for money with Cflow

User Roles & Permissions

Financial Analyst

- Responsibilities: Prepare financial statements, attach supporting documentation, and initiate approval.

- Cflow Permission Level: Submit Form.

- Mapping: “Finance Team” group.

Department Head

- Responsibilities: Verify departmental figures and approve data accuracy.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Department Heads” group.

Internal Auditor

- Responsibilities: Review for compliance with accounting policies and regulatory standards.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Audit Team” group.

Chief Financial Officer (CFO)

- Responsibilities: Validate overall financial accuracy and approve final draft before executive review.

- Cflow Permission Level: Task Owner.

- Mapping: “Executive Finance” group.

CEO / Board Member

- Responsibilities: Provide final executive sign-off before report release.

- Cflow Permission Level: Final Approver.

- Mapping: “Executive Leadership” group.

Compliance Officer

- Responsibilities: Ensure statement meets legal and industry compliance requirements.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance” group.

Discover why teams choose Cflow

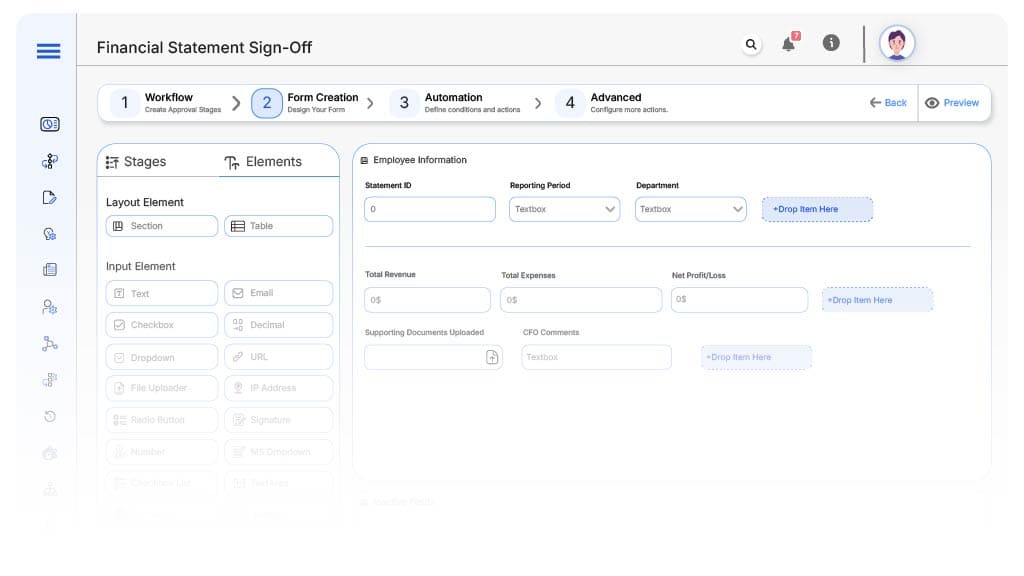

Form Design & Field Definitions

Field Label: Statement ID

- Type: Autonumber

- Auto-Populate: Generated automatically on submission.

Field Label: Reporting Period

- Type: Dropdown (Monthly, Quarterly, Annual)

- Logic/Rules: Determines routing path.

Field Label: Department

- Type: Dropdown

- Auto-Populate: From Finance ERP.

Field Label: Total Revenue

- Type: Currency

- Logic/Rules: Required.

Field Label: Total Expenses

- Type: Currency

- Logic/Rules: Required.

Field Label: Net Profit/Loss

- Type: Currency

- Auto-Populate: Calculation field.

Field Label: Supporting Documents Uploaded

- Type: File Upload

- Logic/Rules: Mandatory before audit review.

Field Label: CFO Comments

- Type: Text Area

- Logic/Rules: Optional.

Field Label: Final Approval Confirmation

- Type: Checkbox

- Logic/Rules: Required for closure.

Transform your Workflow with AI fusion

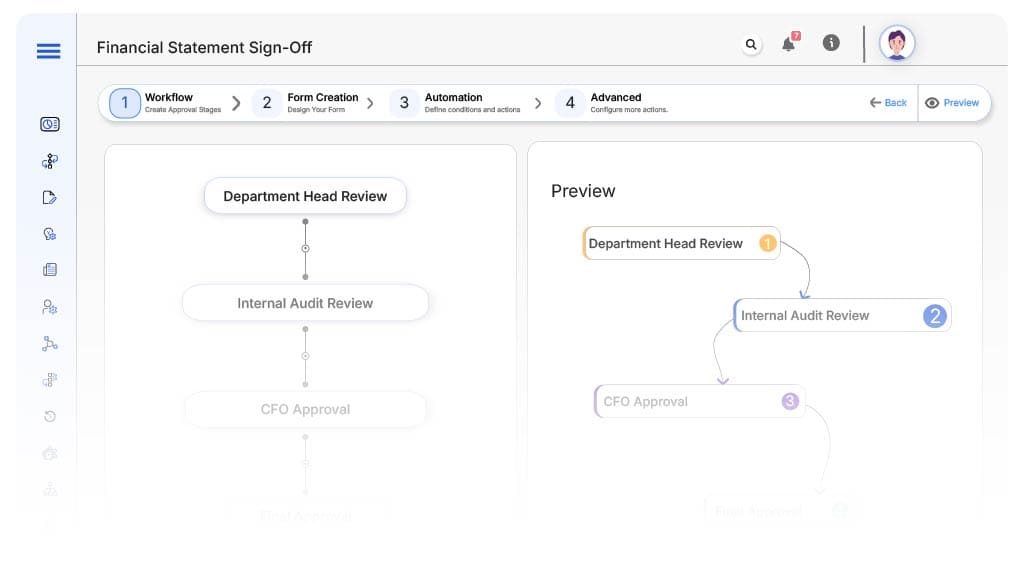

Approval Flow & Routing Logic

Submission → Department Head Review

- Status Name: Pending Department Review

- Notification Template: “Hi {Department Head}, please review and verify departmental data for {Statement ID}.”

- On Approve: Routes to Internal Auditor.

Department Head → Internal Audit Review

- Status Name: Pending Audit Review

- Notification Template: “Hi Audit, please review {Statement ID} for compliance and accuracy.”

- On Approve: Routes to CFO.

- Escalation: Reminder after 2 days.

Internal Auditor → CFO Approval

- Status Name: Pending CFO Approval

- Notification Template: “Hi CFO, please review and approve final draft of {Statement ID}.”

- On Approve: Routes to CEO/Board.

- Escalation: Reminder after 2 days.

CFO → CEO/Board Review

- Status Name: Pending Executive Approval

- Notification Template: “Hi {Executive}, final sign-off required for {Statement ID}.”

- On Approve: Moves to Completion.

- Escalation: Reminder after 2 days.

Final → Statement Published

- Status Name: Sign-Off Complete

- Notification Template: “Financial statement {Statement ID} has been fully approved and archived.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up user groups

Build flow

Configure alerts

Set conditional logic

Reporting period determines approval stages, deadlines, and related compliance documentation requirements for the workflow.

Save and publish workflow

Test

Adjust Logic

Go live

Example Journey: Q4 Financial Statement

FAQ's

Unleash the full potential of your AI-powered Workflow