- Cflow

- Treasury Management Approval Automation

Treasury Management Approval Automation

Learn how Cflow streamlines Treasury Management Approval for finance teams at mid-sized organizations. Includes step-by-step workflow, roles, form fields, approval logic, and real examples.

Clow Team

Treasury teams are responsible for managing liquidity, risk, and investment activities—functions that demand precision, transparency, and timely decision-making. Without structured automation, treasury approvals often suffer from scattered communication, inconsistent reviews, and delayed fund disbursement.

Manual processes lead to approval bottlenecks, incomplete documentation, and exposure to financial risk. Whether it’s cash positioning, FX transactions, intercompany loans, or investment authorization – Cflow enables finance leaders to automate Treasury Management Approval with a transparent, audit-ready workflow.

What Is Treasury Management Approval Automation?

Treasury Management Approval Automation refers to a digitized workflow that governs how treasury-related transactions – such as fund transfers, cash concentration, debt issuance, or investment decisions – are submitted, reviewed, and approved across the finance organization.

Imagine an investment request routed from treasury analysts to senior finance officers, then to CFOs – each with role-specific inputs, deadlines, and documentation. Automation eliminates the manual back-and-forth and ensures compliance at every step.

According to PwC, 67% of treasury leaders cite automation as essential for improving visibility, reducing fraud, and enabling quicker strategic decisions.

Why Treasury Management Approval Needs Automation

Speed & Accuracy

Risk Mitigation

Transparency

Audit Readiness

Key Benefits of Automating Treasury Management Approval with Cflow

- Centralized Treasury Request Portal: Cflow provides a dedicated portal where treasury teams initiate transactions – FX trades, intercompany lending, cash pooling, or investment approvals. All required data, thresholds, and documents are captured in one place.

- Multi-Layered Approval Workflows: Depending on transaction type and amount, requests are routed to Treasury Heads, Legal, CFOs, and even external banking partners. Conditional logic ensures the right people review the right requests – no manual routing needed.

- Threshold-Based Escalation Controls: Requests exceeding predefined limits (e.g., $1M for investments or $500K for wire transfers) are automatically escalated to senior finance executives or board-level committees, ensuring financial governance.

- Real-Time Monitoring & Notifications: Finance heads can monitor ongoing treasury approvals, track delays, and intervene when critical transactions are held up. Automated notifications and 48-hour reminders prevent bottlenecks and ensure business continuity.

- Policy Enforcement & Compliance: Cflow enforces treasury policies – such as dual sign-off for fund movement, mandatory legal checks for FX hedging, or documentation for counterparty risk – before any approval is finalized.

- Audit Trails & Secure Recordkeeping: Every approval, comment, and attached document is stored securely with role-based access. Treasury leaders can instantly generate transaction histories for auditors or regulators.

- Mobile-Accessible Decision Making: Busy finance leaders can approve or reject high-value treasury transactions from their phones, ensuring quick decisions, even while traveling.

Get the best value for money with Cflow

User Roles & Permissions

Treasury Analyst

- Responsibilities: Initiate fund transfers, investment requests, or FX trades.

- Permission Level: Submit Form.

- Mapping: “Treasury Team” group.

Treasury Manager

- Responsibilities: Review transaction details, assess liquidity impact, and forward for approval.

- Permission Level: Approve/Reject.

- Mapping: “Treasury Managers” group.

Legal Officer

- Responsibilities: Review legal risks, counterparty agreements, or compliance issues.

- Permission Level: Task Owner.

- Mapping: “Legal Team” group.

Finance Controller

- Responsibilities: Validate financial impact and fund availability.

- Permission Level: Task Owner.

- Mapping: “Controllers” group.

CFO / Executive Approver

- Responsibilities: Final approval for high-value transactions.

- Permission Level: Approve/Reject.

- Mapping: “Executive Finance” group.

Audit Officer

- Responsibilities: Review historical records and approval trails.

- Permission Level: View Only.

- Mapping: “Internal Audit” group.

Discover why teams choose Cflow

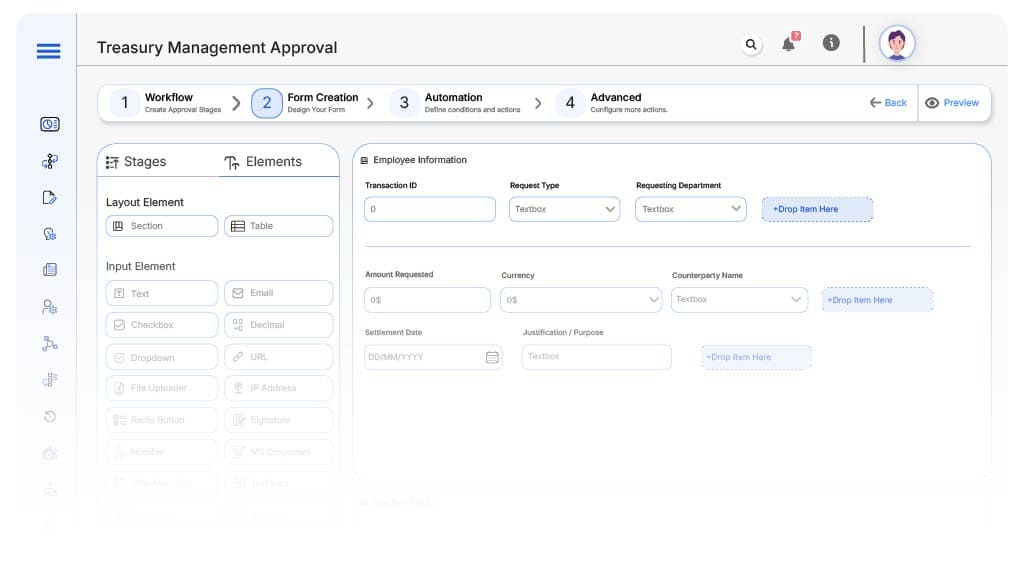

Form Design & Field Definitions

Field Label: Transaction ID

- Type: Autonumber

- Auto-Populate: Generated automatically on submission.

Field Label: Request Type

- Type: Dropdown (Investment, FX Trade, Fund Transfer, Debt Repayment, Intercompany Lending)

- Logic/Rules: Drives conditional routing

Field Label: Requesting Department

- Type: Dropdown

- Logic/Rules: Required

Field Label: Amount Requested

- Type: Currency

- Logic/Rules: Triggers escalation thresholds

Field Label: Currency

- Type: Dropdown

- Logic/Rules: Required

Field Label: Counterparty Name

- Type: Text

- Logic/Rules: Required for FX, lending, and investments

Field Label: Settlement Date

- Type: Date Picker

- Logic/Rules: Required

Field Label: Justification / Purpose

- Type: Text Area

- Logic/Rules: Required

Field Label: Legal Review Completed

- Type: Checkbox

- Logic/Rules: Required for FX and loans

Field Label: CFO Sign-Off

- Type: Checkbox

- Logic/Rules: Mandatory if amount > $500,000

Field Label: Treasury Completion Confirmation

- Type: Checkbox

- Logic/Rules: Required before closing

Transform your Workflow with AI fusion

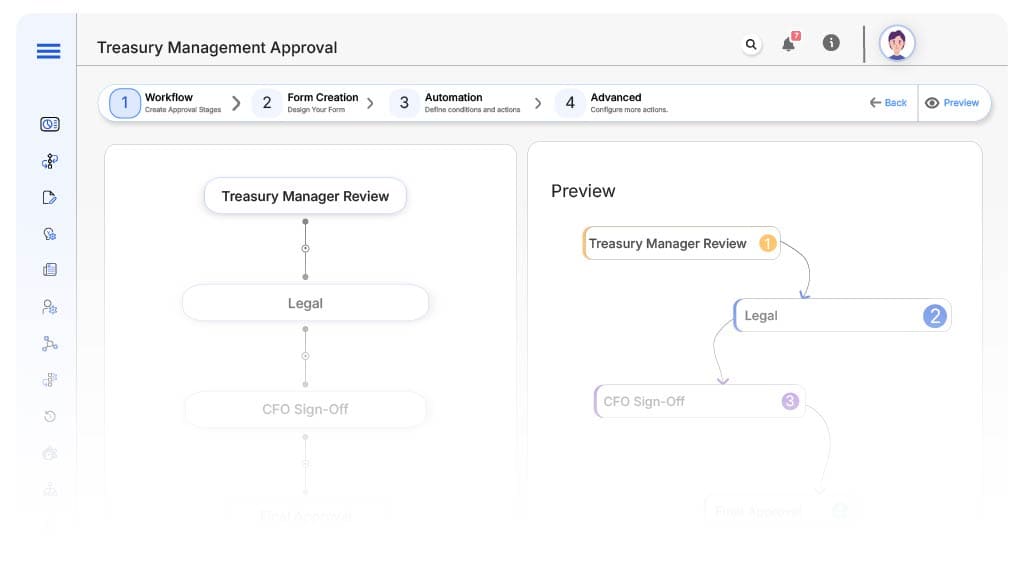

Approval Flow & Routing Logic

Submission → Treasury Manager Review

- Status Name: Pending Treasury Manager

- Notification Template: “Hi Treasury Manager, a new {Request Type} for ${Amount Requested} requires your review.”

- On Approve: Routes to Legal (if required) and Finance Controller

Treasury Manager → Legal + Controller

- Status Name (Legal): Pending Legal Approval

- Status Name (Controller): Pending Financial Review

- Notification Template (Legal): “Hi Legal, review terms for {Counterparty Name} transaction.”

- Notification Template (Controller): “Hi Controller, validate fund availability for {Request Type}.”

- On Complete: Routes to CFO if needed

Controller → CFO Sign-Off

- Status Name: Pending Executive Approval

- Notification Template: “Hi CFO, ${Amount Requested} treasury request is ready for your approval.”

- On Approve: Routes to Treasury Closure

Final → Treasury Completion

- Status Name: Treasury Action Completed

- Notification Template: “Treasury action for {Transaction ID} is now complete. Record archived.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up user groups

Build flow

Configure alerts

Apply conditional logic

Test

Go live

Example Journey: FX Hedging Request by Anisha

FAQ's

Yes. Cflow allows conditional routing and logic based on request types like FX, loans, or investments.

Unleash the full potential of your AI-powered Workflow