- Cflow

- Debt Repayment Authorization Automation

Debt Repayment Authorization Automation

Clow Team

Authorizing debt repayments, whether to vendors, financial institutions, or internal loan accounts, requires strict controls, multi-level reviews, and comprehensive documentation. In most organizations, this process is handled manually through spreadsheets and email threads, increasing the risk of delayed payments, unauthorized approvals, and compliance violations.

Cflow brings structure and transparency to the Debt Repayment Authorization Process by automating requests, approvals, documentation uploads, and finance sign-offs. Every action is timestamped and securely stored, making the process faster, audit-ready, and risk-free. This guide walks you through how Cflow digitizes and secures debt repayments across your organization.

What Is Debt Repayment Authorization?

Debt Repayment Authorization is the internal process used to request, validate, and approve repayment of outstanding obligations. This may include loans, credit lines, vendor financing, or intercompany debts. The process ensures that repayments are aligned with payment terms, budget availability, and internal financial controls.

Think of it as a financial checkpoint system: before any debt is repaid, the request must pass through multiple departments – requestor, finance controller, budget head, and treasury for verification and clearance.

According to Deloitte, nearly 60% of repayment errors in enterprises occur due to lack of structured authorization and incomplete documentation.

Why Automate Debt Repayment Authorization?

Financial Control

Faster Turnaround

Audit Trail

Policy Compliance

Central Visibility

Key Benefits of Automating Debt Repayment Authorization with Cflow

- Centralized Repayment Dashboard: All pending, approved, and completed repayment requests are tracked in a single view. Finance, Treasury, and Audit teams gain full visibility into repayment amounts, due dates, and authorization statuses. This eliminates reliance on email chains and fragmented documents.

- Structured Request Forms with Validation: Cflow captures all necessary repayment details – debt source, amount, due date, justification, lender info – through a structured form.

Mandatory fields and conditional logic ensure no critical data is missed during submission. - Multi-Level Approval Routing: Each repayment request is automatically routed through predefined approvers: Department Head, Finance Controller, Treasury, and finally the CFO or Audit. No request can proceed without sequential approval, preventing policy violations.

- Budget Code & Ledger Mapping: Each repayment is tagged with the appropriate cost center and ledger account. Finance can cross-check against budget availability before approval.

This helps organizations stay within spending limits and ensures accurate reporting. - Document Uploads & Payment Proof Tracking: Cflow allows the upload of loan agreements, repayment schedules, payment receipts, and bank confirmations. This creates a reliable audit trail and supports future reconciliations or audits.

- Automated Reminders & Compliance Checks: System-generated alerts notify approvers of pending tasks, while logic blocks incomplete or non-compliant submissions. Escalation rules ensure timely processing of repayments to avoid late fees or penalties.

Get the best value for money with Cflow

User Roles & Permissions

Requestor (Any Department)

- Responsibilities: Submit repayment request with justification and documents.

- Cflow Permission Level: Submit.

- Mapping: “Finance Requestors” group.

Department Head

- Responsibilities: Review business case and validate repayment purpose.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Department Approvers” group.

Finance Controller

- Responsibilities: Verify amounts, budget mapping, and ledger allocation.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Review” group.

Treasury Manager

- Responsibilities: Validate fund availability and initiate disbursement.

- Cflow Permission Level: Task Owner.

- Mapping: “Treasury Ops” group.

CFO or Auditor

- Responsibilities: Provide final authorization for high-value or sensitive repayments.

- Cflow Permission Level: Final Approver.

- Mapping: “Executive Review” group.

Compliance Officer

- Responsibilities: Monitor policy adherence and archive for audits.

- Cflow Permission Level: View Only.

- Mapping: “Audit Team” group.

Discover why teams choose Cflow

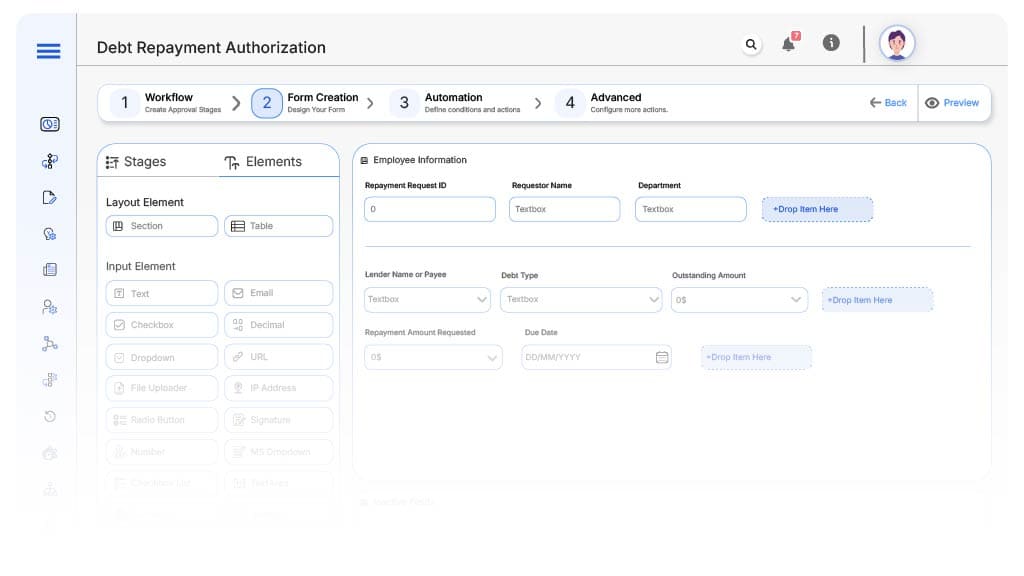

Form Design & Field Definitions

Field Label: Repayment Request ID

- Type: Autonumber

- Auto-Populate: Generated automatically on submission.

Field Label: Requestor Name

- Type: Text

- Auto-Populate: From user profile

Field Label: Department

- Type: Dropdown

- Auto-Populate: From HRIS.

Field Label: Lender Name or Payee

- Type: Text

- Logic/Rules: Required.

Field Label: Debt Type

- Type: Dropdown (Vendor Credit, Loan Repayment, Internal Transfer, Others)

- Logic/Rules: Drives field visibility.

Field Label: Outstanding Amount

- Type: Currency

- Logic/Rules: Required.

Field Label: Repayment Amount Requested

- Type: Currency

- Logic/Rules: Cannot exceed outstanding amount.

Field Label: Due Date

- Type: Date Picker

- Logic/Rules: Drives urgency logic.

Field Label: Budget Code

- Type: Text

- Logic/Rules: Mandatory before Finance Controller approval.

Field Label: Ledger Account

- Type: Dropdown

- Logic/Rules: Required for Finance tracking.

Field Label: Repayment Justification

- Type: Text Area

- Logic/Rules: Required.

Field Label: Supporting Documents

- Type: File Upload

- Logic/Rules: Loan agreement or schedule required.

Field Label: Payment Confirmation Upload

- Type: File Upload

- Logic/Rules: Added post-disbursement by Treasury.

Field Label: Final Approval Checkbox

- Type: Checkbox

- Logic/Rules: Required before marking complete.

Transform your Workflow with AI fusion

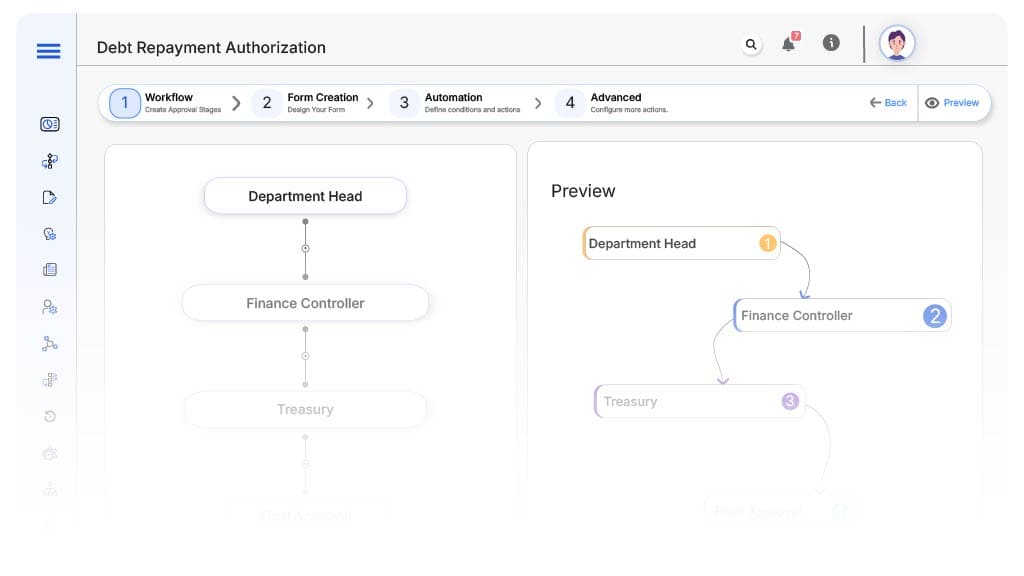

Approval Flow & Routing Logic

Initiation → Department Head

- Status Name: Pending Department Approval

- Notification Template: “Repayment request {RequestID} requires your review and approval.”

- On Approve: Routes to Finance Controller.

Department Head → Finance Controller

- Status Name: Pending Finance Validation

- Notification Template: “Finance review required for repayment request {RequestID}.”

- Escalation: Reminder after 2 days.

Finance → Treasury

- Status Name: Pending Disbursement

- Notification Template: “Funds to be disbursed for repayment request {RequestID}.”

- On Complete: Upload payment confirmation.

Treasury → CFO

- Status Name: Pending Final Authorization

- Notification Template: “Final sign-off required for {RequestID}. Please review.”

- On Approve: Routes to closure.

Final → Request Complete

- Status Name: Repayment Process Complete

- Notification Template: “Repayment for {RequestID} has been completed and archived.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up user groups

Build flow

Configure alerts

Apply conditional logic

Save and publish

Test

Go live

Example Journey: Vendor Loan Repayment

FAQ's

Yes. You can integrate Cflow with ERP or accounting platforms to sync ledger and budget data.

Unleash the full potential of your AI-powered Workflow