- Cflow

- Interest Rate Swap Approval Automation

Interest Rate Swap Approval Automation

Clow Team

Interest rate swaps are complex financial contracts that require strict regulatory compliance, multi-level approvals, and precise documentation. Manual approval processes expose institutions to delays, miscommunication, and compliance risks.

Financial teams must coordinate legal, risk, treasury, and leadership inputs before swaps are executed. Without structured automation, these workflows are prone to error and lack transparency.

Cflow simplifies this by automating every step of the interest rate swap approval process, ensuring secure, auditable, and compliant execution across departments.

What is Interest Rate Swap Approval Process?

The Interest Rate Swap (IRS) approval process governs how proposed swaps are reviewed, risk-assessed, documented, and approved before execution with external parties.

It ensures legal contracts, financial terms, counterparty checks, and compliance validations are completed by stakeholders like Treasury, Risk, Legal, and Leadership teams.

In the financial sector, swap mismanagement leads to millions in exposure. Automation brings control, transparency, and faster approvals.

Why Automate Interest Rate Swap Approvals?

Risk Reduction

Audit & Compliance

Faster Turnaround

Cross-Department Clarity

Key Benefits of Automating with Cflow

- Centralized Approval Tracking: Cflow gives finance teams a live dashboard to view pending swaps, approvals in progress, and escalation triggers. Treasury can track SLAs in real-time.

This real-time visibility reduces back-and-forth emails and ensures timely decision-making. Audit teams can also monitor status without manual updates. - Dynamic Swap Templates: Swap forms can be tailored for fixed-floating, basis, or amortizing swaps. Conditions adapt based on notional value, counterparty, or term length.

Templates support custom validation rules and linked document uploads. Teams can replicate previous swaps to save setup time. - Automated Role Routing: Swap proposals are routed automatically to Treasury, then Risk, Legal, and CFO in sequence. Conditions ensure high-value deals go through extra validation.

Each stakeholder is notified based on role and deal type, reducing delays. Routing logic is fully configurable to match governance policies. - Escalation Alerts & Reminders: Missed SLAs or delayed reviews trigger automated reminders to stakeholders. Nothing slips through the cracks. Escalations can be configured by time, amount, or priority level. Approvers receive mobile, email, and in-app alerts to act faster.

- Regulatory Documentation Compliance: Key artifacts like ISDA forms, valuation sheets, and risk models must be attached. Cflow blocks progression unless mandatory compliance fields are completed. Regulatory templates are pre-configured to match financial regulations. This ensures compliance with internal and external audit protocols.

- Audit-Ready Trail: Each approval, comment, file upload, and timestamp is archived securely. Full traceability is available for internal audit or regulatory checks. Audit logs are exportable in PDF or Excel for compliance reviews. Every action is linked to a user, form version, and decision trail.

- Mobile Access for CFOs and Approvers: Key executives can approve or review interest rate swaps on mobile devices with secure login, ensuring no delays during travel. The mobile interface supports full form access, document preview, and comment history. Approvals are encrypted and time-stamped for added security.

Get the best value for money with Cflow

User Roles & Permissions

Swap Initiator (Treasury Officer)

- Responsibilities: Fill swap proposal, attach documents, and initiate the workflow.

- Cflow Permission Level: Submit Form

- Mapping: “Treasury” group

Risk Manager

- Responsibilities: Validate financial exposure, upload risk models, and assess scoring.

- Cflow Permission Level: Task Owner

- Mapping: “Risk Team” group

Legal Officer

- Responsibilities: Attach compliance documents and validate counterparty legal risks.

- Cflow Permission Level: Task Owner

- Mapping: “Legal Team” group

CFO / Finance Director

- Responsibilities: Conduct final review of the swap and provide approval or rejection.

- Cflow Permission Level: Approve/Reject

- Mapping: “Leadership Team” group

Compliance Auditor

- Responsibilities: View submitted and completed swap records for audit readiness.

- Cflow Permission Level: View Only

- Mapping: “Audit Team” group

Discover why teams choose Cflow

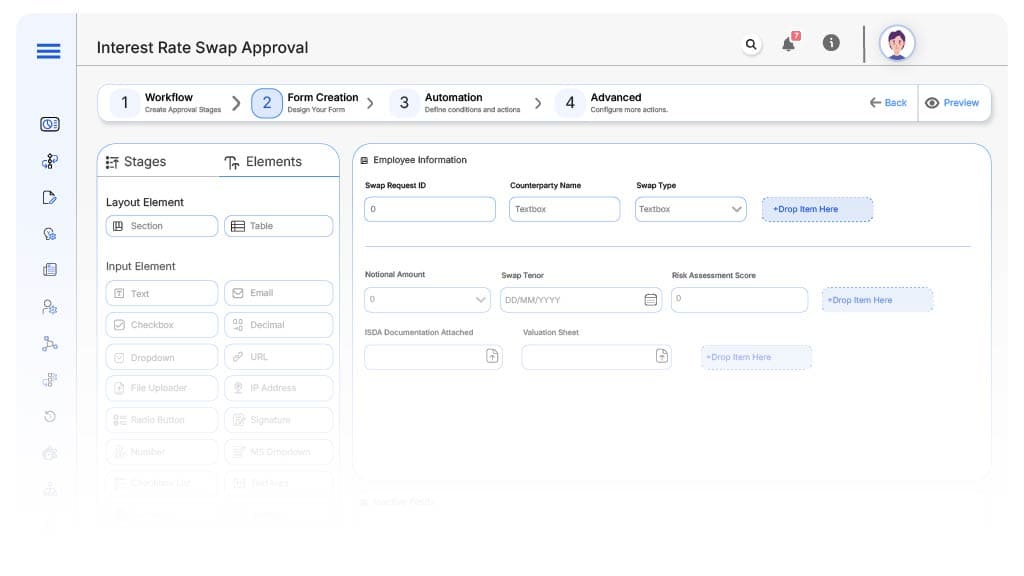

Form Design & Field Definitions

Field Label: Swap Request ID

- Type: Autonumber

- Auto-Populate: Generated upon submission to uniquely identify each swap.

Field Label: Counterparty Name

- Type: Text

- Logic/Rules: Required; specifies the external party to the transaction.

Field Label: Swap Type

- Type: Dropdown (Fixed-to-Floating, Floating-to-Fixed, Basis Swap)

- Logic/Rules: Drives routing logic and compliance checklists.

Field Label: Notional Amount (in USD)

- Type: Currency

- Logic/Rules: Validated for upper limit and triggers risk team routing.

Field Label: Swap Tenor

- Type: Date Range

- Logic/Rules: Defines swap duration and auto-calculates maturity dates.

Field Label: Risk Assessment Score

- Type: Number (Auto-calculated)

- Logic/Rules: Calculated from internal model; determines next-level approvals.

Field Label: ISDA Documentation Attached

- Type: File Upload

- Logic/Rules: Mandatory before Legal team can proceed.

Field Label: Valuation Sheet

- Type: File Upload

- Logic/Rules: Must include pricing model and sensitivity analysis.

Field Label: Treasury Comments

- Type: Text Area

- Logic/Rules: Required for rationale, hedging purpose, and execution context.

Field Label: Compliance Checklist Completed

- Type: Checkbox

- Logic/Rules: Must be checked before CFO can review.

Field Label: Final Approval Signature

- Type: Digital Signature

- Logic/Rules: Required to mark the swap process as complete.

Transform your Workflow with AI fusion

Approval Flow & Routing Logic

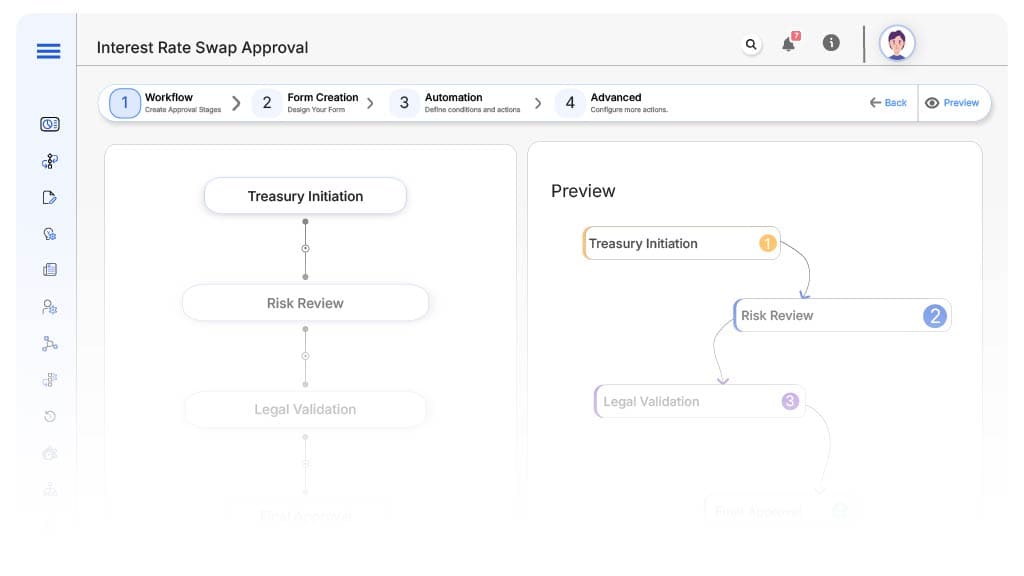

Submission → Treasury Initiation

- Status: Pending Treasury Review

- Notification: “New swap request submitted. Please validate and forward.”

- On Approve: Routes to Risk Team

Treasury → Risk Review

- Status: Pending Risk Assessment

- Notification: “Risk validation needed for {Counterparty} swap.”

- Escalation: Reminder after 1 day

- On Approve: Routes to Legal

Risk → Legal Validation

- Status: Pending Legal Review

- Notification: “Legal compliance review required for IRS approval.”

- Escalation: Reminder after 1 day

- On Approve: Routes to CFO

Legal → CFO Approval

- Status: Pending Final Approval

- Notification: “Swap cleared by Legal. Please provide final approval.”

- Escalation: Reminder after 2 days

- On Approve: Swap marked approved and archived

Final → Approved & Archived

- Status: Swap Approved

- Notification: “Swap request approved. Execution authorized.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set routing logic

Save and publish

Test

Go live

Example Journey: Swap Approval for Acme Bank

FAQ's

Every action is timestamped and archived. Audit logs can be exported instantly.

Unleash the full potential of your AI-powered Workflow