- Cflow

- Insurance Policy Renewal Automation

Insurance Policy Renewal Automation

Clow Team

The Insurance Policy Renewal Process ensures business continuity by maintaining uninterrupted coverage across critical insurance policies like liability, property, cyber, and employee health. Delays or missed renewals can lead to coverage lapses, compliance violations, and financial exposure. Without automation, tracking renewal dates, collecting documents, coordinating with insurers, and obtaining internal approvals becomes a risky manual process.

Cflow eliminates the risk of missed deadlines and policy gaps by automating the entire insurance renewal cycle. This guide explains how Cflow streamlines renewal tracking, approval routing, compliance verification, and documentation.

What Is Insurance Policy Renewal Process?

The Insurance Policy Renewal Process governs how organizations proactively manage and execute the renewal of their insurance policies. It includes identifying policies nearing expiration, collecting updated terms, obtaining budget and risk approvals, and confirming binding with insurers.

Think of it like a scheduled health check-up. Just as skipping one could lead to a crisis, missing a policy renewal could expose your business to legal and financial risk. A structured renewal workflow ensures no deadlines are missed and all approvals are in place.

According to Risk Management Magazine, businesses that automate renewal tracking reduce compliance gaps by 60% and avoid penalties or coverage interruptions.

Why Insurance Policy Renewal Process Is Important for Finance and Risk Teams

Coverage Continuity

Budget Alignment

Legal & Regulatory Compliance

Multi-Team Coordination

Key Benefits of Automating Insurance Policy Renewal Process with Cflow

- Centralized Renewal Calendar: Cflow provides a single view of all policy expiration dates, renewal windows, and assigned owners. The dashboard allows filters by policy type, insurer, location, or business unit. Renewal status can be monitored at a glance across all departments.

- Auto-Triggered Workflows: Cflow automatically triggers the renewal workflow 60 or 90 days before policy expiry. Stakeholders are notified with assigned tasks and timelines.

This eliminates dependency on calendar reminders or manual follow-ups. - Approval Routing Across Departments: Premium approvals, legal reviews, risk assessments, and payment confirmations are automatically routed to relevant stakeholders with escalation rules. This ensures timely collaboration and prevents last-minute delays.

- Document Upload & Repository: Policy documents, quotes, invoices, endorsements, and confirmations are stored in a secure centralized repository with version control and audit logs.

Every team has access to the latest files in one place. - Vendor & Insurer Coordination: Insurer contact details, renewal quotes, and status updates can be tracked in real-time, improving communication and turnaround. Follow-ups are reduced and confirmation cycles are shortened.

- Audit Trail & Compliance Readiness: Every action – from task completion to document upload – is logged with timestamps. Reports can be generated instantly for audits or board reviews. This ensures legal defensibility and audit transparency.

- Mobile Access: Team members can track tasks, approve renewals, and upload files from any device, ensuring renewals stay on schedule even during travel.This improves flexibility and response time for decision-makers.

Get the best value for money with Cflow

User Roles & Permissions

Policy Owner

- Responsibilities: Monitor policy timelines, initiate renewal, review insurer terms.

- Cflow Permission Level: Submit Form.

- Mapping: “Finance Team” group.

Legal Reviewer

- Responsibilities: Review contract language, endorsements, and liability limits.

- Cflow Permission Level: Task Owner.

- Mapping: “Legal” group.

Risk Officer

- Responsibilities: Assess risk alignment, ensure policy scope matches current exposures.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Risk & Compliance” group.

Finance Approver

- Responsibilities: Validate premium cost, budget fit, and payment readiness.

- Cflow Permission Level: Task Owner.

- Mapping: “Finance Controllers” group.

Vendor Coordinator

- Responsibilities: Upload insurer quote, confirm renewal communication.

- Cflow Permission Level: Task Owner.

- Mapping: “Insurance Vendors” group.

Audit Viewer

- Responsibilities: Review records and completion history for audit readiness.

- Cflow Permission Level: View Only.

- Mapping: “Audit” group.

Discover why teams choose Cflow

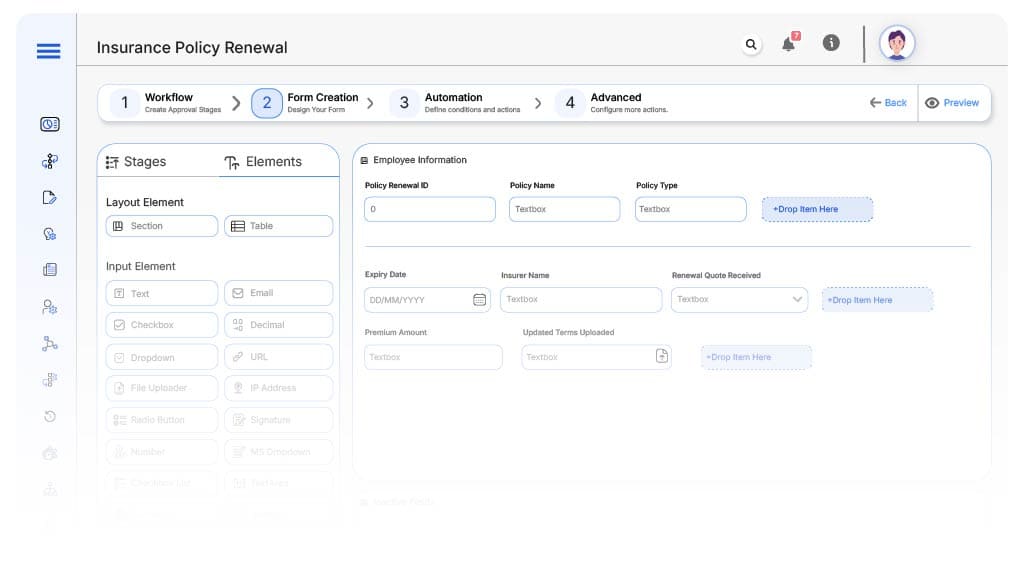

Form Design & Field Definitions

Field Label: Policy Renewal ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Policy Name

- Type: Text

- Auto-Populate: Pre-filled from master policy list.

Field Label: Policy Type

- Type: Dropdown (Liability, Property, Cyber, Health, Auto)

- Logic/Rules: Drives routing logic.

Field Label: Expiry Date

- Type: Date Picker

- Logic/Rules: Auto-triggers workflow based on lead time.

Field Label: Insurer Name

- Type: Text

- Logic/Rules: Verified against vendor list.

Field Label: Renewal Quote Received

- Type: Checkbox

- Logic/Rules: Must be checked before proceeding.

Field Label: Premium Amount

- Type: Currency

- Logic/Rules: Routed to Finance for budget validation.

Field Label: Updated Terms Uploaded

- Type: File Upload

- Logic/Rules: Required before legal review.

Field Label: Final Approval

- Type: Checkbox

- Logic/Rules: Required to mark completion.

Transform your Workflow with AI fusion

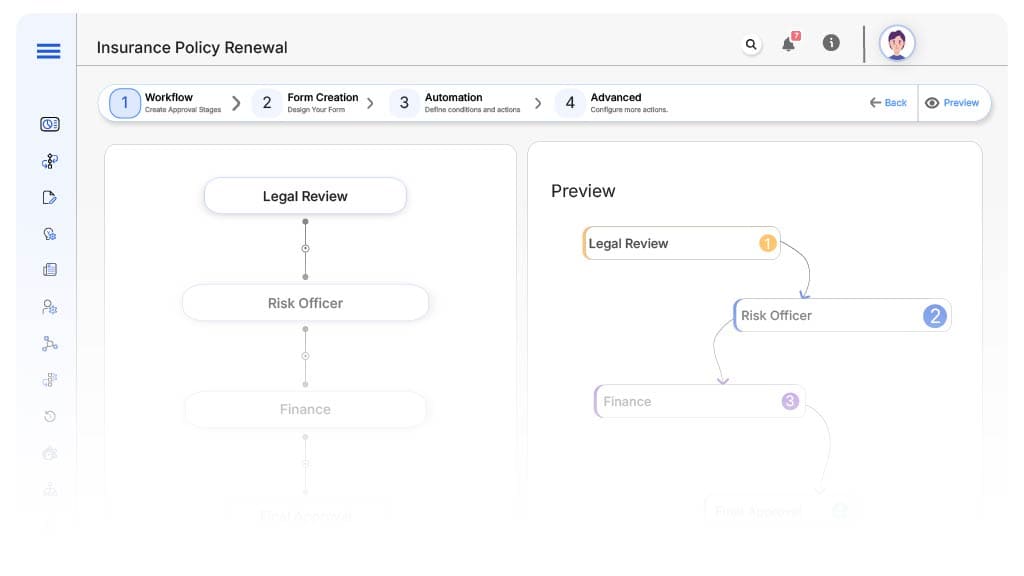

Approval Flow & Routing Logic

Submission → Legal Review

- Status Name: Pending Legal Review

- Notification Template: “New renewal request submitted for {Policy}. Please review legal terms.”

- On Approve: Routes to Risk Officer.

Legal → Risk Officer

- Status Name: Pending Risk Assessment

- Notification Template: “Review risk exposure alignment for {Policy} renewal.”

- On Approve: Routes to Finance.

- Escalation: Reminder after 2 days.

Risk → Finance

- Status Name: Pending Budget Approval

- Notification Template: “Validate budget and premium cost for {Policy}.”

- On Approve: Routes to Vendor Coordinator.

- Escalation: Reminder after 2 days.

Finance → Vendor Coordinator

- Status Name: Pending Vendor Confirmation

- Notification Template: “Upload insurer confirmation and finalized quote.”

- On Complete: Moves to Final Sign-off.

- Escalation: Reminder after 1 day.

Vendor → Final Sign-off

- Status Name: Final Sign-off

- Notification Template: “All renewal tasks complete for {Policy}. Confirm final approval.”

- On Approve: Moves to Renewal Complete.

Final → Renewal Complete

- Status Name: Renewal Complete

- Notification Template: “Policy renewal completed and archived successfully.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Set conditional logic

Save and publish workflow

Test

Adjust logic

Go live

Example Journey: Annual Health Policy Renewal

FAQ's

Yes. Routing logic can handle liability, health, auto, and other types from a single dynamic form.

Unleash the full potential of your AI-powered Workflow