Health Savings Account (HSA) Approvals

Why automate?

How Cflow Can Help Automate the Process:

Automated Eligibility Verification:

Cflow streamlines HSA application reviews by automatically verifying health plan details against IRS guidelines. This process ensures that only qualified applicants are approved, minimizing errors and speeding up approvals.

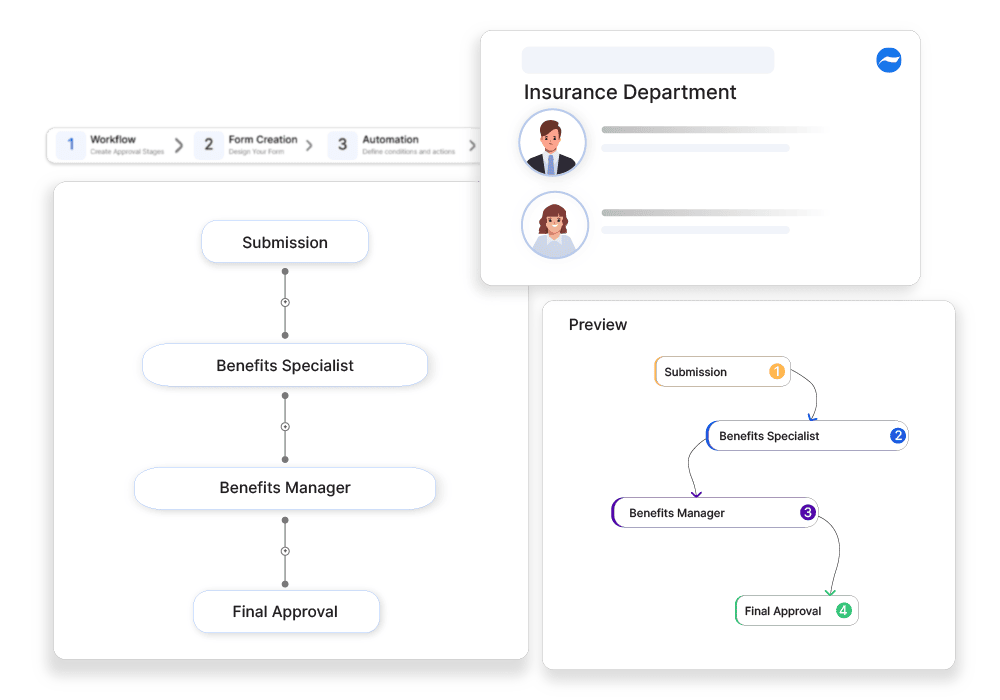

Customized Workflow Templates:

With Cflow, financial institutions, and insurers can design workflows tailored to their HSA approval process. These workflows handle tasks like document collection, eligibility checks, and account setup, ensuring every application is processed smoothly and meets regulatory standards.

Compliance and Regulatory Management:

Staying compliant with IRS regulations is critical for HSA approvals. Cflow includes built-in compliance checks to ensure every application meets legal requirements, reducing the risk of penalties or errors.

Real-Time Tracking and Reporting:

Cflow’s real-time tracking lets institutions monitor each step of the HSA application process. Managers can quickly resolve issues, keep approvals moving, and provide applicants with timely updates. This transparency improves efficiency and builds trust with account holders.

Frequently Asked Questions

What is an HSA approval?

A process that authorizes tax-advantaged savings for medical expenses.

What are the main challenges in HSA approvals?

Regulatory restrictions, contribution limits, and eligibility verification.

How can businesses ensure smooth HSA approvals?

By educating employees on HSA usage, ensuring policy compliance, and offering automated approval workflows.