- Cflow

- Process

Capital Expenditure Approval Automation

Clow Team

Capital expenditures (CapEx) are critical for business growth, long-term asset investments, and infrastructure upgrades. However, manual CapEx approvals often result in inconsistent evaluations, missed budget targets, delayed investments, and audit risks. Recent industry research shows that 68% of finance leaders cite fragmented CapEx approval processes as a key driver of project delays.

Without automation, department heads, finance controllers, CFOs, and executive teams struggle to validate business cases, align CapEx with budgets, apply multi-level approvals, and maintain full audit trails. This guide walks you through exactly how Cflow automates Capital Expenditure Approval Process, from submission to authorization.

What Is Capital Expenditure Approval Process?

The Capital Expenditure Approval Process governs how organizations review, evaluate, and approve large asset purchases, facility upgrades, equipment acquisitions, and long-term investments to ensure they align with financial goals and strategic priorities.

Think of CapEx approvals like long-term business investments , every request requires comprehensive justification, financial validation, and executive oversight before release of funds.

Recent industry research shows that automating CapEx approvals reduces approval cycles by 45% and improves budget adherence by 60%.

Why Capital Expenditure Approvals Matter for Organizations

Financial Control

Risk Management

Cross-Department Collaboration

Audit & Compliance

Try Cflow for free, no credit card needed

Key Benefits of Automating Capital Expenditure Approval with Cflow

- Centralized CapEx Request Portal : Cflow allows department heads and project owners to submit CapEx requests with required business cases, vendor quotes, and budget impact summaries, all in one centralized platform for finance and leadership visibility.

- Dynamic Routing Based on Spend Size : Cflow applies conditional routing rules based on CapEx category, project scope, investment size, and strategic priority to ensure appropriate reviewer involvement.

- Multi-Level Approval Workflows : Requests route through department heads, finance controllers, CFO, legal (if required), and executive board depending on investment scale and contractual obligations.

- Real-Time Notifications & Escalations : Automated reminders prevent delays in project approvals while escalation rules ensure urgent investments are not stalled.

- Vendor Quote Validation & Documentation : Cflow allows multiple vendor quotes, RFP responses, and supplier certifications to be attached for review alongside financial justification.

- Full Audit Trail & Budget Integration : Every CapEx request, revision, approval comment, and funding allocation is archived and fully auditable for financial reporting.

- Mobile Accessibility : Finance leaders, project sponsors, and executives can review, comment, and approve CapEx requests remotely, ensuring investment momentum is maintained.

Get the best value for money with Cflow

User Roles & Permissions

Project Owner (Initiator)

- Responsibilities: Submit capital expenditure request with business case, cost breakdown, and vendor proposals.

- Cflow Permission Level: Submit Form.

- Mapping: “Project Owners” group.

Department Head

- Responsibilities: Validate operational need, alignment with department goals, and resource availability.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Department Heads” group.

Finance Controller

- Responsibilities: Review budget availability, ROI analysis, and forecast impact.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Team” group.

Legal Counsel (Conditional)

- Responsibilities: Review contracts, vendor liabilities, and compliance risks (for large vendor agreements).

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Team” group.

CFO

- Responsibilities: Approve consolidated CapEx requests for financial governance.

- Cflow Permission Level: Approve/Reject.

- Mapping: “CFO” group.

Executive Leadership (Conditional)

- Responsibilities: Final sign-off for strategic or high-value capital projects.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board” group.

Discover why teams choose Cflow

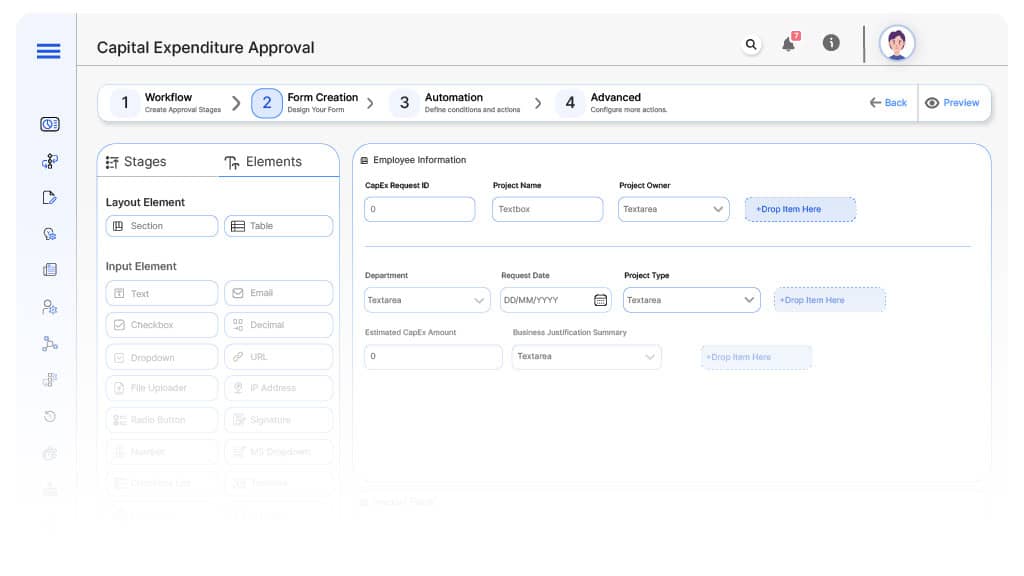

Form Design & Field Definitions

Field Label: CapEx Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Project Name

- Type: Text

- Logic/Rules: Mandatory.

Field Label: Project Owner

- Type: Dropdown (User Directory)

- Auto-Populate: From user profile.

Field Label: Department

- Type: Dropdown

- Auto-Populate: From user profile.

Field Label: Request Date

- Type: Date Picker

- Logic/Rules: Mandatory.

Field Label: Project Type

- Type: Dropdown (Facility Upgrade, Equipment Purchase, IT Hardware, Vehicles, Real Estate, etc.)

- Logic/Rules: Drives routing.

Field Label: Estimated CapEx Amount

- Type: Numeric Field

- Logic/Rules: Drives finance and leadership approvals.

Field Label: Business Justification Summary

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Vendor Quotes

- Type: File Upload

- Logic/Rules: Mandatory for finance and legal review.

Field Label: ROI Analysis Attachment

- Type: File Upload

- Logic/Rules: Required for finance controller.

Field Label: Finance Review Notes

- Type: Text Area

- Logic/Rules: Required for finance controller.

Field Label: Legal Review Notes

- Type: Text Area

- Logic/Rules: Required if legal involved.

Field Label: CFO Review Notes

- Type: Text Area

- Logic/Rules: Required for CFO approval.

Field Label: Executive Comments

- Type: Text Area

- Logic/Rules: Required for executive board.

Field Label: CapEx Approval Confirmation

- Type: Checkbox

- Logic/Rules: Finance marks allocation finalized.

Transform your Workflow with AI fusion

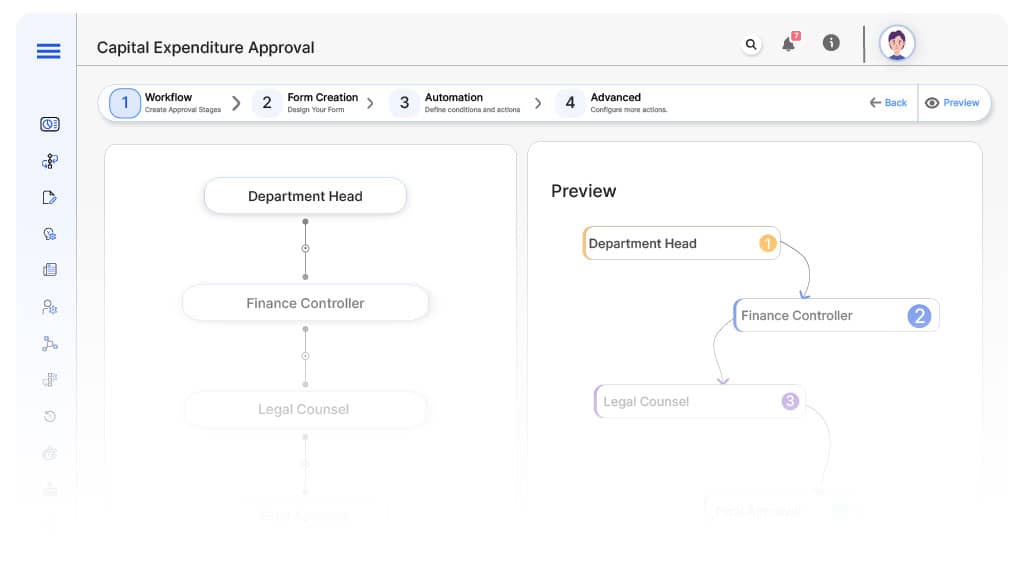

Approval Flow & Routing Logic

Submission → Department Head

- Status Name: Pending Department Review

- Notification Template: “Hi Department Head, new CapEx request submitted for operational validation.”

- On Approve: Moves to Finance Controller.

- On Reject: Returns to Project Owner.

- Escalation: Reminder after 1 day.

Department → Finance Controller

- Status Name: Pending Finance Review

- Notification Template: “Hi Finance, CapEx request requires budget and ROI validation.”

- On Approve: Moves to Legal Counsel (if applicable).

- On Reject: Returns to Department Head.

- Escalation: Reminder after 1 day.

Finance → Legal Counsel (Conditional)

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, vendor agreements require legal review.”

- On Approve: Moves to CFO.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Legal → CFO

- Status Name: Pending CFO Review

- Notification Template: “Hi CFO, consolidated CapEx request ready for financial governance review.”

- On Approve: Moves to Executive Leadership (if applicable).

- On Reject: Returns to Legal Counsel.

- Escalation: Reminder after 1 day.

Final → CapEx Approved

- Status Name: Capital Expenditure Authorized

- Notification Template: “CapEx request approved and funds allocated.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Manufacturing Equipment Acquisition

FAQ's

Setup typically completes within 5–7 business days.

Unleash the full potential of your AI-powered Workflow