What is Vendor Payment Process and How to Automate it?

Processing and paying vendor bills has been a hassle for big organizations for a long time. Beyond simply paying an invoice and meeting deadlines, the vendor payment process calls for security and careful consideration and can make the difference between having successful or unsuccessful supplier relationships. You can preserve a positive working relationship with your suppliers and vendors by making on-time vendor payments. Furthermore, business owners should never take the vendor payment process lightly as they are crucial to managing accounts payable. Every organization should have a thorough understanding of vendor payments and the reasons behind their importance for the efficient operation of an organization, as they represent the most significant step in the procure-to-pay process.

In this blog, we’ll discuss the importance of the vendor payment process, the steps involved in them, and tips to improve your vendor payment system.

What is Vendor Payment?

Vendor payment is the practice of compensating service providers or wholesale distributors for the products or services they have supplied to a company. the process by which the company makes the purchase and pays its suppliers for the products and services it has purchased. When the supplier shares an invoice, the payment procedure for the vendor begins. After that, the purchased item invoice is processed. After verification, vendor payment is made at the end of the process. Depending on what is accepted by each vendor, payments to vendors can be made by several different money transfer methods. Furthermore, vendor payments may be made on time or occasionally after the deadline, contingent on how quickly the company processes vendor payments.

These difficulties can be avoided with a carefully thought-out vendor payment procedure that doesn’t involve a lot of manual intervention. Furthermore, a well-designed payment procedure accomplishes more than only avoiding late costs. It facilitates payment cycles, increases accuracy, and even strengthens business ties. Every entrepreneur wins when their business is presented as dependable and professional, which is what happens with such a seamless payment process.

What are the Frequently Used Vendor Payment Methods?

Payment options for vendors include cheques, wire transfers, ACH payments, credit card payments, and virtual cards. An AP department’s choice of payment method is influenced by several variables, including price, convenience, vendor preference, and payment method security. However, checks continue to be the preferred method of B2B payment despite the many benefits of electronic payments. A 2021 State of the AP Report research found that 22% of AP departments stick to their current payment procedures since it’s how they’ve always done it. Given that accounts payable represent the final mile in the supplier relationship, companies stand to gain a great deal from more efficient vendor payment solutions that enhance their present workflows.

Over half of survey respondents cited supplier readiness to accept ePayments as a hurdle to the implementation of digital payments, according to the research. Simultaneously, 58% of participants expressed that the significance of supplier connections is increasing. This percentage rises to 74% among those who have witnessed a recent surge in automated vendor payments.

Importance of Vendor Payments Automation

Vendor payment is what you pay your suppliers for supplying the materials and labor needed to create the final product that your company will market. For this reason, your company has to have vendor management and vendor payment procedures in place if it wants to keep good relationships with its suppliers. The timely verification of the vendor’s invoice via the appropriate stages and prompt payment of the vendor is guaranteed by a methodical workflow process.

Therefore, your company needs a vendor management system to pay vendors correctly. Every company sets up a customized procedure or workflow called a vendor management system to make sure all of its vendors and the associated functions are suitably arranged. Using a logical approach to automatic vendor payments, you can also prevent interest and late payment fees. It also makes it easier for your company to run smoothly over time.

6 Steps in the Vendor Payment Process

1. Collecting the invoices from the vendor

Collecting the vendor invoice for the products and services that were purchased by the organization is the first step in any vendor payment procedure. The invoice may be received in a variety of formats and via several different ways. It can be transmitted via email or another communication method, or it can be delivered in person.

2. Verify invoice accuracy

Verifying the accuracy and authenticity of the vendor invoice comes next on the list of tasks. An invoice primarily includes the invoice number, the date it was issued, the due date, the vendor’s bank information, GST information, item specifications, quantities, and price.

Therefore, it is crucial to confirm all the information on the invoice before sending in payment. To verify this, the invoice is compared to other documents such as purchase orders, account statements, credit receipts, etc. Accurate verification is essential since sellers occasionally change the numbers on purpose or by accident.

3. Making journal entries and invoice account

The process of journal entry and invoice accounting follows the vendor payment procedure. The invoice is then recorded in the accounting records once its validity has been confirmed. Accounting invoices are completed in addition to the standard payment and debit entry processing to determine whether any withholding tax may apply to the payment.

4. Pay the tax to avoid penalties or additional taxes

Make sure you pay your TDS payment to the government by the deadlines stipulated in the Income Tax Regulations. Additionally, wherever relevant, disclose any such ITC on the GSTR-3B form that is reported on a monthly or quarterly basis.

Additionally, at predetermined intervals, reconcile GSTR-2A and GSTR-2B using the purchase register. Make sure the suppliers submit the invoices in their GSTR-1 and follow up if they have uploaded invoices for which you can make an ITC claim.

5. Get consent from the authorized person

The final stage before paying the vendor is obtaining authorization from the management or other designated individuals. When processing vendor payments manually, a member of the accounts payable team must personally obtain signatures from the managers. On the other hand, the system has an approval workflow if the procedure is automated. The invoice appears on the managers’ screens via this route, allowing them to approve it right away.

6. Proceed with the payment

Making the payment is the last step. Cash payments can be made in person or through bank transfers. Your company can make automated vendor payments with just one click by utilizing features like corporate cards and international vendor accounts that are included in an automated vendor management system.

Challenges of the Vendor Payment Process

Invoice inaccuracies and disparities

Errors and anomalies in invoices can cause payment process delays and uncertainty. These are a few of these problems:

- Inaccurate invoice information: Inaccuracies in the quantities, pricing, or terms of payment on an invoice might delay the processing of the invoice and the approval of payments.

- Similar invoices: Receiving bills that are the same could result in disagreements or overpayments.

- Missing or misplaced invoices: Payment delays and payment process disruptions may result from missing or misplaced invoices.

Absence of analytics and data visibility

The accounts receivable (AR) and accounts payable (AP) departments want methods for assessing their present efficacy and figuring out whether process modifications are enhancing those metrics. For instance, suppliers need to know indicators like Days Sales Outstanding (DSO) to effectively manage invoice payments, forecast cash inflow, and assist buyers in staying within their credit limitations.

Ineffective payment methods

Imagine keeping track of invoices and payments with manual sheets and book ledgers. Ineffective payment methods might indeed lead to mistakes and delays when paying vendors. For the generation of invoice templates, wholesale billing, invoice management, or purchase order templates, relying on human data entry and paper-based solutions raises the risk of errors and slows down the payment process.

It could be challenging for suppliers to get payments in a timely and easy way if you only accept a limited number of payment options or if your payment terms are rigid. Inadequate integration among eCommerce accounting, payment systems, and procurement can lead to misunderstandings and inefficiencies.

Intricate communication between suppliers and purchasers

Vendor data can be shared by payment methods, regular mail, phone calls, or email. However, if every vendor uses a different approach, buyers, and suppliers could have to track conversations manually and inaccurately, which could lead to several risk and fraud problems along the road. Maintaining an accurate and secure record of the most recent information can be challenging if recommended practices are not followed, whether due to hostile attempts or data-entering errors.

Challenging to optimize the combination of payment options

The preferred methods of payment for each vendor may vary and change over time. Due to the difficulties in collecting and processing checks, a lot of suppliers aggressively sought out ePayments in light of the pandemic and associated obstacles. This can require the AP department to manually manage and execute several distinct payment forms, which increases the work involved in paying vendors.

How to Improve the Vendor Payment Process?

Process automation

Automating your vendor payment process is the first step towards enhancing it. These days, many payment technologies and payment processing applications are available that can streamline corporate operations and improve employee productivity. Using technology can allow you to send out recurring payments and generate invoices automatically, which will satisfy your vendors and streamline the vendor payment process.

Give precise payment terms

Maintaining an open and effective vendor payment process requires clearly defined payment conditions. You may prevent misunderstandings and disagreements by outlining expectations and guidelines in advance, which will make the payment process go more smoothly for your company as well as your vendors.

Track and analyze payments

It can be beneficial to regularly audit and monitor your vendor payments to spot inefficiencies, mistakes, or possible fraud. You can stay on top of things and keep a healthy cash flow by being vigilant about your payment process.

Build a solid vendor network

Vendor relationships are becoming more and more vital for many firms, as this article has previously discussed. There is a possibility that any modification made by an AP department to its vendor payment procedure will affect the relationship, either favorably or unfavorably. Selecting the best AP automation supplier is essential.

Simplify the onboarding of vendors

Both the vendor and the AP department will find the vendor onboarding process simple with the help of appropriate payment automation technology. Strong supplier enablement begins with targeted onboarding during the new solution’s adoption and then moves into a continuous procedure.

While expediting the onboarding process for all new suppliers, a continuous onboarding strategy keeps the door open for current suppliers who may modify their payment preferences in the future. For firms to get the benefits, onboarding needs to happen fast and automatically. Additionally, companies can satisfy supplier payment process preferences while also achieving their objective of optimizing savings, security, and rebates. As a result, neither party experiences friction in the AP process and everyone wins.

Recover early payment discounts and cut expenses

Many AP departments have cost reduction as one of their main objectives, and AP automation can assist in a few ways. Firstly, the manual workload is reduced by AP automation technologies, freeing up employee time that could be better used elsewhere. Second, just like credit cards, virtual card payments, which are frequently a component of automated processes, often include cash-back rebates. Organizations can also more easily take advantage of early payment reductions provided by many vendors with the help of AP automation. Vendors want to get paid, and a lot of them are accustomed to payments arriving slowly enough that they reward early payers with incentives. The challenge for AP departments is to set up procedures that are effective enough to enable them to benefit from those savings if they so desire.

Lower the chance of fraud

Payment methods with lower fraud risk are made possible by AP automation, which also protects data. For example, it is far more difficult for fraudsters to take advantage of virtual cards that are only used once. To ensure least-privilege access, tools may make use of AWS bank-level encryption, two-factor authentication, audit trails, and fine-grained access controls. It is possible to process payments securely and maintain supplier payment process information with the help of additional strong internal controls and industry best practices.

Be aware of transfer costs, both within and between countries

Small expenses and even hidden fees can build up and eventually hurt your bottom line when moving money domestically or abroad. There are costs involved when transferring money between banks. This could take the form of a percentage of the transferred money, a fixed transaction cost, or perhaps both. This is the reason why selecting the appropriate payment service is crucial. The cost of goods increases, particularly when transferring money internationally. You should anticipate that foreign payments will be more expensive than local ones due to currency conversion rates as well as generally higher percentages and taxes.

Schedule your overseas payments for better conversion rates

Monitoring changing currency exchange rates is one of the difficulties that come with doing business internationally. As a result, you need to monitor both the potential cost of a transaction now vs later, in addition to the conversion rates for certain services. Companies should use timing to their advantage to maximize profitability, allowing payments to be made at the most economical times. Although keeping an eye on currency changes may seem difficult and time-consuming, Wise’s Auto Conversions tool makes it simple.

Conclusion

There are still a lot of business owners who have not digitalized or automated their vendor payment processes. It’s time to switch if you’re one of them. Automating operations and utilizing digital payments has several benefits, including easy transactions and simple procedures. Examine the benefits and drawbacks of each vendor payment option before dividing on and putting it into place in your company. Make sure the approach you choose closes the gaps and outperforms your current system for paying vendors. Additionally, be sure the solution you select is the most appropriate for your business and includes a variety of features.

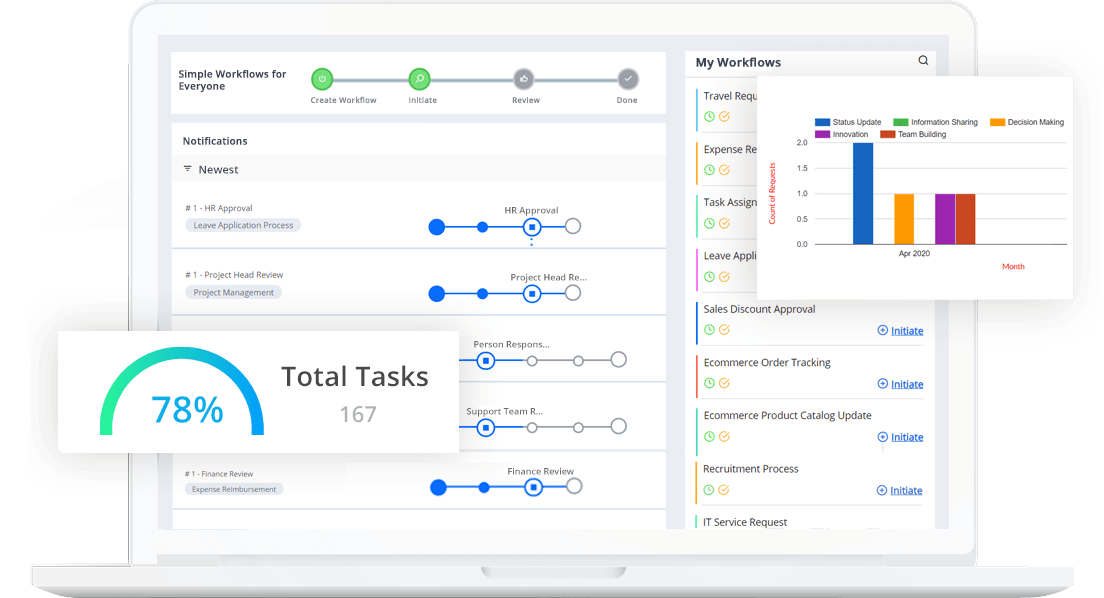

Cflow is a complete workflow automation solution that offers the highest levels of processing security, quality, and speed. Features include real-time AP analytics, payment authorization, execution, and optimization, as well as invoice collection and approval. Increase efficiency and improve supplier relationships with Cflow while maximizing the benefits of B2B payments through continuous supplier enrollment and payment assistance.

Sign up here to automate your business payment process with Cflow!