A Comprehensive Guide to Optimizing the Accounts Receivable Process

The lifeblood of an organization is a steady flow of cash. The accounts team is in charge of tracking and collecting dues on time. Improper or delayed accounts receivable management mainly due to manual processing, leads to severely clogged collections.

In the era of an evolving financial landscape, the switch over from manual to automated accounts receivable process must be considered for seamless accounts receivable management. Let’s further explore accounts receivable procedures, the need to automate the accounts receivable collection process, and best practices in the accounts receivable process.

What is the Accounts Receivable Process?

If you are involved in finance or run a business, you know very well that accounts receivable isn’t merely a line item on your balance sheet. It is essential to maintaining a healthy cash flow, which is crucial for the sustainability of the business. Managing accounts receivable effectively can be quite challenging with issues like delayed payments, reconciliation errors, etc.

All the outstanding invoices your company has to process, which is essentially money owed to you, come under the scope of accounts receivable. Accounts receivable represents revenue that has not been earned yet. It is an asset on the balance sheet that you will want to convert into cash as quickly as possible.

A thorough understanding of the accounts receivable process is essential to optimize and streamline accounts receivable procedures in an organization. What is the accounts receivable process? The accounts receivable is the money owed to your business when the customer purchases a service or product.

The account receivable serves as an IOU until the payment is processed. The accounts receivable process is a structured sequence of actions that a company undertakes to invoice clients, monitor payments, and ensure the collection of funds owed for the products or services delivered to customers.

The account receivable process is not a standalone activity, rather, forms the vital link between sales and revenue. Smooth flow of accounts receivable processes ensures that business transactions are not just initiated but also successfully concluded through on-time payments. This seamless conversion from sales to actual revenue is what keeps the business financially healthy and capable of sustained growth. While collecting payments and recording revenue may seem a simple task, in practice, the collection process is anything but linear and simple. The accounts receivable process has its fair share of complications and exceptions, involving plenty of back and forth between AR teams and their customers. Key tasks in the accounts receivable process flowchart would include –

- Sending out invoices

- Managing collections

- Processing payments

- Matching invoices to payments, and posting them to the enterprise resource planning system

Each of these processes can be a highly involved process in its own right, especially when the AR team still uses manual workflows.

How to do accounts receivable transactions efficiently?

Doing away with manual processing is the first step to improving the efficiency of the accounts receivable process.

Importance of the Accounts Receivable Management

The accounts receivable function is the cornerstone of financial stability and growth in the B2B sector. Efficient management of accounts receivable not only helps the business maintain a healthy cash flow but also supports risk mitigation, customer relationships, and strategic decision-making essential for long-term success. If a company has receivables, it means that a sale has been made but money has not yet been collected from the buyer. A majority of companies operate by allowing a portion of their sales to be on credit, offering clients the ability to pay after receiving the service.

Most businesses operate by allowing their clients to buy goods on credit. The cost of sales on credit is referred to as Accounts receivable. While accounts payable is the debt the company owes to its suppliers, accounts receivable is the debt of the buyers to the company. Accounts receivables are important assets to the firm, and they need to be offered to customers to choose their products over the competitor’s products.

Steps in the Accounts Receivable Process

Understanding how the accounts receivable process works can be done with the help of an accounts receivable process flowchart. The following steps make up the accounts receivable collection process.

1. Customer creates an order

When the customer expresses their intent to purchase a product or service, they create a purchase order that describes their requirement. When the business receives the purchase order, the data is reviewed and approved by the business. An approved PO forms the basis of the sales order. A sales order is a binding agreement with the customer that covers the following –

- Goods and services that are being sold to the customer

- Quantity and price of goods and services

- Delivery date and location

- Terms and conditions of the sale

The credit manager or the credit department needs to review and approve the sales order before sending it to the customer.

2. Approval of customer for credit

When an account is sold, the seller agrees to extend credit to your customers and collect payment later. Most business-to-business transactions are made on account. Giving credit to the customer brings with it an inherent risk of bad debt or delayed invoice payments, businesses need to find new ways to assess creditworthiness before fulfilling the order. The credit application process takes care of assessing the creditworthiness.

Every business requires a documented credit policy that is required for assessing customer’s credit. The risk tolerance of your business depends on the business size, margins, and current cash flow. While assessing, if you discover that the customer isn’t fit to receive credit, then you might arrange alternative payment terms like cash on delivery.

3. Sending the invoice

An invoice provides complete details on the customer’s purchase order – like how much they owe, and by which date/time they need to pay. The time/date by which the customer has to pay depends on the specific credit practices. It could be 30, 60, or 90 days. In case there is an additional charge for late payments, it is important to mention this clearly in the invoice. Invoices are usually created by customers through ERP or Microsoft programs, and delivered to customers via email, electronic data interchange, or regular mail.

4. Managing collections effectively

Late payment of invoices is inevitable in any business. To increase the chances of collecting unpaid invoices on time, it is important to have the collection staff follow up with customers at regular intervals. Some of the timeframes for carrying out their collections are –

- Less than 7 days past due – Give a gentle reminder to the customer

- 8-14 days past due – Reach out to the customer for the second time

- 15-30 days past due – Reach out to the customer for the 3rd time, and also inform them that late payment fees might kick in

- 31-45 days past due – Contact the customer for the 4th time, in case the request is still unsanctioned a final letter can go out.

- 46-60 days past due – Continue outreach every 5 business days

- 61-90 days past due – If the request is still unsanctioned at this point, the senior management, legal counsel, or a collection agency should be involved for help in pursuing the debt.

Before the outreach for collections is begun, the reason for late payment should be determined. In some cases, the reason for late payment could be internal errors. Internal errors could be that the invoice was never sent or the discount promised to the customer wasn’t reflected in the invoice. It is also a good idea to review the customer’s payment history before getting to the outreach stage.

5. Monitoring and addressing any existing disputes

Disputed invoices are among the biggest causes of late payments. Whenever there are any disputes in an order, the customer would like to resolve them before releasing any funds to you. Disputes in invoices may be due to human error issues with delivered goods/services discrepancy between POs and invoices, or communication issues. Customers may sometimes pay a portion of their invoice (short payment), which adds another layer of complexity for the accounts receivable team. Investigation of the dispute must be started promptly to prevent delayed payments.

6. Writing off uncollectible debt

As time goes on, the chances of collecting outstanding invoices decrease. When all the outreach efforts have been exhausted and you determine that the payment is uncollectible, then the payment is written off as bad debt. Based on accrual basis accounting, companies plan for a certain portion of their accounts receivable to be uncollectible by setting aside a budget for doubtful accounts.

The point at which the decision is taken that the invoice is uncollectible depends on the industry. In industries like transportation and logistics, sales outstanding days above 50 days are considered normal. So, if late payments are common in your line of work/industry it makes sense to wait it out before you write it off as bad debt.

7. Processing the payment

Payment of invoices is done in several ways, such as, –

- EFT or ACH

- Wire transfer

- Debit, credit, or virtual card

- Cheques

A payment gateway or a payment processor and at least one merchant account are needed to process online payments from customers. Moreover, the sales platform must support e-commerce or self-service customer payments. It is a good idea to opt for payment service providers that provide all of these facilities as a single offering.

Most B2B businesses continue to indulge in substantial volumes of paper cheques. Paper cheques are managed by opting for lockbox services.

8. Posting the payment into corresponding invoices

Once a payment is received, then the accounts receivable process moves to the cash application stage. At this stage, you will be recording the revenue into the accounting software. When a payment cheque comes in, it will be recorded in the accounting receivable ledger as credit, and the amount will be deducted from the remaining unpaid receivables.

The payment information must be accurately matched with the right invoices and any relevant credits or discounts must be recorded before closing the receivable in the system. In some cases, AR staff will need to reach out to the customer for clarity on how they should apply their payment.

9. Reporting status of AR

At the month-end closure, the finance team will check that they have recorded all the transactions and noted the closing balance of all general ledger accounts into a trial balance. The frequency of reporting collections depends on the size of the company. Once a month is a good time frame to aim for to report AR aging reports. Several metrics help assess the health of the accounts receivable function. Some of the metrics include- Day Sales Outstanding, Customer Satisfaction, Revised invoices, Collective Effectiveness Index, etc. Choose the KPIs that are relevant to the way your business operates for effective tracking of AR function performance.

Traditional versus Modern Accounts Receivable Process

The accounts receivable landscape has undergone a sea of change over the years, especially with the introduction of automation technologies. Traditional methods that have been followed for decades are not capable of scaling up to increasing consumer demands. Knowing the differences between traditional and modern AR systems would help in making the right decision to automate the AR process.

| Attribute | Manual AR | Automated AR |

|---|---|---|

| Invoicing | Manual invoice generation and dispatch | Invoices are automatically sent out through invoicing systems |

| Collections | Manual follow-up and tracking of due accounts | Dunning and past-due tracking is done automatically |

| Processing payments | Manual data entry, prone to errors | Automated payment gateways for processing |

| Record-keeping | Physical records or basic digital records | Real-time, accurate record keeping that is cloud-based |

| Cash reconciliation | Time-consuming, tedious manual reconciliation | Reconciliation is automated and provides real-time updates |

| Error handling | Manual data entry leads to high error rates and a lengthy correction process | Automated error detection leads to lower error rates and correction times |

| Scalability | Requires increased manpower when the business scales up | Effortless scaling to growing business needs |

| Compliance and security | Higher risk of non-compliance due to manual updates | Enhanced security features and automated updates result in 100% compliance |

| Customer experience | Limited self-service options for customers | Improved customer portals and self-service options for customers |

| Reporting and analytics | Manual-generated basic reporting | Real-time reporting and advanced analytics for deeper process insights |

The above comparison puts automated accounts receivable processes in the limelight. The advent of automation technologies has revolutionized the accounts receivables landscape. Implementing automation technologies can streamline operations, minimize errors, and improve customer satisfaction greatly.

AR Processes that Can be Automated

In manual AR processing, you need to sift through piles of paperwork to see how much payment is pending and review any other notes on each customer between invoicing and payment. Not all tasks in the accounts receivable process can be automated. You need to choose processes that are tedious, repetitive, and time-consuming, for automation. Automation of such processes yields better outcomes.

Customer Outreach

Nothing can be more unnerving than following up on customer payments. Some customers may respond promptly to follow-up, while others may simply ignore messages. Automation can help generate and send emails or text messages to customers a week before payments are due. The automation software can be configured to send repeated emails or reminders at preset intervals until payment is received. What’s more! Emails and text messages can be tailored to each customer.

Payment processing

Collecting payments is faster and more efficient when done digitally. Digital payment channels are easy to set up and help maintain a steady cash flow as well. Such payment platforms enable customers to set up auto-recurring payments and other options that make payments easy and time-bound. Automated clearing house (ACH) payments or peer-to-peer payment apps are examples of how digital payments make AR processes more efficient.

Invoicing

Receiving funds on time is the main aim of the accounts receivable process. With AR automation, these invoices get generated automatically and are delivered to customers within seconds. Wherever VAT or sales tax is applicable, the automated system identifies the applicable tax rate for each transaction to ensure the correct amount is collected.

How AR Automation Streamlines the Process?

The advent of automation technologies has altered the way accounts receivable processes are carried out. Automation of accounts receivable procedures offers a host of benefits that streamline operations, minimize errors, and improve customer satisfaction. Here are the key benefits of automating the accounts receivable collection process.

1. Faster invoicing

Automation allows for almost instant generation and dispatch of invoices once the order is confirmed. The confirmation of the invoice can be provided via email, EDI, or even traditional mail. Automation not only speeds up the invoicing process but also sets the stage for quicker payments.

2. Automated collections

Manual follow-ups of overdue payments are not efficient, especially at scale. Automation of the AR process takes care of the entire collections management workflow, from segmenting customers to auto-sending correspondences to prioritizing accounts. This significantly reduces the time and effort required for collection follow-up.

3. Accurate record keeping

When the accounts receivable process is automated an accurate record of all the transactions is maintained. Not just accurate recording, but real-time updates on all the transactions are provided to all users. This is beneficial for cash reconciliation, wherein payments are automatically matched with the invoices, even in cases where remittance information is missing or incomplete. This ensures that records are always accurate and up-to-date.

4. Real-time payment processing

Automated payment gateways enable real-time payment processing, which means that records are instantly updated and cash flow is improved. An automated system also supports multiple payment methods, like ACH, wire transfers, and credit cards. Both you and your customers are provided with flexibility through automated AR systems.

5. Improved customer experience

Customer experience is greatly improved by automating the AR process, which offers self-service options and instant pre-built responses. Customers can view the status of invoices, and raise disputes or queries, through automated customer portals.

6. Advanced reporting and analytics

Automation provides advanced reporting features and predictive analytics that help forecast cash flows, analyze customer payment behavior, and even predict potential bad debt. Armed with advanced analytics, the management and leadership team can make data-driven business decisions.

7. Reduce costs

When manual labor and errors are reduced, the costs associated with them are also reduced proportionally. The initial investment involved in setting up the automated system is quickly offset by the long-term cost benefits of reduced manual labor.

Best Practices in Accounts Receivable Process

How to streamline the accounts receivable process? We have put together a set of best practices that will guide you on how to process accounts receivable.

Integration of tech stack with existing system

When the business decides to adopt accounts receivable automation, the first point to be borne in mind is how well the automation tool will integrate with the existing tech stack. If the answer is negative, then it might result in more time and cost in automation implementation. It is important that the tool integrates seamlessly with the existing tech stack so that –

- You can cut down on mundane work by syncing invoices, payments, credit notes, and more, automatically

- You can get real-time visibility into expected revenue, and a single source of truth for all AR data

- You can gain actionable insights into recovering failed payments and prioritizing collection efforts

- You can automate payment reminders with smart engagement rules for a seamless customer experience

Incentivize advance payments

Payment conditions should include incentives for customers who make early payments. The software must allow you to offer early or upfront payment discounts. For example – the software must include the “Pay Early” option for users who do not want to wait for the last date for payment.

Enable a seamless payment experience

A smooth payment experience holds the key to automating the invoice-to-cash cycle. Additionally, the payment gateways should be integrated into billing and receivable software.

Enable quick dispute resolution

Disputes are among the most common causes of non-payments and rising DSOs. They need to be monitored closely to understand the reasons for them and try to resolve them as soon as possible and avoid delayed collections.

Establish a robust dunning mechanism

Dunnins is a mechanism for systematically communicating with a customer to guarantee collections. The software must provide smart auto-engagement features that help handle failed payments and involuntary churn.

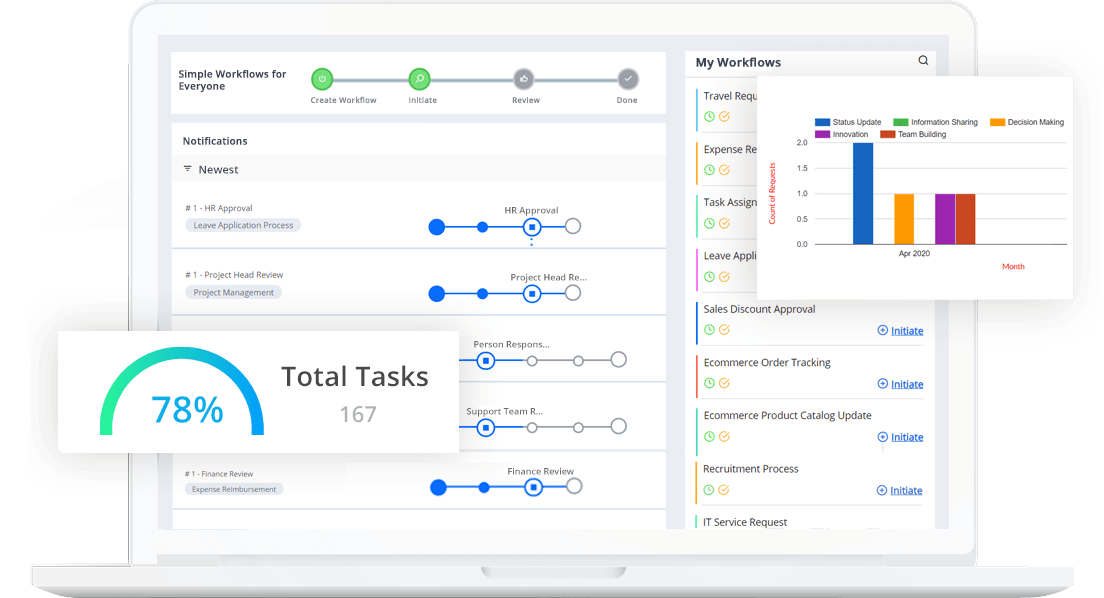

Streamline your Accounts Receivable Process with Cflow

The importance of the accounts receivable process in ensuring a steady cash flow cannot be undermined. Automating the accounts receivable procedures is the most effective way to ensure that payments are received on time, and payment dues are followed up diligently. Automating the accounts receivable workflow requires a robust, fully customizable automation software like Cflow.

The visual form builder in Cflow can be used to create automated accounts receivable workflows by simply moving the visual elements. Advanced reporting and analytics feature in Cflow enables leadership and management to stay updated on the status of pending payments. Bid goodbye to outdated, paper-based accounts receivable procedures with Cflow.

Ready to take Cflow for a test drive? Sign up for the free trial to explore no-code workflow automation.