Credit Management Workflows: Automate Approvals from Credit Initiation to Credit Decision!

A Deloitte report says that “About 60% of businesses are increasing their investment in credit risk management technology to improve efficiency.”

Today’s businesses are more strategic and cannot be effectively managed using methods and techniques from the past. Credit management is ever-changing and businesses look for high-tech solutions that will help them mitigate financial risks. Organizations expend a considerable amount of effort and time on credit risk management and credit management workflows do wonders here.

As a response to increasing regulatory constraints, investor demands, and emerging competition, creditors need to prioritize automation in order to remain competitive. Automation allows for more efficient processes, more accurate risk assessments, and faster decision-making, leading to improved efficiency and cost savings for businesses. Nowadays, customers also require more intricate and tailored financial solutions that enable quick decision-making and appropriate risk premiums.

Manual credit risk management procedures should be swapped for digitized ones as there is a wide range of cutting-edge technologies (credit management workflows) that can significantly improve risk assessment. This article digs deeper into the key considerations, importance, and challenges involved in credit management. This write-up also throws light on how automated workflows tackle associated risks and keep businesses ahead of the curve.

What is Credit Management Workflow?

Credit operations are always complicated and are prone to risks and any tool that mitigate these risks is indeed welcomed. Credit management workflow refers to the set of processes and procedures that a company or organization follows to manage its credit operations. The goal of the digital credit management workflow is to ensure that a company’s credit policies and procedures effectively minimize credit risk while maximizing sales and revenue. Credit risk management workflow typically entails:

- Assessing the creditworthiness of potential customers,

- Establishing credit limits and payment terms,

- Monitoring customer accounts for timely payment, and

- Managing delinquent accounts.

The credit management process also includes credit scoring, collection procedures, credit reporting, and other related activities. These risk mitigators should also be able to judge the credit risk capacity of the business and analyze individual borrowers’ risks and their instinctive understanding of default risks. Such tools and techniques aid businesses from losing money and form a multi-level process called a credit management system. The credit management process leverages automation technology to evaluate and mitigate risks.

Why Is Credit Management Important?

Imagine a closed business deal, even after the purchase is done via credit – doesn’t progress with the payment for a fulfilled order on a payment date. Just because of the poor credit management setup. This ascertains the importance of a good credit management system.

Good credit management is essential for any successful business. When done correctly, it can help maintain a steady cash flow, minimize lost revenue, and ensure that any customer payments are received on time.

Poor Credit Management = Suffering Cash Conversion

Credit management workflows are one of the most important tools available to businesses for achieving these goals:

- Expanded sales for the business

- Increased customer base

- Encouraged purchase activities with increased payment options

- enhanced customer trust with the customer

- A loyal customer base enriches your business and competitive ends

The need to automate and digitalize large parts of the credit workflow has become even more critical in an environment that has seen significant changes and disruptions. Credit management workflows can help credit departments to adapt to the changing environment by providing reliable and consistent credit processes. Furthermore, automation and digitalization can help to ensure that credit departments can continue to offer competitive credit pricing even in a volatile market.

Key Areas In Credit Management

The credit management process is a crucial aspect of financial management for any business, and it involves a range of activities and processes aimed at ensuring that a company’s credit policies and procedures are effective and efficient. Some key areas for credit management include:

- Credit Policy Development: This involves developing a set of guidelines and procedures for extending credit to customers, including credit limits, payment terms, and credit application processes.

- Credit Analysis: This involves assessing the creditworthiness of customers through a review of their credit history, financial statements, and other relevant data to determine their ability to repay credit.

- Credit Monitoring: This involves tracking customers’ payment patterns and identifying any potential issues with their credit accounts, such as delinquencies or defaults.

- Cash Flow Management: This involves managing the collection of overdue payments from customers, including establishing payment plans, negotiating settlements, and taking legal action when necessary.

- Risk Management: This involves identifying and managing the risks associated with extending credit to customers, including credit risk, market risk, and operational risk.

- Reporting and Analysis: This involves generating reports and analyzing data related to credit management activities, such as credit utilization rates, customer payment patterns, and collection performance.

Challenges in Manual Credit Management

Credit management can be daunting in financial management for businesses. Some of the key challenges that can result in inaccurate credit decisions, delays in credit decisions, and increased credit risk are listed below.

Delayed Payment and Bad-Debt Impacts:

The risk of customers defaulting on their credit obligations can be a significant challenge for credit managers. This can result in losses for the business and can impact cash flow. Delayed payments are as adverse as bad debts if the customer is not reliable. Delayed payments results in days sales outstanding (DSO) which is a measure of effective credit management in an organization. Increased DSO represents that your business cash conversion is badly affected.

Managing Collections and Customer Relationships:

Credit managers need to balance the need to extend credit to customers with the need to protect the company’s financial interests. This can be challenging, particularly when customers are experiencing financial difficulties.

- Credit adjustments and bad credit (customers opting for different payment modes), though creating goodwill among customers are risky.

- Collecting overdue payments from customers can be a challenging task. Credit managers need to have effective collections strategies in place, while also maintaining positive relationships with customers.

Compliance:

Credit managers must ensure that their credit management practices comply with relevant regulatory requirements, such as those related to debt collection practices. This is more challenging when customers are financially unstable.

Technology:

Credit management processes often involve a significant amount of data processing and analysis. Credit managers need to have access to reliable and efficient technology systems to manage this data effectively. Staying up to date with the trends is the key to good credit management.

Economic Conditions:

Economic conditions can impact the creditworthiness of customers and the overall demand for credit. Credit managers need to be able to adapt their strategies to changing economic conditions to manage credit risk effectively. The outbreak of covid-19 is a good example of a case where customers suffered to repay debts and the government redefined credit policies as customers can avail of loan/interest waivers.

Manual credit management can be time-consuming and can lead to inconsistent credit risk evaluation when handling a huge volume of varying credit criteria. Inaccurate and delayed credit decisions are common with manual credit management. This can result in inadequate credit monitoring which makes it difficult to identify the potential problems and their solutions.

How Workflow Automation Benefits Credit Management

Automating your credit management process can bring several benefits to your business. Automation of the credit workflow is essential for credit departments to remain competitive and successful in today’s environment. Credit risk management workflow can help to reduce operational expenses, speed up credit decisions, and ensure accurate credit pricing for customers and counterparties. Through digital credit management workflow, credit departments can ensure the long-term success and sustainability of their functions.

Some of the key benefits are

Increased Accuracy:

Automating credit management processes helps to eliminate errors that can occur when using manual processes. This can result in more accurate data and better decision-making. Automation of credit risk workflows can also help to reduce operational costs. By automating the process of collecting customer data, businesses can reduce the amount of manual labor associated with the credit risk management process. This can help you reduce operational costs and improve your business’s bottom line.

Faster Processing:

Credit management workflows can accelerate the time it takes to process credit applications and approve credit limits. This can help to improve customer satisfaction by providing a faster turnaround time for credit applications. It can also help you keep track of customer payments more easily and efficiently. Additionally, automated invoice systems can help you manage customer payments more accurately, improving efficiency.

Better Risk Management:

Automated credit risk management workflows can help to identify potential risks early, allowing you to take appropriate actions to mitigate them. This can help to reduce the risk of bad debt and improve cash flow. Credits and risks perform in tandem and managing them effectively ensures businesses’ long-term stability. Credit risk management processes involve the evaluation of a customer’s creditworthiness. This process usually includes gathering customer data, analyzing the data, and making decisions about the creditworthiness of the customer.

Improved Communication:

Digital credit management workflows can help to improve communication with customers by providing real-time updates on credit applications and payment status. This can help to improve customer satisfaction and reduce disputes.

Enhanced Reporting:

Automated credit management workflows can provide detailed reports on credit applications, approvals, and payment history. This can help to improve decision-making and identify areas for improvement. Digital credit management workflow facilitates features like automated KYC without compensating the personalized customer experience. This speeds up the credit management process improving credit decisions to a greater degree and these systems spice up the process with personalized services.

Reduced Manual labor & Time:

Automating your credit management process can help you save time, money, and resources. By automating your workflow process, you can minimize the manual effort involved in debt collection and invoice processing. Automation tools like automated invoice systems, automated payment reminders, and automated debt collection processes can help reduce the time taken to complete repetitive tasks.

Reduced Manual Errors:

Automation also helps to reduce errors as it eliminates manual data entry and ensures that all information is accurate. This helps in improving customer experience as well as reducing operational costs. Automating credit management processes reduces the manual workload, thereby allowing your staff to focus on more important tasks. This can save time and reduce errors associated with manual data entry improving accuracy and better decision-making.

Personalized Customer Service:

By automating the process of collecting customer data, customers can also benefit from processing times. Thus, digital credit management workflows can help customers to access the funds they need more quickly and easily. Additionally, self-credit evaluation is easy if they know their credit history.

Credit Risk Management:

The automation of credit risk workflows can also help lenders to reduce the amount of time required to process loan requests. By automating the verification and evaluation of loan applications, lenders can reduce their processing time and increase their loan approval rate. Additionally, digital credit management workflows can help businesses stay ahead of fraud and any other risks.

Five Must-Have Credit Management Approval Workflows

As businesses of all sizes start to take advantage of digital transformation and streamline their processes, workflows become an increasingly important consideration. Credit management has been a routine task in organizations and streamlining it is important for any organization to improve credit efficiency. Here are a few workflows that are globally recognized by credit and A/R professionals as a must-have in an organization looking for an optimized credit management system.

1. Credit Application Workflow:

This workflow establishes a streamlined process for credit applications, including gathering necessary financial information, performing credit checks, and assessing creditworthiness. This process should also include establishing credit limits and terms for approved customers. By cross-referencing the applicant’s information against a database of known fraudsters, the workflow can help identify suspicious applications and reject them before any funds are disbursed. The general outline of credit application workflow involves:

- Application Submission: This workflow originates with the credit generation when a credit application is submitted. The individual submits a credit application, either online or in person, providing information such as their name, contact details, income, employment status, and credit history. The credit application workflow captures these data and utilizes them in adjusting or extending credit lines. The reports on these data do the credit reports for the customer and are usually validated by the credit analysts.

- Application Review: The credit provider reviews the application and verifies the information provided by the customer. This may involve checking the borrower’s credit report, income documents, and employment history. The analysts gather information from external credit rating agency sites and are validated for correspondence with internal business teams.

- Credit Score Calculation: The workflow calculates the borrower’s creditworthiness based on their credit score, debt-to-income ratio, payment history, and other factors. This helps the lender determine the borrower’s ability to repay the loan. Based on the defined rules, the workflow assigns a credit limit for the customer which will be directed to a credit analyst for missing information otherwise.

- Credit Decision: Based on the credit analysis, the workflow makes a decision on whether to approve or deny the credit application. If approved, the designated authority will also determine the loan amount, interest rate, and repayment terms. The decision depends on the credit score and also abides by the credit policy.

- Notification to the Stakeholders: The stakeholders must be notified to make regular payments to repay the loan according to the agreed-upon terms by the workflow. This may involve making monthly or biweekly payments over a fixed period of time. There is a notification for credit analysts too to change the status of the customer request.

- Account Setup: If the credit application is approved, the credit organization disburses the loan amount to the individual, either as a lump sum or in installments. The account setup involves customer onboarding which requires sensitive data transfer from both ends. Investing in a tool/ workflow that facilitates features like pre-defined rules that are also customizable according to the credit scoring and e-signatures would make the process hassle-free.

- Monitoring: Throughout the credit application workflow, the creditor may communicate with the borrower to request additional information or clarification on certain aspects of the application. It’s important for both the borrower and lender to maintain open lines of communication to ensure a smooth and efficient credit application process.

By implementing a credit application workflow, a company can ensure that new customers are properly vetted and credit risks are effectively managed. This can help to minimize bad debt and improve the overall financial health of the company.

2. Blocked Order Workflow:

This workflow aids organizations to manage orders that have been blocked due to various reasons, such as credit issues, inventory issues, or compliance issues. Here is a general outline for a blocked order workflow:

- Identify the Blocked Order: An order blocked might encompass various reasons and identifying one manually is wrecksome. Workflows work wonders here. A trade order getting blocked can be a nightmare for any business and this workflow makes tracking them easy-breezy. Orders that cannot be fulfilled immediately are identified and flagged for further action.

- Determine the Reason for the Block: A blocked order workflow is a process used to manage orders that cannot be fulfilled immediately due to certain issues or constraints. These issues could be related to the customer’s credit limit, payment history, or any other factor in the customer portfolio that prevents the order from being processed.

- Notify the Customer: Credit limits exceeding orders are generally blocked by workflow to prevent fulfillment. The customer is notified of the issue automatically and provides an alert to the credit analyst with the corresponding details. If there are any alternative options available, such as a partial release or a substitute product, the customer is informed of those options as well.

- Resolve the Issue: The reason for the blockage is investigated, and appropriate actions are taken to resolve the issue. The blocked order workflow resolves the identified block reasons automatically by performing an instant review of the portfolios, past payments, or other payment attributes. For example, if the order is blocked due to delayed payment issues, the workflow routes a notification to the analyst to revise the case to resolve the issue.

- Release the Order: The credit analyst revises the blocked order case and sometimes can manually release the order based on the creditworthiness of the customer (based on his repayment history and other attributes). The approval part is facilitated by the workflow with the corresponding information flow. There may also be instances where the credit authority can route the collection team to recover pending payments and free up the credit limit of the customer.

- Monitor For Future Block: Credit management is all about a constant race of cash flow in and out. Workflows are known for their continuous contribution to making an impact in such fields. The blocked orders are tracked to ensure that the issue has been resolved. If there are any further issues or delays, the customer is notified promptly and provided with updated information. This foretells the customer to maintain his payment history fairer.

Regular reviews of the blocked order report can help identify any systemic issues and help improve the overall credit management in an organization to be in place.

3. Credit Limit Review workflow:

A credit limit review workflow regularly reviews and reassesses the credit limits of your customers based on their payment history, financial stability, and other relevant factors. This workflow process can help you identify potential credit risks and adjust your credit policies accordingly.

- Identify Customers for Review: The first step in the credit review process is to identify the customers to be reviewed. Credit scores are prone to change and a one-time review of the credit limit does not help, and there could not be a better way to get doomed in credit management. This workflow helps identify the creditworthy customers giving you an assurance that your business is on the safer side/optimum risk. This workflow automatically fetches the customer accounts to be reviewed and lists them in the analyst workspace panel.

- Gather Information: The workflow collects data on the customer’s credit history and financial situation. This may include credit reports, financial statements, tax returns, and other relevant documents. The workflow also has backup data so that the customer portfolio is always matched with the extended/ adjusted credit limit.

- Review Information: Once the data has been collected, it is analyzed to determine the effective payment modes for the customer. This analysis may include a review of multiple aspects like the arrear details, average payment, past the due date, average days to make payment, open item values, and other payment-relevant factors.

- Risk Assessment: Based on the analysis, a risk assessment is conducted to determine the level of credit risk associated with the customer. This assessment may involve assigning a risk rating or score to the customer. The workflow gives insights into the maximum credit limit and categorizes the risk associated with the limit accordingly. The credit review workflow assesses the risk in terms of checking for collateral expiry and realigning the portfolio of the customer, thereby reducing the overhead costs. If there is a collateral expiry, the subsequent process is directed and taken care of by the collateral expiry workflow, discussed in the section below.

- Make Credit Limit Decision: Based on the risk assessment and references from credit reports, income/insurance statements, and bank guarantee reports, the workflow makes a decision on the customer’s credit limit. After a few validation checks, the workflow decides whether to extend credit to the customer or not, and if so, the terms and conditions of that credit. This decision may involve setting credit limits, adjusting payment terms, credit realignment, or taking other steps to mitigate risk.

- Notify Customer: The workflow notifies the customer about the modified credit limit and the pertaining credit score and the risk category they fall into. The workflow thus aids in simplifying the convoluted tasks in credit management making it easy for businesses to meet regulatory compliance requirements.

- Update System: The workflow checks for accurate credit data and verifies the collected data. This information is scanned and processed enumerating a number of validation points. These changes are reflected in the system and updates on review date, interest, or risk features are made available.

- Ongoing Monitoring: After the credit has been extended, the customer’s creditworthiness is monitored on an ongoing basis to ensure that they continue to meet their financial obligations. This may involve periodic credit reviews at regular intervals. This can help to minimize the risk of bad debt, improve cash flow, and maintain financial stability.

4. Collateral Expiry Workflow:

A collateral expiry workflow is a process that a lending institution or creditor can implement to manage the expiration of collateral that has been pledged to secure a loan or credit facility. This workflow establishes a process for handling customers with delinquent or undone payments and here is a general outline for a collateral expiry workflow:

- Identify Collateral Expiration Dates: The credit guarantees submitted by the customer have validity and organizations should be aware of such collateral and their expiries. The workflow identifies the collateral that was pledged by the borrower as security for a loan or credit facility, which boosts the confidence of the creditor that they are not at risk. When the customer fails to repay the debt or becomes delinquent and the collateral is already expired, it means nothing to the creditor in any terms. The workflow automatically identifies the customer data whose collateral is to be expired. The workflow also checks the expiration date of the collateral to determine if it is still valid. The expiration date is usually specified in the loan agreement or security agreement. The workflow brings such expiring collateral to the analyst desk.

- Notify Borrower: If the collateral is set to expire soon or has already expired, the workflow notifies the customer in writing of the impending expiration or expiration that has already occurred. The workflow also notifies the customer to submit new collateral.

- Review the Status of the Collateral: If the customer wishes to extend the collateral, they may submit a written request to the credit analyst for an extension along with any required documentation. The workflow reviews and alerts the analysts to check. The workflow appraises the value of the collateral to determine whether it is sufficient to cover the outstanding loan balance or not.

- Renew or Replace Collateral: If the collateral is not extended or the extension request is denied, the customer may sell the collateral to recover the outstanding loan balance or release it back to the customer. The workflow will initiate a fresh request to the customer to revalidate collaterals with new securities.

- Update Records: If the collateral sale or release results in the full repayment of the outstanding loan balance, the loan is closed. The workflow updates the validated data records on status, limit, or loan exit procedures.

- Monitor for Future Expiries: Throughout the collateral expiry, workflow monitors the collateral expiry details and communicates with the customer. This workflow requests additional information or clarification on certain aspects of the collateral or the extension request from the customer. It’s important for both the customer and financing organization to maintain open lines of communication to ensure a smooth and efficient collateral expiry process. This aid business rolling out credit management without future collateral insufficiency or risks.

5. Credit Reporting Workflow:

This workflow regularly reports on your company’s credit performance and credit risks to management and stakeholders. This process can include tracking key performance indicators, such as overdue accounts and bad debts, and providing regular reports on credit-related metrics. A credit reporting workflow involves several steps, including:

- Identify Key Performance Indicators: This workflow is used by credit reporting agencies to collect, analyze, and report information on individuals and businesses related to their credit history and financial activities. The information that defines the customer’s creditworthiness, past payment history, and other financial activities are the key performance indicators and the workflow.

- Gather Data: The workflow collects information from a variety of sources, such as credit card companies, banks, and other financial institutions. They may also collect public records and other information that is relevant to an individual’s credit history.

- Analyze Data: Once the data has been collected, the workflow analyzes it to determine an individual’s creditworthiness. This analysis may include reviewing the individual’s payment history, credit score, debt-to-income ratio, and other relevant factors.

- Prepare Report: Based on the data analysis, a credit report is created by the workflow for the individual. This report includes information on the individual’s credit history, such as their credit score, payment history, and outstanding debts.

- Review Report: The workflow reviews the prepared data and alerts the credit analysts regarding the poor-performing areas/ accounts that need revision/improvement.

- Distribute Report: The workflow distributes credit reports to a variety of customers or agencies. These parties use the credit report to assess an individual’s creditworthiness and make decisions about whether to extend credit or offer other financial products or services.

- Use the Report to Make a Decision: If an individual believes that there is an error on their credit report, they can dispute the information and raise a ticket. The tickets are captured by the workflow and the agency will investigate the dispute and make any necessary corrections to the report. The authorized parties are supposed to resolve the dispute within a certain timeframe.

By implementing a Credit Reporting Workflow, a company can ensure that its credit performance and credit risks are effectively managed.

These workflows can make the credit management process easier and faster and ensure organizations with informed and secure credit decisions.

Best Practices To Optimize Credit Management Approvals:

Here are a few things to make your business optimized in credit management.

- Look for an advanced automated credit processing system. Opt for an automated business solution that has credit management workflow as an inbuilt feature.

- Build your own credit score model and calculate the credit score of the customer and know their creditworthiness.

- Monitor credit utilization to be free from any fraud and bad debts.

- Implement varied payment plans to enhance your customer experience.

- Make your customer informed and aware of credit policies and regulations.

- Review your credit policies regularly

- Use data analytics and reports to know about the risks and opportunities to improve.

Final Thoughts

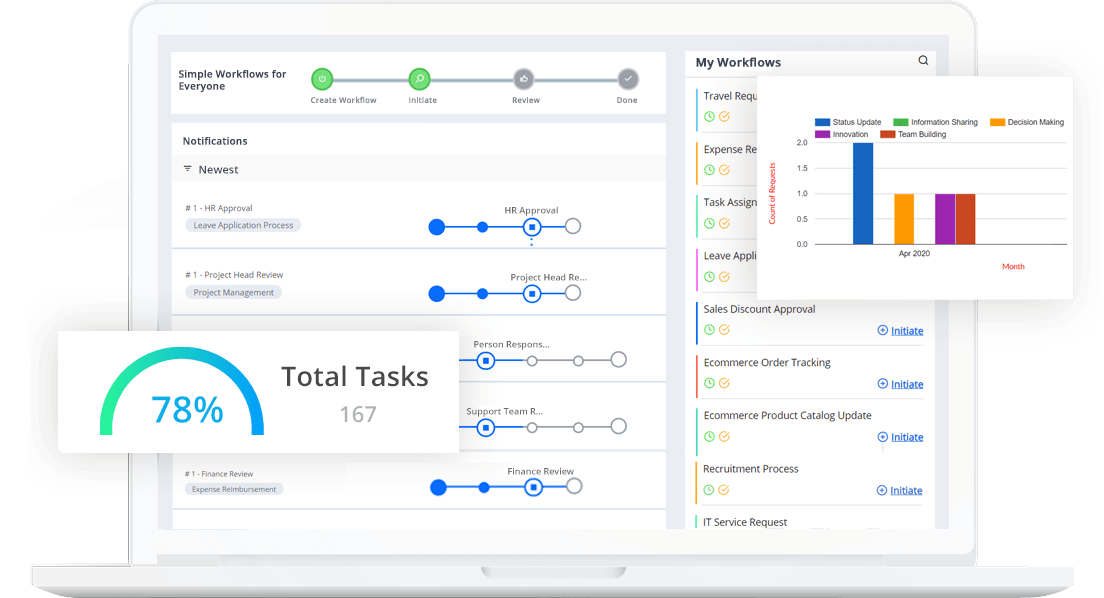

Credit management workflows are an important tool for any business that wants to ensure its accounts receivable are managed effectively. Additionally, business automation solutions can improve the efficiency of the credit management process, while providing customers with convenient payment options. You can also track customer transaction history with real-time credit risk monitoring, with the right solution. Optimized credit management also improves productivity and saves time with automated periodic credit reviews. Your search for a complete credit management solution ends with the automated business solution Cflow. With Cflow’s advanced reporting and analytics businesses gain 360° process visibility keeping your credit management processes as efficient and effective as possible.

Shape the future of every customer transaction with Cflow: Sign Up now!