Supplier Credit Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Credit Evaluation Submission:

Cflow provides a centralized platform for submitting and documenting supplier credit assessments where all the necessary information is captured and stored accurately. This results in a simplified approval process and centralized data management.

Automated Financial Analysis and Risk Assessment:

Using Cflow finance professionals they conduct automatic supplier assessment which gives them a comprehensive view of their creditworthiness based on specific criteria such as credit history, financial records, and risk metrics. It also identifies and points out any discrepancies that arise during the evaluation to maintain consistency.

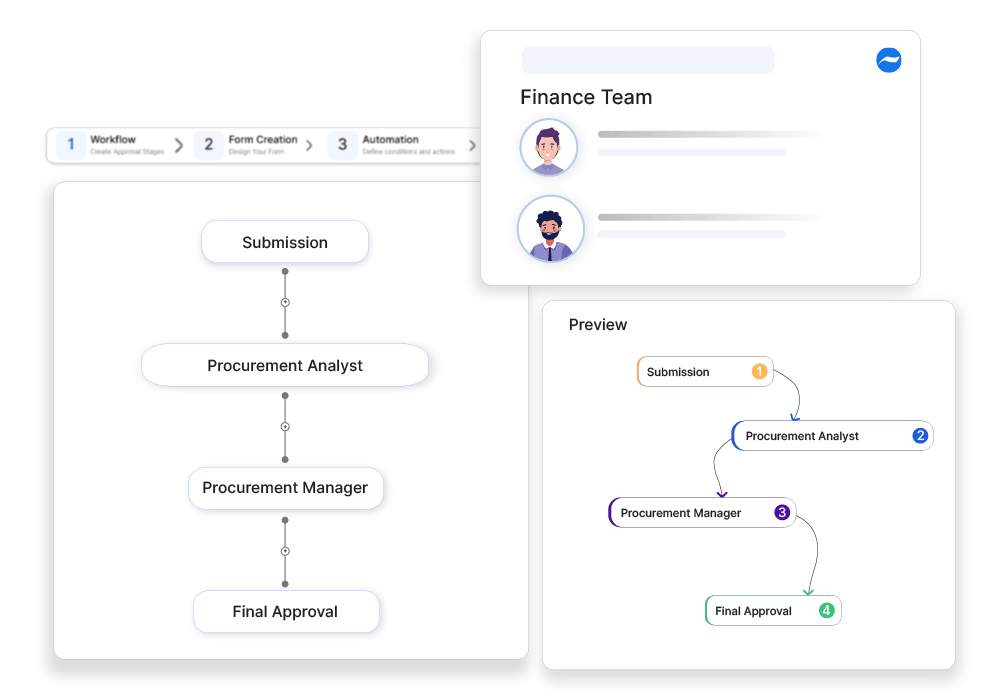

Streamlined Approval Workflows:

Supplier credit assessments go through a predefined approval workflow which is thoroughly reviewed by procurement and finance teams. A streamlined approval process results in timely authorization and effective supplier management.

Detailed Reporting and Risk Monitoring:

Cflow provides detailed reports and analytics on credit assessments, approval histories, and risk monitoring. This enhances visibility and provides financial oversight on mitigating risks and supplier credit profiles.

Frequently Asked Questions

How do businesses evaluate supplier creditworthiness?

By assessing financial stability, trade references, and past payment history.

What are the risks of extending supplier credit?

Non-payment, supply chain disruptions, and cash flow constraints.

Can supplier credit terms be renegotiated?

Yes, based on payment performance and business needs.