Short Sale Approval Requests

Why automate?

How Cflow Can Help Automate Short Sale Approval Requests

Centralized Document Management

All documentation related to the short sale is stored in a centralized platform for easy access and a clear audit trail. Whether it is financial statements or legal agreements or even property appraisals – all documents are made available in the centralized platform.

Automated Financial Review

Lenders can easily review the borrower’s financial situation through the data available in Cflow to determine their eligibility for the short sale. This helps ensure that short sales are justified and that all parties understand the financial implications.

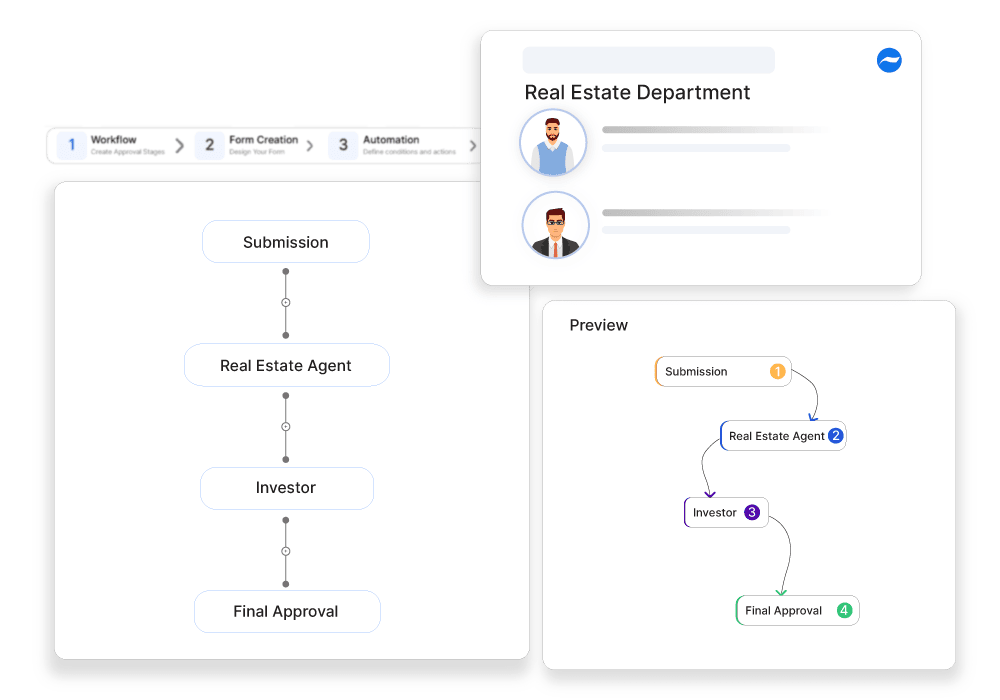

Streamlined Approval Workflow

Cflow automatically routes the requests to appropriate managers in the legal and management teams for review and approval. This ensures that all necessary approvals are obtained promptly, reducing delays in the sale process and minimizing financial losses.

Automated Compliance Checks

Compliance checks are also automated in Cflow by integrating with compliance tools for verifying whether short sales comply with all relevant regulations, including tax implications and lender requirements. This helps protect both the lender and the borrower from legal challenges and ensures that transactions are conducted ethically.

Frequently Asked Questions

What is a short sale approval request?

A process where a lender reviews and approves the sale of a property for less than the outstanding loan balance.

What challenges arise in short sale approval requests?

Complex negotiations with buyers, lender reluctance, and legal documentation errors.

How can organizations streamline short sale approval requests?

By setting clear terms for short sales, involving legal counsel early, and using transaction management software.