Pension Liability Monitoring Process

Why automate?

Cflow Automation Benefits:

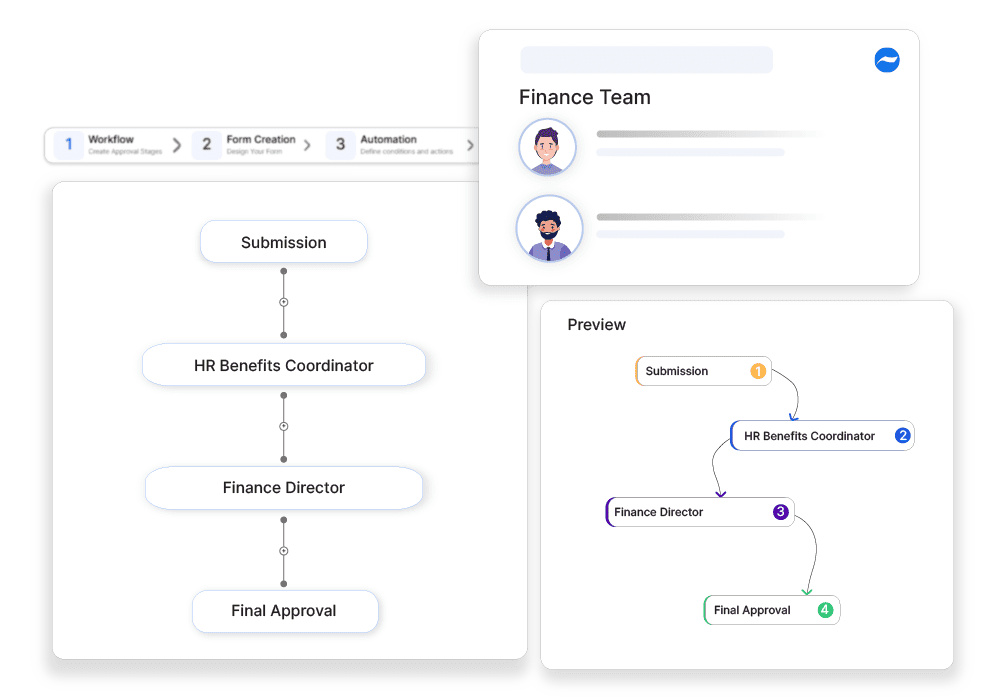

Actuarial Review Routing:

Submit pension calculations for actuarial validation and approval.

Funding Gap Alerts:

Flag gaps between projected obligations and current assets for proactive action.

Historical Change Logs:

Track changes in assumptions, interest rates, or mortality tables over time.

Board-Ready Reporting:

Ensure every pension entry is reviewed and auditable for executive or regulator presentations.

Frequently Asked Questions

What is the pension liability monitoring process?

A process to track and manage an organization’s pension obligations to ensure long-term financial stability.

What are the main challenges in pension liability monitoring?

Managing actuarial risks, maintaining sufficient funding, and complying with pension regulations.

How can institutions improve pension liability monitoring?

By conducting regular actuarial assessments, optimizing pension fund investments, and ensuring compliance with reporting standards.