Offshore Account Monitoring Process

Why automate?

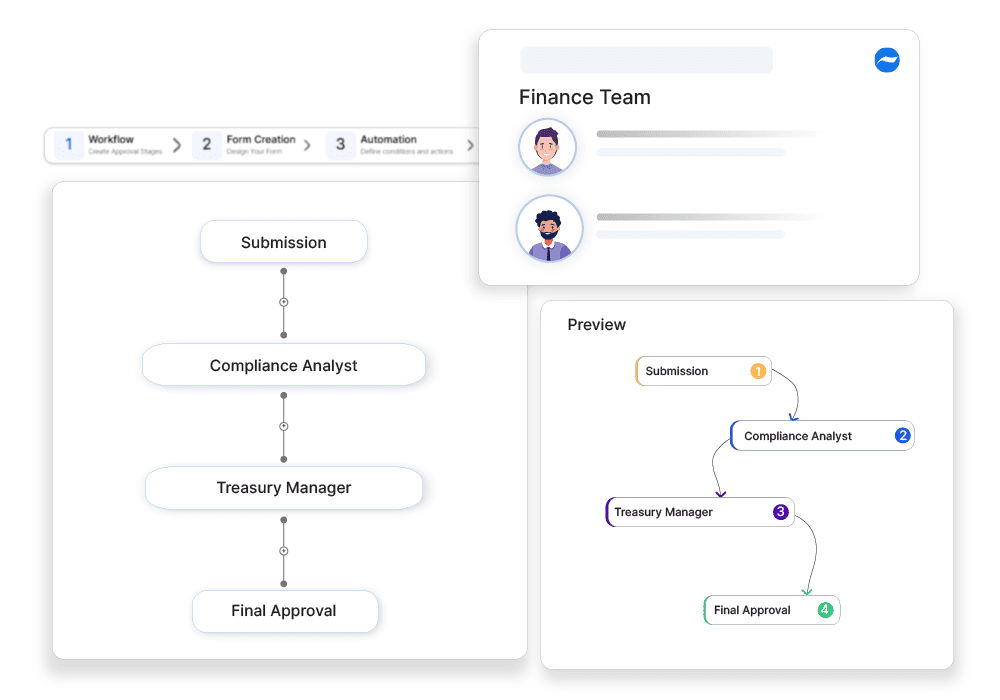

Cflow Automation Benefits:

Scheduled Review Workflows:

Set up periodic account reviews with required documentation.

Fund Movement Approvals:

Trigger workflows for large or unusual transactions requiring sign-off.

Jurisdictional Rule Checks:

Flag activity based on location-specific compliance rules.

Risk Mitigation Logs:

Maintain detailed histories of reviews and decisions for regulators or board oversight.

Frequently Asked Questions

What is the offshore account monitoring process?

A structured approach to tracking and managing offshore accounts for compliance, tax reporting, and financial oversight.

What are the main challenges in offshore account monitoring?

Ensuring compliance with international tax laws, preventing financial fraud, and maintaining accurate reporting.

How can institutions improve offshore account monitoring?

By automating compliance checks, integrating financial reporting tools, and maintaining clear audit trails.