Currency Hedging Strategy Management

Why automate?

Cflow Automation Benefits:

Exposure Reporting Integration:

Attach relevant FX exposure data and revenue forecasts for accurate evaluation.

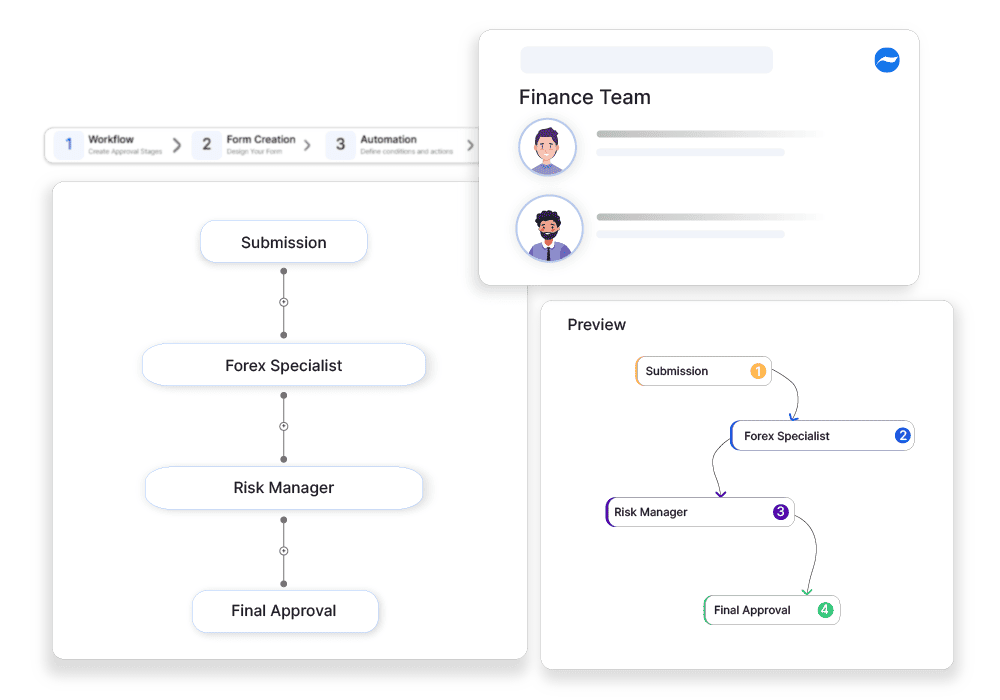

Multi-Tiered Review Flows:

Large or long-term hedges route to senior executives for oversight.

Contract Term Validation:

Ensure all derivatives or hedging instruments comply with internal risk policies.

Audit Trail of Decisions:

Log all approvals and rejections for compliance, strategy reviews, or audits.

Frequently Asked Questions

What is currency hedging strategy management?

A process to minimize financial risk from currency fluctuations through strategic hedging techniques.

What are the main challenges in currency hedging?

Managing exchange rate volatility, selecting the right hedging instruments, and balancing cost vs. risk reduction.

How can institutions optimize currency hedging?

By using automated hedging tools, analyzing market trends, and integrating real-time foreign exchange data.