Credit Check Approvals

Why automate?

How Cflow Can Help Automate Credit Check Approvals

Automated Credit Report Integration

Cflow is an automation tool that can integrate with credit reporting to automatically review credit reports. This ensures that all necessary financial information is evaluated.

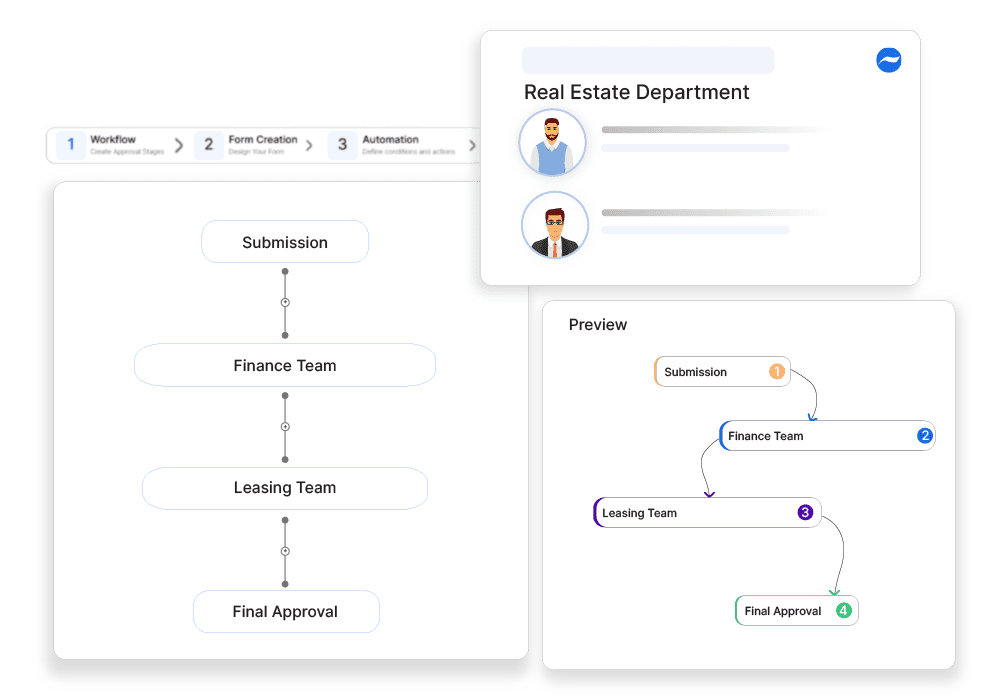

Streamlined Approval Workflow

With Cflow, credit check reports can be automatically routed to the appropriate stakeholders for approval. This ensures that all necessary approvals are obtained quickly.

Centralized Credit Report Management

Cflow is a centralized platform that provides space for storing and managing all credit check records. This ensures that all necessary documentation is easily accessible to the users.

Automated Compliance Checks

Cflow can automate the verification process against regulatory requirements. This ensures all evaluations comply with laws and other relevant regulations.

Frequently Asked Questions

What is a credit check approval?

A process where financial institutions or landlords review and authorize credit history reports.

What challenges arise in credit check approvals?

Incorrect credit reports, delayed reporting, and privacy concerns.

How can organizations streamline credit check approvals?

By using reliable credit agencies, automating verification, and ensuring secure data handling.