Supply Chain Finance Approval Requests

Supply Chain Finance Approval Requests

Optimize cash flow with automated supply chain finance approval requests.

Why automate?

Supply chain finance (SCF) is a set of financial tools designed to optimize cash flow within the supply chain, allowing suppliers to get paid earlier while buyers extend payment terms. The SCF approval request process involves reviewing and authorizing financial arrangements to ensure they align with cash flow management goals, improve supplier relationships, and reduce financial risk. Manual handling of SCF approval requests can lead to delays, missed opportunities, and potential disruptions in supplier relationships, affecting overall supply chain performance. Automating the supply chain finance approval request process allows finance managers and supply chain leaders to quickly review and approve financial arrangements based on predefined criteria. Automated workflows can ensure that all necessary information, such as payment terms, interest rates, and risk assessments, is submitted and verified before approval. This reduces the risk of errors, such as approving unfavorable or high-risk financial arrangements, and ensures that SCF initiatives are aligned with cash flow optimization and risk management goals. In addition, automation enhances visibility and control over the finance approval process. Stakeholders can track the status of SCF approval requests in real-time, ensuring that all relevant parties are informed and aligned. This transparency reduces the likelihood of miscommunications and ensures that supply chain finance arrangements are managed according to plan, optimizing cash flow and strengthening supplier relationships.

How Cflow Can Help:

Cash Flow Optimization:

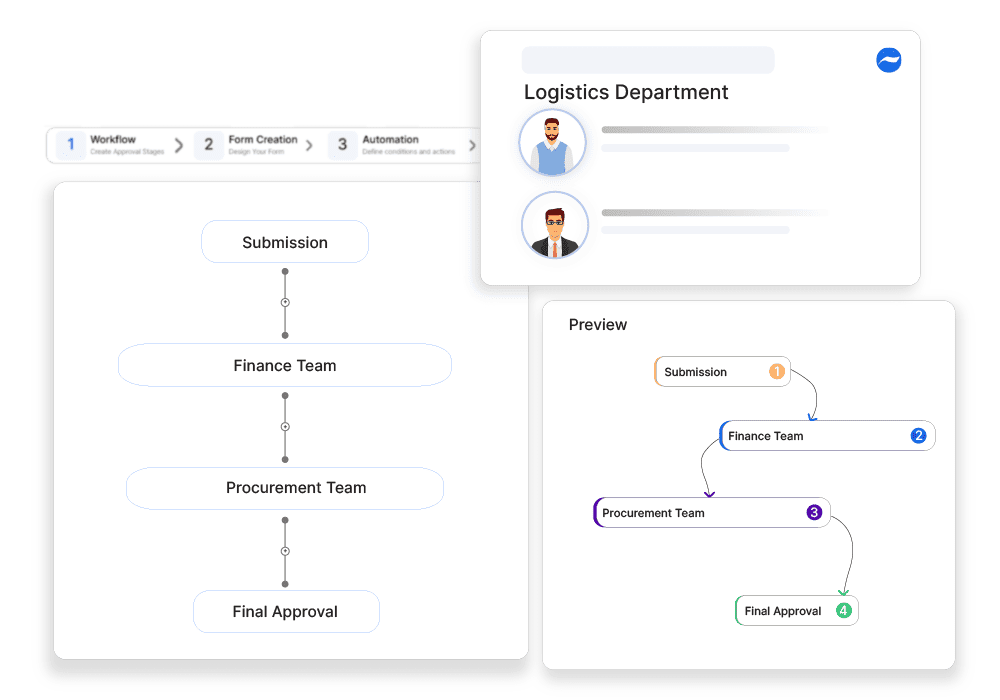

Cflow automates the approval process for supply chain finance requests, ensuring that all financial arrangements are reviewed and approved quickly based on cash flow management goals.

Risk Management:

By automating approval requests, Cflow helps ensure that SCF initiatives are aligned with risk management strategies, reducing financial exposure and improving profitability.

Real-Time Monitoring:

Cflow provides visibility into the supply chain finance approval process, allowing stakeholders to monitor the status of approvals and ensure alignment.

Strengthened Supplier Relationships:

Cflow’s automated workflows help ensure that SCF arrangements are managed efficiently, supporting timely payments and enhancing supplier partnerships.

Frequently Asked Questions

What is a supply chain finance approval request?

A process where management reviews and authorizes funding for supply chain operations and improvements.

What challenges arise in supply chain finance approval requests?

Budget constraints, delayed funding, and compliance issues.

How can organizations streamline supply chain finance approval requests?

By setting clear funding criteria, automating approval workflows, and involving financial teams.