- Cflow

- Loan Application Endorsement Automation

Loan Application Endorsement Automation

Clow Team

Loan application endorsement is a critical phase in financial institutions to ensure proper evaluation, risk assessment, and regulatory compliance before final loan disbursement. Without automation, manual endorsement processes result in delayed decisions, inconsistent risk evaluation, customer dissatisfaction, and regulatory exposure. Recent industry research shows that 60% of financial institutions face processing delays due to manual endorsement and review bottlenecks.

Without automation, relationship managers, credit officers, risk analysts, compliance officers, legal counsel, and senior approvers struggle to coordinate documentation review, financial analysis, and regulatory assessments. This guide walks you through exactly how Cflow automates Loan Application Endorsement Process, from application submission to final endorsement.

What Is Loan Application Endorsement Process?

The Loan Application Endorsement Process governs how financial institutions review, verify, and formally endorse loan applications based on financial eligibility, creditworthiness, regulatory guidelines, and organizational credit risk policies before final loan approval.

Think of loan endorsements as multi-level financial gatekeeping , every application must meet stringent evaluation before disbursement.

Recent industry research shows that automating loan endorsement reduces processing time by 50% and improves credit portfolio quality by 35%.

Why Loan Application Endorsement Matters for Organizations

Risk Control

Regulatory Compliance

Customer Experience

Audit Readiness

Portfolio Health

Try Cflow for free, no credit card needed

Key Benefits of Automating Loan Application Endorsement with Cflow

- Centralized Loan Submission Portal: Cflow allows relationship managers to submit complete loan applications with financial statements, credit reports, KYC documents, and supporting files into a unified workflow. All documents are stored in a secure, centralized repository with controlled access. This streamlines document collection, minimizes back-and-forth, and enables faster loan lifecycle processing.

- Dynamic Routing Based on Loan Type & Amount: Cflow applies routing logic based on loan product (personal, SME, commercial, mortgage), loan amount, collateral type, and risk grade. Rules can be customized per lending policy and jurisdictional regulations. This ensures high-value or high-risk loans are automatically escalated to the appropriate authority level for scrutiny.

- Multi-Level Review Workflows: Applications route through credit analysts, risk management, compliance, legal, and leadership based on exposure level. Role-specific tasks and deadlines are auto-assigned to streamline collaboration. Each level provides checks and balances to improve credit quality and reduce approval bottlenecks.

- Real-Time Notifications & Escalations: Automated alerts ensure timely evaluations while escalation rules prevent customer delays. Pending reviews and overdue actions are flagged in real-time dashboards. Notifications can be customized based on customer priority, loan volume, or SLA requirements.

- Policy Compliance Enforcement: Cflow integrates internal credit risk policies, eligibility criteria, debt-to-income ratios, and external regulatory standards into routing and endorsement logic. Any deviation from policy triggers conditional logic or rejection workflows. This ensures consistent decision-making and audit-ready compliance with both internal and external rules.

- Full Audit Trail & Decision History: Every application, evaluation, risk scoring, and endorsement decision is fully archived for audits. Logs are timestamped and linked to specific users for complete traceability. This simplifies regulatory reporting and supports internal reviews or dispute resolution.

- Mobile Accessibility: Relationship managers and executives can review and endorse applications remotely, speeding up turnaround. The mobile-friendly interface supports document previews, comments, and digital signatures. Users remain in control of the lending process regardless of location or time zone.

Get the best value for money with Cflow

User Roles & Permissions

Relationship Manager (Initiator)

- Responsibilities: Submit complete loan application with supporting documentation and borrower profile.

- Cflow Permission Level: Submit Form.

- Mapping: “Sales/Relationship Team.”

Credit Analyst

- Responsibilities: Evaluate borrower creditworthiness, financial ratios, and repayment capacity.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Credit Team.”

Risk Officer

- Responsibilities: Perform risk scoring, default probability analysis, and policy compliance verification.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Risk Team.”

Compliance Officer

- Responsibilities: Validate regulatory compliance, KYC/AML documentation, and sanction screening.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Legal Counsel

- Responsibilities: Review legal contracts, collateral documents, and enforceability aspects.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Group.”

Credit Committee / Board (Final Approver)

- Responsibilities: Final endorsement for large or high-risk loans.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board.”

Discover why teams choose Cflow

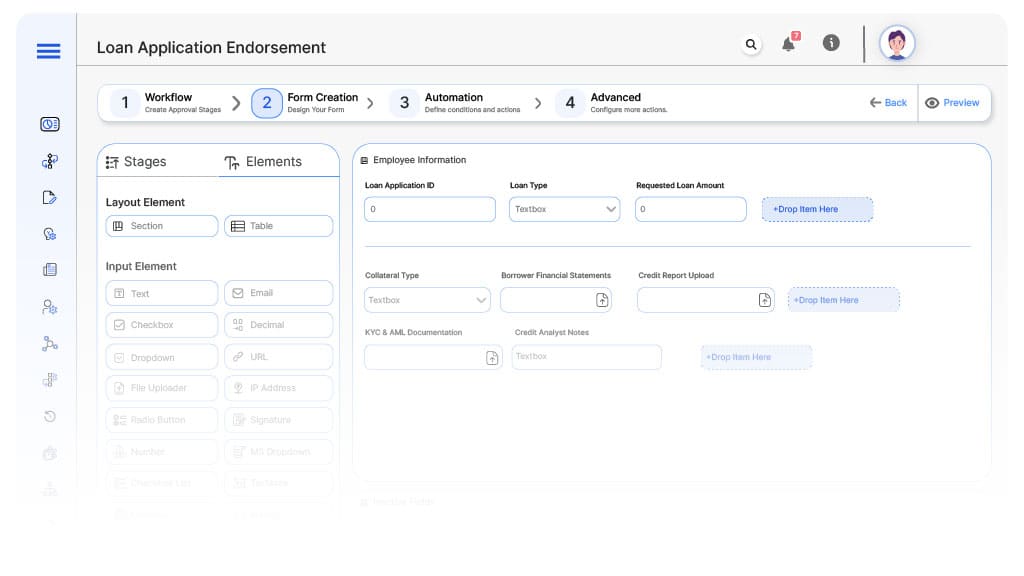

Form Design & Field Definitions

Field Label: Loan Application ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Loan Type

- Type: Dropdown (Personal, SME, Business, Commercial, Mortgage)

- Logic/Rules: Drives routing.

Field Label: Requested Loan Amount (USD)

- Type: Numeric Field

- Logic/Rules: Drives approval level.

Field Label: Collateral Type

- Type: Dropdown (Real Estate, Equipment, Guarantee, None)

- Logic/Rules: Drives legal routing.

Field Label: Borrower Financial Statements

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Credit Report Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: KYC & AML Documentation

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Credit Analyst Notes

- Type: Text Area

- Logic/Rules: Required.

Field Label: Risk Evaluation Notes

- Type: Text Area

- Logic/Rules: Required.

Field Label: Compliance Review Notes

- Type: Text Area

- Logic/Rules: Required.

Field Label: Legal Counsel Notes

- Type: Text Area

- Logic/Rules: Required

Field Label: Final Endorsement Comments

- Type: Text Area

- Logic/Rules: Required.

Field Label: Endorsement Confirmation

- Type: Checkbox

- Logic/Rules: Marks application fully endorsed.

Transform your Workflow with AI fusion

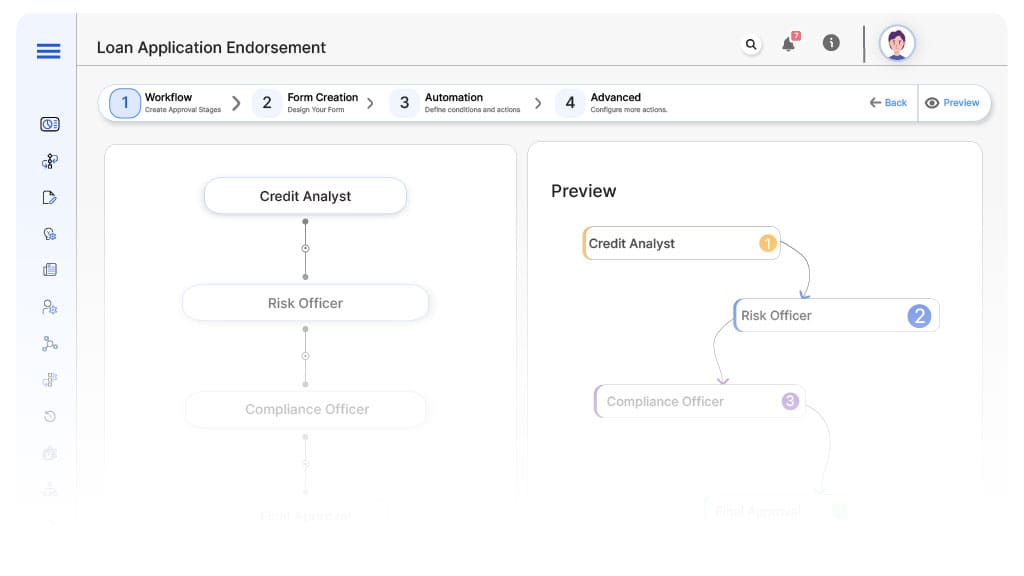

Approval Flow & Routing Logic

Submission → Credit Analyst

- Status Name: Pending Credit Review

- Notification Template: “Hi Credit Team, new loan application submitted for credit evaluation.”

- On Approve: Moves to Risk Officer.

- On Reject: Returns to Relationship Manager.

- Escalation: Reminder after 1 day.

Credit → Risk Officer

- Status Name: Pending Risk Evaluation

- Notification Template: “Hi Risk Team, application requires risk scoring and policy compliance check.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Credit Analyst.

- Escalation: Reminder after 1 day.

Risk → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Hi Compliance, regulatory and AML validations required.”

- On Approve: Moves to Legal Counsel.

- On Reject: Returns to Risk Officer.

- Escalation: Reminder after 1 day.

Compliance → Legal Counsel

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, legal and collateral documents need review.”

- On Approve: Moves to Credit Committee.

- On Reject: Returns to Compliance Officer.

- Escalation: Reminder after 1 day.

Legal → Credit Committee

- Status Name: Pending Final Endorsement

- Notification Template: “Hi Credit Committee, large loan request ready for final endorsement.”

- On Approve: Moves to Loan Endorsed.

- On Reject: Returns to Legal Counsel.

- Escalation: Reminder after 1 day.

Final → Loan Endorsed

- Status Name: Application Endorsed

- Notification Template: “Loan application fully endorsed. Ready for disbursement and customer notification.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: SME Loan Endorsement

FAQ's

Setup typically completes within 5–7 business days.

Unleash the full potential of your AI-powered Workflow