- Cflow

- Financial Policy Update Automation

Financial Policy Update Automation

Clow Team

Financial policies govern how organizations handle budgeting, spending, investments, reporting, and compliance obligations. Updating these policies requires careful coordination between finance, compliance, legal, and executive teams to ensure transparency, accuracy, and regulatory adherence. Manual coordination leads to version control issues, delayed approvals, and risk of non-compliance. Recent industry research shows 42% of financial policy errors stem from poor version control and untracked approvals.

Without automation, finance departments struggle to track who reviewed which draft, whether legal reviewed regulatory implications, and when executive sign-off occurred. This guide walks you through exactly how Cflow automates Financial Policy Update Process, from draft submission to final policy adoption.

What Is Financial Policy Update Process?

The Financial Policy Update Process governs how organizations create, review, validate, and adopt changes to financial policies and procedures. These policies address accounting standards, reporting protocols, investment guidelines, procurement rules, and compliance obligations.

Each proposed update must be reviewed by finance controllers, compliance officers, legal counsel, and executive leadership to ensure accuracy, regulatory compliance, and strategic alignment.

Recent industry research shows that organizations automating financial policy updates reduce approval cycle times by 35% and cut policy errors by 50%.

Why Financial Policy Update Automation Matters for Organizations

Regulatory Compliance

Risk Management

Version Control

Cross-Functional Accountability

Faster Adoption

Try Cflow for free, no credit card needed

Key Benefits of Automating Financial Policy Updates with Cflow

- Centralized Policy Submission Portal: Cflow provides a centralized portal where finance controllers upload proposed policy updates, complete with supporting documentation, risk assessments, and revision history. This ensures consistent formatting and centralized access to all policy-related data for internal and external audits.

- Dynamic Routing Based on Policy Type: Cflow routes tax-related updates to tax counsel, procurement updates to compliance, and financial reporting changes to CFOs, ensuring appropriate subject-matter experts review each change. Routing logic minimizes delays and ensures that policies reach only the relevant teams for faster approvals.

- Legal & Compliance Review Stages: Legal validates regulatory adherence while compliance officers assess operational implications and audit requirements before policies reach executive review. Multiple checkpoints help reduce risk and ensure all policies are fully vetted before implementation.

- Real-Time Notifications & Escalations: Cflow sends reminders to reviewers and approvers at each stage to ensure deadlines are met and policy updates stay on schedule. Escalation rules prevent bottlenecks and keep the review process aligned with compliance timelines.

- Version Control & Document Archive: All policy drafts, revisions, comments, and approvals are captured within Cflow’s audit-ready archive, ensuring full traceability. Teams can refer back to older versions and approval trails anytime for transparency and compliance.

- Integration with Document Management Systems: Approved financial policies can be automatically pushed into centralized document repositories, eliminating redundant uploads.

This ensures all departments access the latest approved policy without manual syncs. - Mobile Accessibility: Executives and approvers can review, comment, and approve financial policy updates from mobile devices for rapid decision-making even when traveling. This promotes continuous policy governance without disruptions caused by remote availability.

Get the best value for money with Cflow

User Roles & Permissions

Finance Controller (Initiator)

- Responsibilities: Submits policy updates with supporting documentation, financial rationale, and revision history.

- Cflow Permission Level: Submit Form.

- Mapping: “Finance Team.”

Legal Counsel

- Responsibilities: Reviews policy for legal compliance, regulatory alignment, and contractual implications.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Legal Group.”

Compliance Officer

- Responsibilities: Evaluates policy’s auditability, operational compliance, and risk mitigation.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Executive Approver

- Responsibilities: Provides final authorization for organization-wide adoption of financial policy updates.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Executive Board.”

Discover why teams choose Cflow

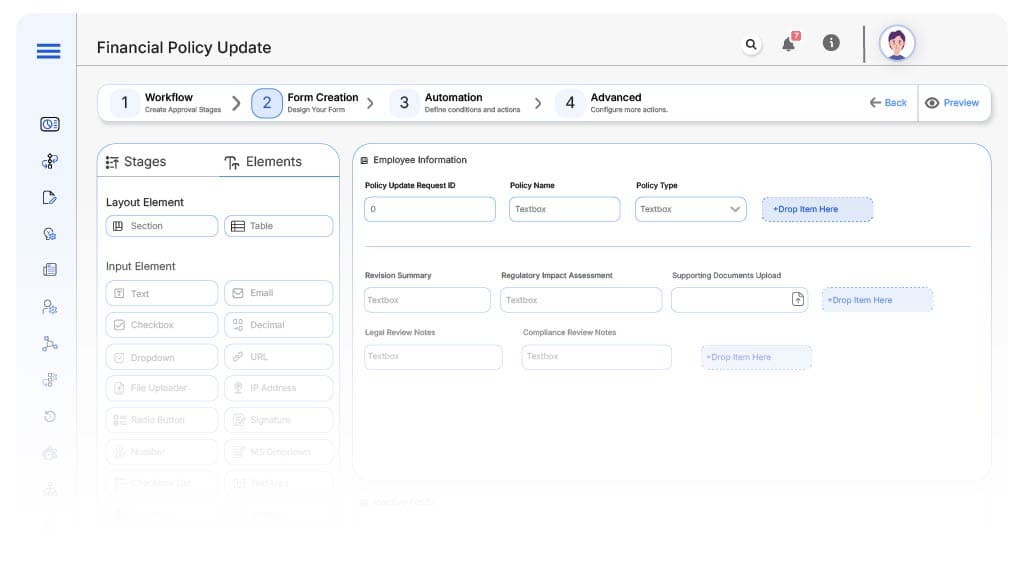

Form Design & Field Definitions

Field Label: Policy Update Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Policy Name

- Type: Text

- Logic/Rules: Mandatory.

Field Label: Policy Type

- Type: Dropdown (Tax, Procurement, Financial Reporting, Investment, Other)

- Logic/Rules: Drives routing.

Field Label: Revision Summary

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Regulatory Impact Assessment

- Type: Text Area

- Logic/Rules: Mandatory.

Field Label: Supporting Documents Upload

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Legal Review Notes

- Type: Text Area

- Logic/Rules: Mandatory for Legal.

Field Label: Compliance Review Notes

- Type: Text Area

- Logic/Rules: Mandatory for Compliance.

Field Label: Executive Final Approval

- Type: Checkbox

- Logic/Rules: Mandatory for final sign-off.

Transform your Workflow with AI fusion

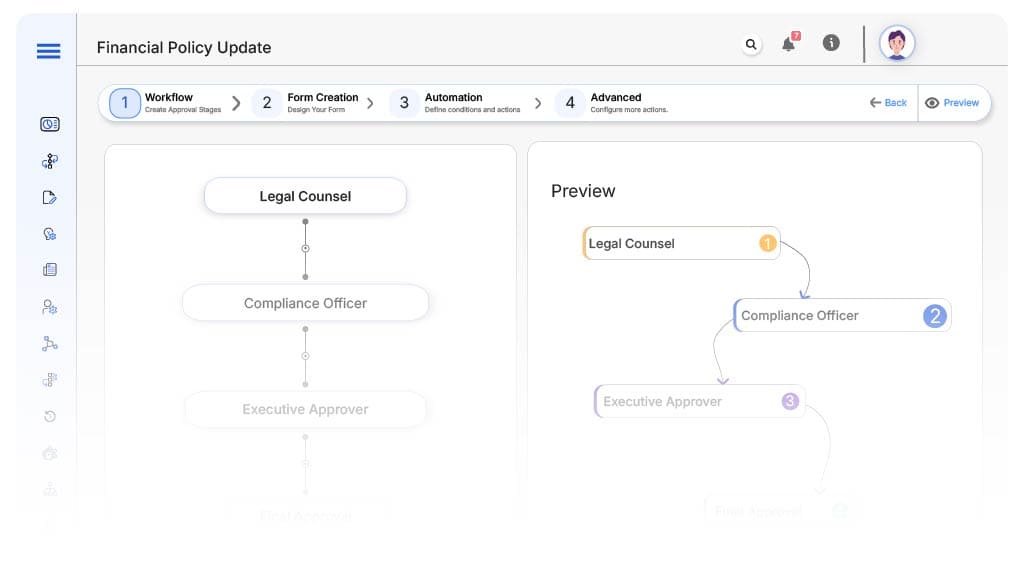

Approval Flow & Routing Logic

Submission → Legal Counsel

- Status Name: Pending Legal Review

- Notification Template: “Hi Legal, financial policy update submitted for legal compliance review.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Finance Controller.

- Escalation: Reminder after 1 day.

Legal Counsel → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Hi Compliance, policy update requires operational compliance assessment.”

- On Approve: Moves to Executive Approver.

- On Reject: Returns to Legal Counsel.

- Escalation: Reminder after 1 day.

Compliance Officer → Executive Approver

- Status Name: Pending Executive Approval

- Notification Template: “Hi Executive, financial policy update ready for final approval.”

- On Approve: Moves to Policy Adopted.

- On Reject: Returns to Compliance Officer.

- Escalation: Reminder after 1 day.

Final → Policy Adopted

- Status Name: Policy Adopted

- Notification Template: “Financial policy update fully approved. Proceed with organization-wide publication.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Procurement Policy Update

Finance submits an update to the procurement policy adjusting approval thresholds for capital purchases. Cflow assigns ID FPU-2025-412. Legal validates compliance with procurement regulations, Compliance verifies internal controls, Executive signs off within 48 hours, and the updated policy is immediately distributed organization-wide.

FAQ's

Absolutely. Cflow integrates with SharePoint, Google Drive, and other repositories.

Unleash the full potential of your AI-powered Workflow