- Cflow

- Financial Audit Sign-Off Automation

Financial Audit Sign-Off Automation

Clow Team

Financial audits require multi-stage verification, documentation, and sign-offs across multiple teams to ensure compliance, accuracy, and readiness for internal or external audits. Without automation, manual audit sign-offs lead to delayed audits, missing documentation, compliance risks, and increased auditor scrutiny. Recent industry research shows that 65% of organizations experience audit delays due to incomplete documentation and uncoordinated sign-offs.

Without automation, finance controllers, accounting teams, compliance officers, auditors, and CFOs struggle to gather required documentation, verify reconciliations, track pending audit items, and maintain comprehensive audit trails. This guide walks you through exactly how Cflow automates Financial Audit Sign-Off Process, from audit request initiation to final CFO certification.

What Is Financial Audit Sign-Off Process?

The Financial Audit Sign-Off Process governs how financial documents, reconciliations, supporting schedules, and compliance documentation are reviewed, verified, and signed off in preparation for audits and certifications.

Think of audit sign-offs like audit-readiness checklists , every financial record must pass through multiple layers of verification before being certified as complete and ready for external audit engagement.

Recent industry research shows that automating audit sign-offs reduces audit preparation time by 55% and lowers external audit fees by 35% due to improved readiness.

Why Financial Audit Sign-Off Matters for Organizations

Compliance Assurance

Audit Readiness

Financial Accuracy

Accountability

Audit Trail

Try Cflow for free, no credit card needed

Key Benefits of Automating Financial Audit Sign-Off with Cflow

- Centralized Audit Preparation Portal: Cflow provides a centralized portal where finance teams can upload audit schedules, reconciliations, policy confirmations, and documents. This structured workflow eliminates email threads and manual file sharing. It streamlines preparation, ensures consistency, and improves audit readiness.

- Dynamic Routing Based on Account Type: Cflow routes documents based on GL account types like assets, liabilities, revenue, or expenses. Materiality thresholds further influence routing paths for approvals and reviews. This smart logic ensures accurate handling by the right stakeholders.

- Multi-Level Approval Workflows: Audit documents are routed through preparers, reviewers, compliance officers, and CFOs based on type and risk level. Cflow automates this sequence to prevent delays or oversight. Each role contributes to a thorough and compliant audit trail.

- Real-Time Notifications & Escalations: Cflow sends instant alerts for pending reviews or actions across audit workflows. If deadlines are missed, automatic escalations notify higher authorities to intervene. This prevents bottlenecks, especially during tight audit timelines.

- Policy Compliance Validation: Cflow checks all entries against company policies, GAAP/IFRS standards, and SOX compliance rules. Submissions with inconsistencies are flagged before they move forward. This ensures that all audit steps align with regulatory expectations.

- Full Audit Trail & Sign-Off Logs: Every audit action – preparation, review, correction, or sign-off is captured in Cflow’s audit trail. This provides traceability for internal teams, regulators, and external auditors. The logs ensure accountability and compliance at every stage.

- Mobile Accessibility: With Cflow’s mobile access, CFOs and audit teams can review, annotate, and approve audit schedules from any location. This supports real-time collaboration during audits. Remote functionality helps teams meet tight deadlines efficiently.

Get the best value for money with Cflow

User Roles & Permissions

Finance Preparer (Initiator)

- Responsibilities: Prepare reconciliations, schedules, and upload supporting documentation.

- Cflow Permission Level: Submit Form.

- Mapping: “Finance Preparer Group.”

Finance Reviewer (Controller)

- Responsibilities: Verify accuracy of submitted schedules and reconciliations.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Finance Controller Group.”

Compliance Officer

- Responsibilities: Review compliance with internal controls, SOX, and regulatory policies.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Compliance Group.”

Internal Auditor

- Responsibilities: Review audit schedules for completeness and accuracy.

- Cflow Permission Level: Approve/Reject.

- Mapping: “Internal Audit Group.”

CFO (Final Approver)

- Responsibilities: Certify final audit readiness and sign-off for external audit engagement.

- Cflow Permission Level: Approve/Reject.

- Mapping: “CFO Group.”

Discover why teams choose Cflow

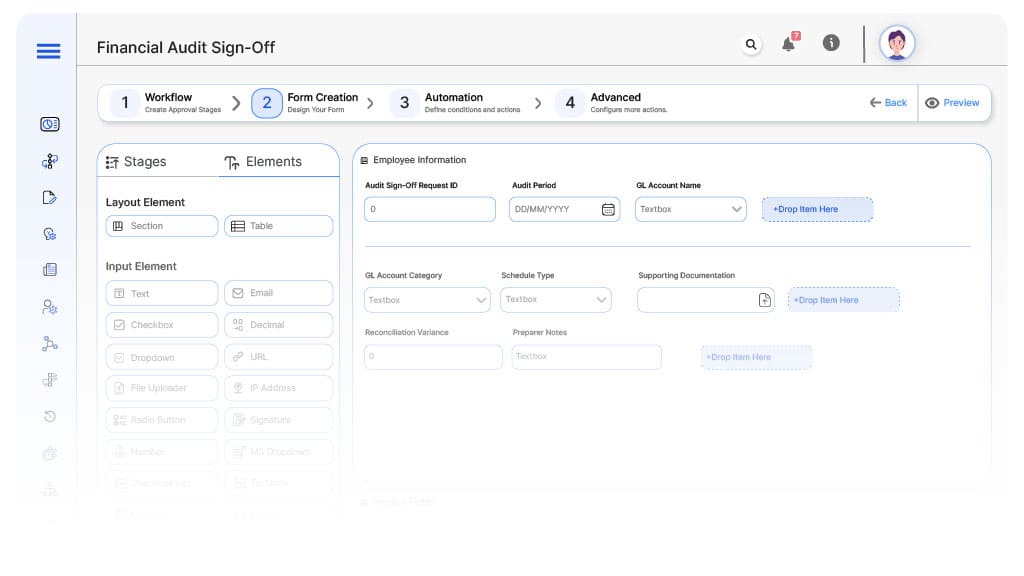

Form Design & Field Definitions

Field Label: Audit Sign-Off Request ID

- Type: Autonumber

- Auto-Populate: Generated on submission.

Field Label: Audit Period

- Type: Date Range Picker

- Logic/Rules: Mandatory.

Field Label: GL Account Name

- Type: Dropdown

- Logic/Rules: Mandatory.

Field Label: GL Account Category

- Type: Dropdown (Assets, Liabilities, Revenue, Expenses)

- Logic/Rules: Drives routing.

Field Label: Schedule Type

- Type: Dropdown (Reconciliation, Roll-forward, Supporting Schedule, Policy Confirmation)

- Logic/Rules: Mandatory.

Field Label: Supporting Documentation

- Type: File Upload

- Logic/Rules: Mandatory.

Field Label: Reconciliation Variance

- Type: Numeric Field

- Logic/Rules: Flags high-variance items.

Field Label: Preparer Notes

- Type: Text Area

- Logic/Rules: Required for preparer.

Field Label: Controller Review Notes

- Type: Text Area

- Logic/Rules: Required for finance reviewer.

Field Label: Compliance Review Notes

- Type: Text Area

- Logic/Rules: Required for compliance officer.

Field Label: Internal Audit Comments

- Type: Text Area

- Logic/Rules: Required for internal auditor.

Field Label: CFO Certification Notes

- Type: Text Area

- Logic/Rules: Required for CFO.

Field Label: Audit Sign-Off Confirmation

- Type: Checkbox

- Logic/Rules: Marks schedule fully certified.

Transform your Workflow with AI fusion

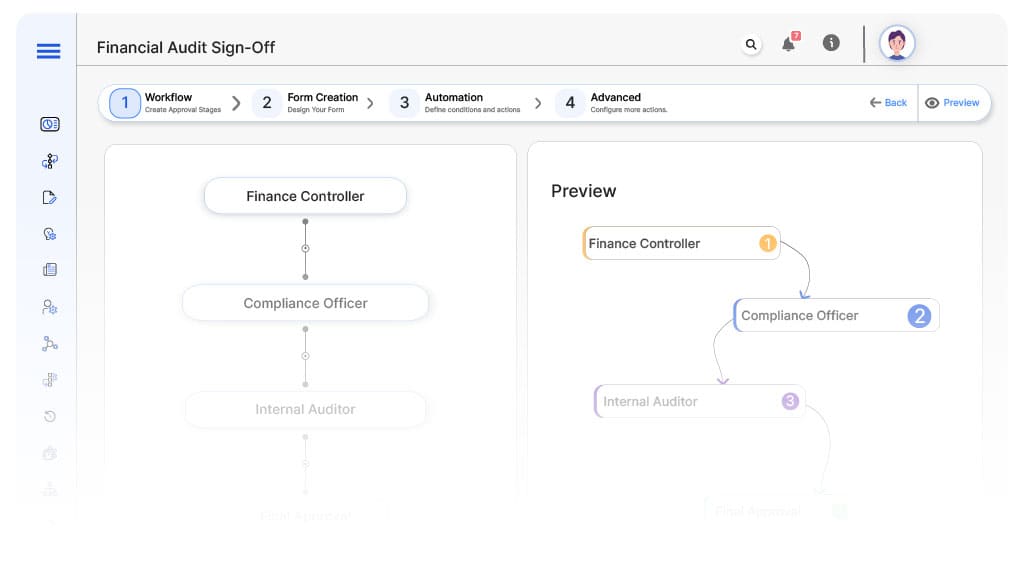

Approval Flow & Routing Logic

Submission → Finance Controller

- Status Name: Pending Controller Review

- Notification Template: “Hi Controller, new audit schedule submitted for review.”

- On Approve: Moves to Compliance Officer.

- On Reject: Returns to Preparer.

- Escalation: Reminder after 1 day.

Controller → Compliance Officer

- Status Name: Pending Compliance Review

- Notification Template: “Hi Compliance, audit schedule ready for policy review.”

- On Approve: Moves to Internal Auditor.

- On Reject: Returns to Controller.

- Escalation: Reminder after 1 day.

Compliance → Internal Auditor

- Status Name: Pending Internal Audit Review

- Notification Template: “Hi Internal Audit, schedule ready for audit sign-off.”

- On Approve: Moves to CFO.

- On Reject: Returns to Compliance Officer.

- Escalation: Reminder after 1 day.

Internal Audit → CFO

- Status Name: Pending CFO Certification

- Notification Template: “Hi CFO, audit file ready for final certification.”

- On Approve: Moves to Audit Certified.

- On Reject: Returns to Internal Audit.

- Escalation: Reminder after 1 day.

Final → Audit Certified

- Status Name: Audit Schedule Certified

- Notification Template: “Audit schedule fully certified and ready for external audit submission.”

Transform your AI-powered approvals

Implementation Steps in Cflow

Create a new workflow

Design the form

Set up User Roles/Groups

Build the process flow diagram

Configure notifications

Apply templates and escalation rules per Approval Flow.

Set conditional logic

Save and publish workflow

Activate process.

Test with a sample request

Adjust logic if needed

Go live

Example Journey: Year-End Fixed Asset Reconciliation

FAQ's

Setup typically completes within 5–7 business days.

Unleash the full potential of your AI-powered Workflow